[su_heading style=”modern-2-dark” size=”20″] Market Update: Bulls Remain In Control [/su_heading]

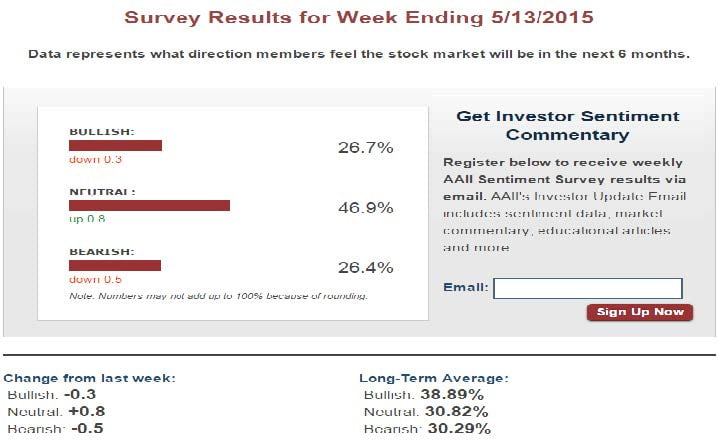

For the week, the bulls emerged victorious as the major indices positively reversed (opened lower and closed higher) which is a subtle and bullish sign. On the downside, the economy was the big loser after the latest round of “data” showed the economy remains weak. That means the “data-dependent” Fed will likely not raise rates anytime soon (which, for now, is bullish for stocks). It is also bullish to see so many bears out there even as stocks flirt with record highs (see page 2). For now, the market looks very strong and we want to err on the long side until we see more technical damage emerge. History shows us that some of the market’s strongest performers occur from big gaps up on earnings and some of the weakest stocks gap down after reporting numbers. The big winners (so far) from earnings season include: Amazon.com ($AMZN), Netflix ($NFLX), Hasbro ($HAS), Domino’s Pizza ($DPZ), Skechers ($SKX), Dunkin (Donuts) Brands Group ($DNKN), Microsoft Corp ($MSFT), O’Reilly Automotive ($ORLY), and YUM Brands ($YUM), Skywest ($SKYW), Web.com ($WWWW), Equinix ($EQIX), Styngenta ($SYT), Nutri System ($NTRI), Brink’s Co ($BCO), Teradyne Inc ($TER), Skyworks Solutions ($SWKS), GoPro ($GPRO), Estee Lauder ($EL), Abiomed Inc ($ABMD), Golar LNG ($GLNR), Energizer Holdings ($ENR), RetailMeNot, Inc ($SALE), Herbalife ($HLF), BlueBird Bio ($BLUE), HubSpot Inc ($HUBS), Alibaba Group ($BABA), Qorvo Inc ($QRVO), Visteon Copr ($VC), Norwegian Cruise Line Holdings ($NCLH). On the downside: Whole Foods Market ($WFM), Keurig Green Mountain ($GMCR), Kate Spade ($KATE), Lannett Co ($LCI), Nu Skin ($NUS), Terra Nitrogen ($TNH), Tumi Holdings ($TUMI), Noodles & Company ($NDLS), Qualys ($QLYS), Groupon Inc ($GRPN), News Corporation ($NWSA), Vitamin Shoppe Inc, ($VSI), Fossil Inc ($FOSL), Frontier Communication ($FTR), TriNet Group ($TNET), Zulily Inc ($ZU), Weight Watchers ($WTW), Walter Energy Inc. ($WLT), Skullcandy ($SKUL) Twitter ($TWTR), Yelp ($YELP), LinkedIn ($LNKD), Constant Contact (CTCT), Accuray ($ARAY), Cooper Tire & Rubber ($CTB), Abaxis ($ABAX), Texas Instruments ($TXN), Buffalo Wild Wings ($BWLD), Baidu Inc. ($BIDU), Stratasys ($SSYS), Harman ($HAR), Nokia ($NOK), Travelers ($TRV), 3M ($MMM), Chipotle ($CMG), Pulte Group ($PHM), Biogen Inc ($BIIB), Generac Holdings ($GNRC), First Solar ($FSLR), and American Express ($AXP), just to name a few.

[su_heading style=”modern-2-dark” size=”20″] Portfolio Update [/su_heading]

Thankfully, FLS has navigated the market rather well. Here is a snapshot of the FLS portfolio as of Friday’s close

[su_heading style=”modern-1-dark” size=”18″] Positions [/su_heading]

- The service owns: TSLA +21.57%, GDX +3.19%, AAPL -0.95%, NFLX +6.44%, REGN +0.60%

- The service will exit: TSLA @ 204.69, GDX @ 19.24, AAPL @ 121.62, NFLX @ 551.97, REGN @ 453

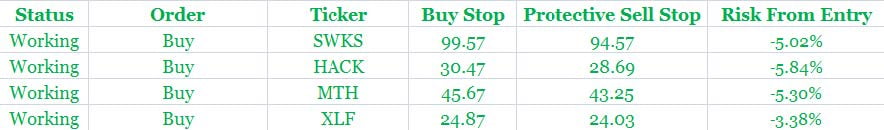

[su_heading style=”modern-1-dark” size=”18″] Working Buy Orders [/su_heading]

[su_heading style=”modern-2-dark” size=”20″] Analyzing The S&P 500’s Latest Moves (Up & Down) [/su_heading]

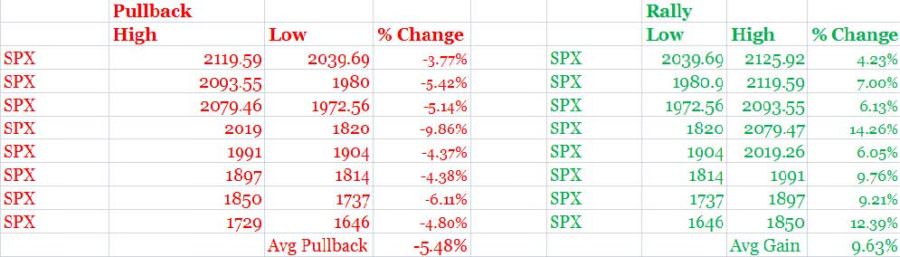

Nearly every pullback has been shallow in both size (small percent decline) and scope (short in duration) which is bullish for this ongoing and very powerful rally.

[su_heading style=”modern-2-dark” size=”20″] Chart of the Week [/su_heading]

American Association of Individual Investors Survey: It is Bullish To See “Only” 26.7% Of People Bullish Even As Stocks Flirt With Fresh Highs

[su_heading style=”modern-2-dark” size=”20″] 2015 Scorecard [/su_heading]

Nasdaq Comp +6.2% YTD, Russell 2k +3.2%, S&P 500 +3.2% YTD, DJ Industrials +2.5%

[su_heading style=”modern-1-dark” size=”18″] Key Points [/su_heading]

- Uptrend: Short-Term, Intermediate & Long Term Remain Strong

- SPX Support = 2039, 1980, 1972, 1904, 1820

- SPX Resistance = 2126

- Sarhan’s Crowd Behavior Index: Bullish

(Proprietary market indicator that measures crowd sentiment: Bullish Bearish or Neutral)

[su_heading style=”modern-1-dark” size=”18″] Global Macro Update [/su_heading]

[su_row]

[su_column size=”1/2″]

- Stocks: Uptrend

- Bonds: Looks Toppy

- Currencies (Euro/USD): Uptrend

- Softs: Downtrend

[/su_column]

[su_column size=”1/2″]

- Energy: Uptrend

- Metals: Sideways

- Grains: Downtrend

[/su_column]

[/su_row]