Although $NVDA had a good earnings report, the stock price fell, and the $SMH and $QQQ fell along with it. The stock market is a forward-looking mechanism, and my read is that all the enthusiasm for the semiconductors (which are fueling the AI revolution) has already been priced in the market, and buyers are taking a break and realizing profits. I’m reading Ray Kurzweil’s new book “The Singularity is Nearer: When We Merge with AI,” and I’m convinced semiconductors will be back, but for now, I’m putting a “red light” on that sector — except Palantir Technologies $PLTR (I’ll explain below). The charts in this post are courtesy of StockCharts.com.

Market Conditions: Green Light

Even though tech is down, other sectors are waking up: insurance and financials, for instance. The Dow $DIA is at an all-time high. The S&P 500 ($SPY) is near all-time highs. Aflac ($AFL) is the biggest winner in the model portfolio right now. Meanwhile, Adam Sarhan points out that many equities are forming bullish handles, signaling the potential for another leg up.

Advanced Entry Points:

Palantir Technologies ($PLTR)

$PLTR has defied the rest of the tech sector, and while $NVDA, $SMH, and $QQQ are down, $PLTR is above the 21-day moving average. In fact, it just found support at the 21-day moving average, and the model portfolio bought the dip after the bounce on 8/29/2024 at $31.48 per share with a close protective stop below the 21-day moving average at $29.85.

SharkNinja Inc. ($SN)

Thursday, 8/29/24 $SN broke out of a beautiful bullish flag pattern. The model portfolio is in at $31.48 with a protective stop just below support at $88.00.

Aon Corp. ($AON)

We took a position in $AON at $344.24 with a stop at $330.00 because of this great long flag that has been respecting support allowing us to put in a tight stop at less than 5%.

