Stocks rallied last week after nearly every major Central Bank in the world continued to err on the side of caution. The big news came from the U.S. Fed when it raised rates by a quarter point for the second time in three months. For the first time since the 2008 financial crisis, it appears that the Fed is back in the Driver’s Seat.

Stocks rallied nicely after the Fed raised rates and that hasn’t happened since before the 2008 financial crisis. Confidence, a huge part of the investing equation, is slowly being restored in global central banks and the global economy. So, stepping back, monetary policy remains accommodative for investors and so does fiscal policy.

When Trump won the historical election back in November 2016, stocks soared because so-called animal spirits were released. The famous economist John Maynard Keynes referred to animal spirits as spontaneous optimism. That said, as long as stocks continue to rally we could be (not there just yet) entering into a climax run.

The two biggest climax runs happened in 1929 and 1999 and tend to occur in the latter stages of a bull market. This bull market just turned 8 and is the second longest bull market in history and at some point it will end. That doesn’t mean we can’t shoot higher for here and rally for a few more years but that we want to stay grounded and keep everything in perspective.

The two biggest climax runs happened in 1929 and 1999 and tend to occur in the latter stages of a bull market. This bull market just turned 8 and is the second longest bull market in history and at some point it will end. That doesn’t mean we can’t shoot higher for here and rally for a few more years but that we want to stay grounded and keep everything in perspective.

A Closer Look at What Happened Last Week…

Mon-Wed Action:

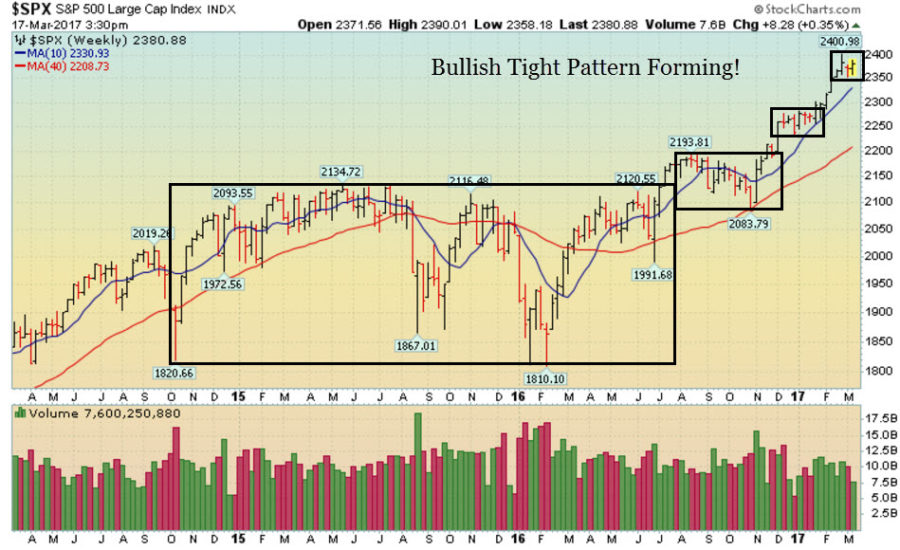

Stocks were quiet on Monday as investors waited for a busy week of market moving data. The benchmark S&P 500 traded in its tightest range of 2017. The big news of the day came from Bill Ackman. The billionaire investor sold his stake in Valeant Pharmaceuticals and the stock plunged -13% to $10.56 heavy volume.

Stocks were quiet on Monday as investors waited for a busy week of market moving data. The benchmark S&P 500 traded in its tightest range of 2017. The big news of the day came from Bill Ackman. The billionaire investor sold his stake in Valeant Pharmaceuticals and the stock plunged -13% to $10.56 heavy volume.

Stocks slid on Tuesday after crude oil fell 2% to hit a fresh three-month low. Oil fell after OPEC said oil inventories had continued to rise even though the cartel decided to cut production. Separately, Saudi Arabia surprised the Street when it self-reported a jump in production, despite the global deal to cut supply.

The big news of the week came on Wednesday when the U.S. Federal Reserve raised rates by a quarter point and, for the first time in years, appeared to be operating from a position of strength, not weakness. The other big event came from the Dutch elections. The election did not take a populist turn which could have caused the country to leave the E.U.

The big news of the week came on Wednesday when the U.S. Federal Reserve raised rates by a quarter point and, for the first time in years, appeared to be operating from a position of strength, not weakness. The other big event came from the Dutch elections. The election did not take a populist turn which could have caused the country to leave the E.U.

Thur & Fri Action:

Stocks closed mixed to slightly lower on Thursday as investors digested a busy week of data. Overnight, The Bank of Japan held monetary policy steady and maintained a positive view on the economy. The BOJ said it did not expect to expand monetary stimulus in the near future. Separately, The Bank of England did not raise rates as Brexit approaches. In the U.S. housing starts came in at 1.288 million, beating estimates for 1.270 million. Stocks were relatively quiet on Friday as investors digested a busy week and looked ahead to the G-20 meeting.

Market Outlook: Strong Action Continues

The market remains strong as the major indices continue to hit fresh record highs. The bulls have a very strong fundamental backdrop of monetary and now fiscal policy. All the major central banks are still relatively “dovish” which is bullish for stocks. The U.S. Fed only raised rates by a quarter point to 0.75%, which, historically, is still very low. On the fiscal side, Trump’s pro-growth policies are received well. As always, keep your losses small and never argue with the tape.