Bullish Week On Wall Street

Bullish Week On Wall Street

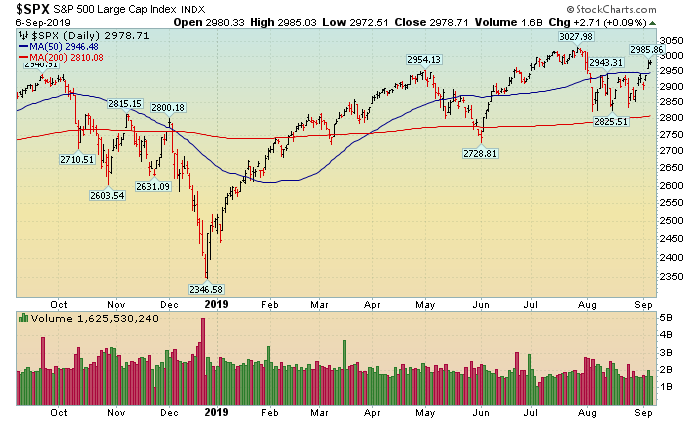

The market rallied sharply last week after news broke that the U.S. and China will sit down next month and hopefully resolve their trade dispute. Technically, it was a bullish week as the major indices jumped above their respective 50 DMA lines which has served as formidable resistance over the past few weeks. Additionally, several lagging sectors also caught a nice bid and they rallied after being under pressure for most of August. The Transports (IYT), Financials (XLF), Semiconductor (SMH), Housing Stocks (XHB), Industrials (XLI), just to name a few. Even retail stocks (XRT), which have been in a bear market recently, managed to briefly jump back above its respective 50 DMA line. There are still many lagging areas but that is normal as the market trades in a long sideways trading range and a few percentage points below a record high. Remember, stepping back, the major indices haven’t really gone anywhere since Q1 2018 and that is normal after a big rally. The bulls are back in control as long as the major indices continue trading above their respective 50 DMA lines.

Monday-Wednesday’s Action:

Stocks were closed on Monday in observance of the Labor Day Holiday. On Tuesday, stocks fell over 300 points after the Institute for Supply Management said U.S. manufacturing activity contracted in August for the first time since early 2016. The U.S. imposed 15% tariffs on a variety of Chinese goods on September 1, while China imposed new tariffs on a slew of U.S. goods. It marked the latest escalation in their long-running trade war. In other news, Wal-Mart said it will stop selling ammo after the horrific gun violence recently. Stocks rallied on Wednesday after Hong Kong stepped back and gave the protesters what they wanted letting go of certain legislation. In other news, former Fed Chairman Alan Greenspan said it’s ‘only a matter of time’ before negative rates spread to the US and he urged investors to watch the stock market carefully- because if it falls hard that will change the playing field.

Thursday & Friday Action:

On Thursday, stocks soared after China said talks will resume in October which helped spark a huge rally. In related news, several “reliable China insiders” hinted that this round of trade talks could lead to a ‘breakthrough.’ Technically, it was bullish to see the major indices jump back above their respective 50 DMA lines. Before Friday’s open, the government said, U.S. employers added +130,000 jobs in August, missing estimates for a gain of 150,000. Unemployment remained steady at a rate of 3.7% while wages grew more than expected. Wages expanded by 0.4% on a month-over-month basis and by 3.2% year over year. Separately, Jay Powell said the Fed will continue to monitor incoming data and the ongoing trade war. Separately, Powell said the Fed is not forecasting or expecting a recession.

Market Outlook: Easy Money Is Back

Once again, global central banks showed up and juiced markets. Just recently, James Bullard, who serves as a proxy for Jay Powell, came out and gave dovish comments which also boosted markets. The market has soared all year based on two key points: optimism that a trade deal will be reached between the U.S. and China and more easy money from global central banks. Earlier this year, the Federal Reserve reversed its stance and moved back into the easy money camp. Then, other central banks followed suit and that means easy money is back to being front and center for the market. Separately, the trade talks hit a hiccup and that is the primary reason for the recent pressure. As always, keep your losses small and never argue with the tape.

Do You Know The Most Under-Valued Stocks In The Market?

Our Members Do. Take a FREE TRIAL – CheapBargainStocks.com