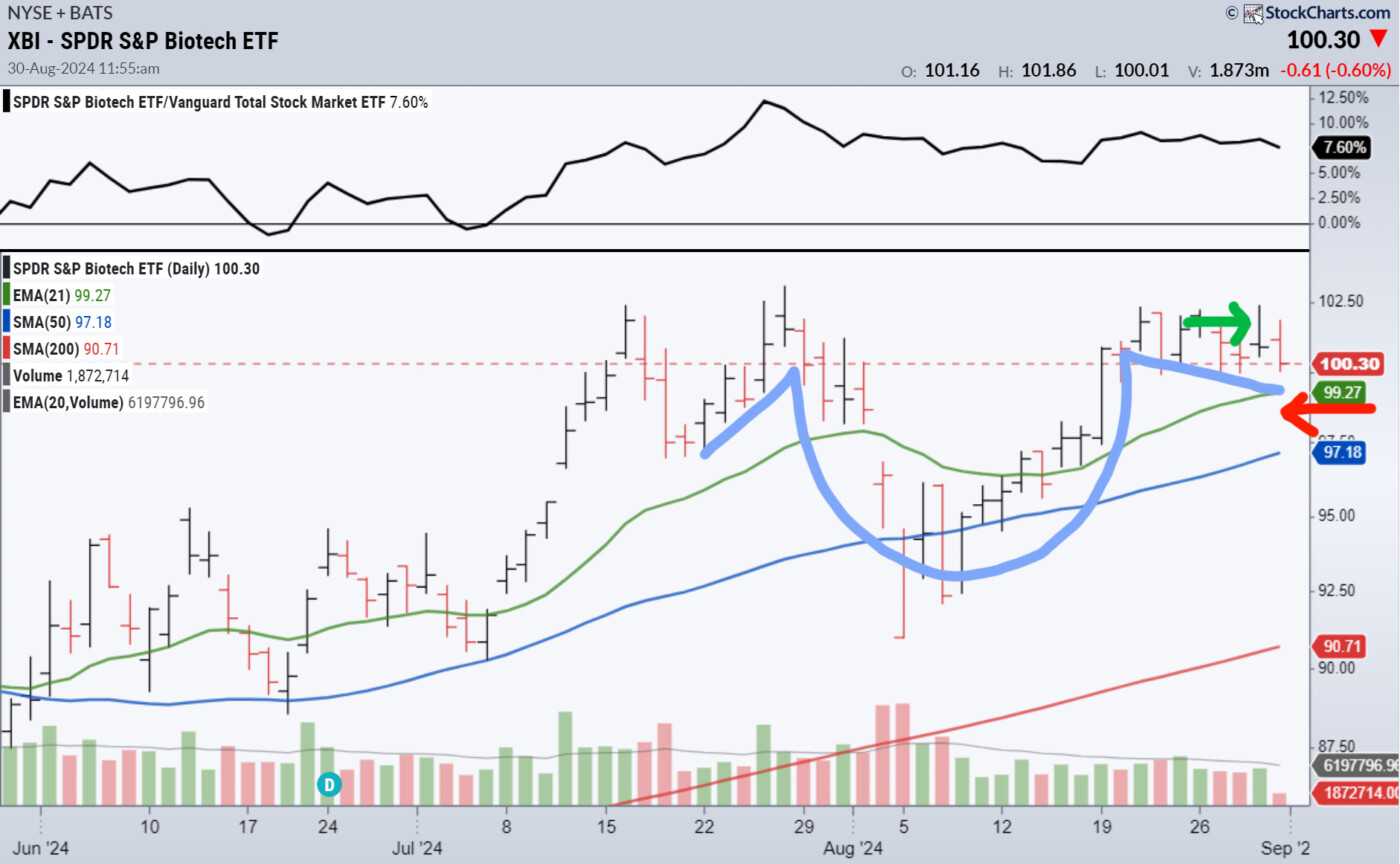

SPDR S&P Biotech ETF ($XBI)

$XBI has been forming a handle on a messy cup and handle pattern. For a moment on 8/29/24 it seemed poised to break out. We got in at $101.74 with a super-tight stop below support and just below the 21-day moving average at $97.00 (less than 4%). This seemed worth the risk. We had cash on hand to invest, and we were looking for a new sector outside of semiconductors. This was an early entry for us; we’ll see how it pays off.

Defense First

One of the reasons we took four new positions this week is that we’ve locked in profit on six other positions with protective stops, and the new positions we took had close support so we could enter with tight stops. That means, even with four new positions, we practically only have less than 1% of the entire portfolio at risk. The chance that one of the new positions will take off is worth the exposure from our point of view with the portfolio balanced the way it is.

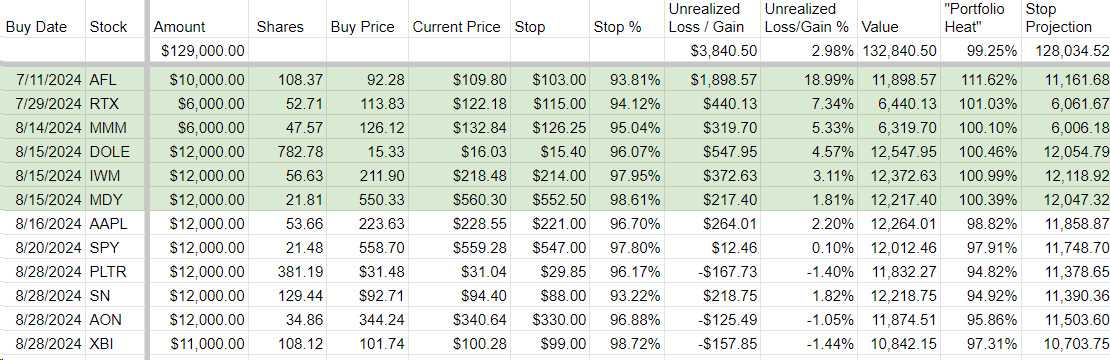

We started this model portfolio one year ago today. As of this moment, the model portfolio is up 28.01% compared to 26.17% for the $QQQ and 24.12% for the $SPY. Our goal is 20% per year with a cherry on top if we can beat the leading index, which was the $QQQ. We succeeded on both counts. Here are our current positions: