[su_spoiler title=”Monday-Wednesday’s Action: Earnings Continue To Be Released” style=”fancy”]

Stocks rallied sharply on Monday after China took more steps to stimulate their economy. Over the weekend, China’s Central Bank, The People’s Bank of China, lowered the reserve requirement ratio for banks to 18.5% from 19.5%. The 100 basis point cut was the largest move since November 2008 and is intended to stimulate their economy. The move came one trading day after China raise margin requirements for traders and allowed short selling in their equity market. Stocks sold off hard on the prior Friday but bounced back on Monday after more interference from global central banks. Hasbro ($HAS) gapped up after reporting Q1 results. Tuesday was a quiet day as investors digested Monday’s strong move. German economic sentiment fell to 53.3 in April, missing estimates for 55.3. Famous bond investor, Bill Gross was very vocal and said German bunds (their bonds) are “The short of a lifetime.” Shares of Fortinet ($FTNT) surged over 10% after it reported very strong Q1 results. Other cyber security stocks also rallied nicely on the news: FireEye ($FEYE), Cyberark ($CYBR), the Cyber Security ETF ($HACK), and Palo Alto Networks ($PANW) enjoyed a nice breakout on heavy volume. Teva Pharmaceuticals ($TEVA) offered $40Bin cash and stock to buy Mylan ($MYL). If the deal goes through, the new company would be worth $30B. MYL previously stated that they want to stay independent. It was another quiet day on Wednesday as the major averages sit quietly just below their record highs. In other news, Visa ($V) and Mastercard ($MA) surged on heavy volume after China announced it will open its $6B bank card clearing market in June to outside companies. In other news, Tesla ($TSLA) shares rallied nicely after the company announced that its new home-battery product is currently being tested by 300 homes and it wants to power 15 Wal-Mart ($WMT) stores in California. The new products will be formally announced on April 30 at the Tesla plant in Hawthorne, California. Economic data was mixed on Wednesday. Existing home sales jumped +6.1% from February to an annualized rate of 5.19 million units, beating estimates for 5.05 million and hit the highest level in 18 months. Separately, the FHFA Housing Price Index for February rose 0.7%, beating estimates for a gain of 0.6%. The weekly MBA Mortgage index rose 2.3% which was more good news for the housing market.

[/su_spoiler]

[su_spoiler title=”Thursday-Friday’s Action: Nasdaq Hits 2000 Closing High” style=”fancy”]

Stocks were quiet on Thursday as investors digested the latest round of mixed economic and earnings data. Weekly jobless claims rose to 295k, missing estimates for 286k. Manufacturing data remained weak across the globe. Markit’s German flash composite PMI slid to 54.2 in April from an eight-month peak of 55.4 in March. Factory data in China also missed estimates, HSBC’s preliminary reading of China’s factory activity fell to 49.2 in April, missing estimates for 49.6. In the U.S., the PMI Manufacturing index slid to 54.2, missing estimates for 56. In other economic data, New Home sales tumbled -11.4% in March and hit 481k, missing estimates for 510k. Stocks opened higher on Friday even as durable goods missed estimates. Google ($GOOG), Microsoft ($MSFT) and Amazon.com ($AMZN) all gapped higher and were the standout winners on Friday.

[/su_spoiler]

[su_spoiler title=”Market Outlook: The Central Bank Put Is Alive And Well” style=”fancy”]

Remember, in bull markets surprises happen to the upside. This has been our primary thesis since the end of 2012. We would be remiss not to note that this very strong bull market is aging (celebrated its 6th anniversary in March 2015) and the last two major bull markets ended shortly after their 5th anniversary; 1994-2000 & 2002-Oct 2007). To be clear, the central bank put is very strong and until material damage occurs, the stock market deserves the longer-term bullish benefit of the doubt. As always, keep your losses small and never argue with the tape.

