- Don’t Forget #GivingTuesday

Please join me in helping fight childhood cancer with @StJude: https://www.stjude.org/donate/thanks-and-giving.html?cID=13805&pID=24591&sc_cid=smd7206

- Next Webinar:

2. Learn How To Buy Leading Stocks Early – Join Us For A

(Free) Webinar Tomorrow After The Close (4pm EST)

Sign Up Here: https://chartyourtrade.com/webinar-11-29-2017

Market Update: Healthy Action Continues

The healthy action continues as the market pauses to digest a very strong rally. The Nasdaq 100 and SOX (semiconductor index ticker: SMH) are very extended and up for 8-9 straight weeks. They need to pullback- it is just a matter of when, not if. Separately, retailers are happy because Black Friday/Cyber Monday sales were up across much of the country. That should pave the way for a strong Q4 holiday shopping season. Remember, there is a slight upward bias in the last week of every month (window dressing) and we are in that period now.

BlockChain/Bitcoin Update:

In other news, Bitcoin is about to hit 10k and Mark Cuban came out recently and said investors should put 10% of their money into crytpo currencies. Separately, former Fortress hedge fund manager Michael Novogratz (who is very bullish on bitcoin and the entire Blockchain/crypto space) believes bitcoin can increase 4-5 times over the next year! Of course, he’s talking his book but there is something with this blockchain technology. I will be releasing an update soon to many of you who have asked how to get involved in this space. Clearly, buying bitcoin now is not “chasing” by any measure of the word. But, investing in a new token, might provide larger risk-adjusted returns. I’ll get back to you shortly when all the t’s are crossed and i’s dotted.

FLS Portfolio:

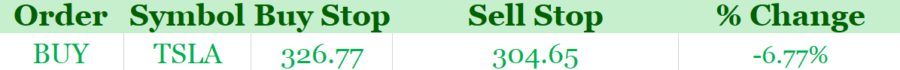

The FLS portfolio is continues acting well. On Monday, the service added MELI. Currently, the service is sitting on lofty gains and the protective stops were recently moved up to protect our positions. Here is a snapshot of the portfolio as of Monday’s close:

Positions:

The service owns: ADBE +66.53%, BABA +92.06%, CAT +28%, ISRG +28.04%, NFLX +13.04%, NVDA +27.94%, RMD +8.98%, MNST +10.22%, MELI -0.70%

The service will exit: ADBE @ 147.94, BABA @ 166.67, CAT @ 120.07, ISRG @337.27, NFLX @179.27, NVDA @187.62, RMD @ 77.70, MNST @56.04, MELI @ 250.73

Working Orders:

Disclaimer:

This analysis contains information from resources believed to be reliable but are not guaranteed as to accuracy or wholeness as of the date of this publication. Past performance is not necessarily indicative of future results. There is always a risk of loss in trading and investing. Opinions articulated are subject to change without notice. This analysis and any opinions expressed are intended for educational purposes only and should NOT BE interpreted as a call for engagement in any transaction involving the purchase or sale of any security or investment product or service. The risk of loss in investing and or trading can be substantial, and traders/investors should carefully consider the inherent risks of such an investment in light of their financial condition. The author, firm, associates, or the firm’s clients may have a position in any of the investments mentioned and their positions are subject to change without notice. Any reproduction or retransmission of any portion of this report without the express written consent of 50 Park Investments is strictly prohibited.