59.2% Of Stocks in the S&P 500 Are Above Their Respective 50 DMA (Market Tends To Turn When This Reading Gets Above 70% or Below 40%) Observation: Readings above 70% usually (not always) correspond with a short term pullback Conversely, reads below 40% usually (not always) correspond with a short term bounce

[/su_spoiler]

[su_spoiler title=”Big Stock List” style=”fancy”]

- AAPL – Nice Bounce off 50 DMA line ahead of earnings 4/27/15 after close

- AMZN – Adding back to list after huge earnings related break-away gap

- EA – Strong rally last week after brief one day violation of 50 DMA line. Earnings 5/5/15 after close

- FB – Fell after reporting earnings. Closed above 50 DMA line

- FLT – Nice breakout last week ahead of Earnings 4/30 after close

- GOOGL – POWERFUL rally last week on heavy volume after the company reported earnings

- ILMN – Fell last week after earnings. Closed below 50 DMA line

- LNKD – Forming bullish handle (even though handle is sloppy) ahead of Earnings 4/30/15 after close

- NFLX – Adding back to list after huge earnings related break-away gap

- SBUX – HUGE bullish gap after stock reported Earnings

- TSLA – Healthy action continues as it tries to form a bottom ahead of Earnings on 5.13.15 after close

- UA – Big negative and downside reversal last week after earnings

- V – Big gap up last week after China announced it would open up its market to outside credit card companies. Earnings 4/30/15 after close

[/su_spoiler]

[su_spoiler title=”16 New Setups” style=”fancy”]

These hand-picked stocks are carefully selected to help with your idea generation and offer you additional setups each week. The setups are based on our proprietary criteria and offer advanced (dotted line) & classic long and short entry points (solid line). Short patterns are typically mirror images of long patterns.

Note: Please Verify All Earnings Dates/Data from Multiple Sources for Every Stock in all our report(s).

Charts Courtesy of Stockcharts.com

BLDR Setup: Watch For A Breakout

HALO Setup: Nice Early Entry Breakout. Classic Breakout

CLDX Setup: Early Entry Setup

LCI Setup: Nice Early Entry Forming

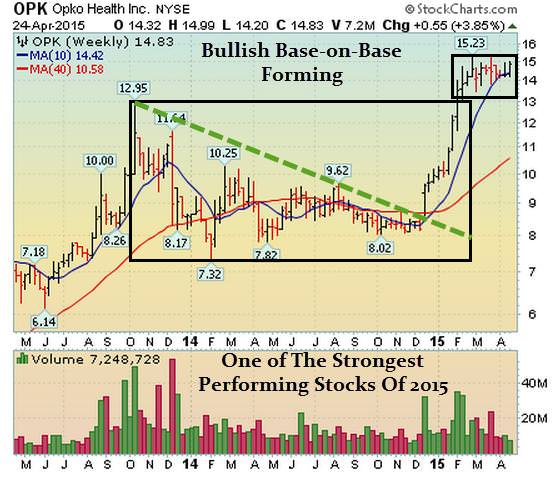

OPK Setup – Bullish Base-on-Base Forming

DK Setup – Early Entry Forming After Support Is Defended

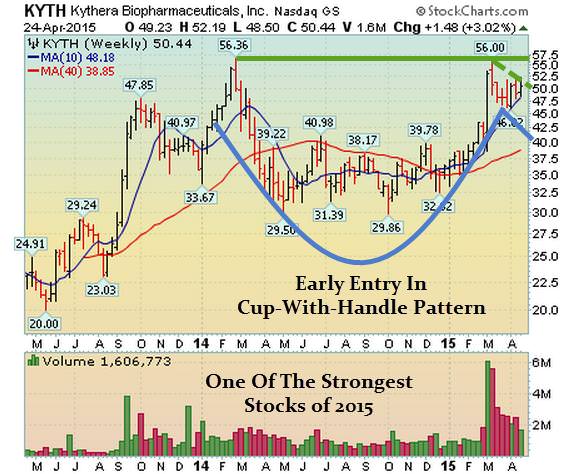

KYTH Setup – New Early Entry Forming In Cup-with-Handle Pattern

TWTR Setup: Early Entry Forming Ahead of Earnings

FEYE: Very Nice Setup Ahead of Earnings

KND Setup – Nice Early Entry Ahead of Earnings

GMCR Setup: New Early Entry Forming Ahead of Earnings

MNST Setup: Nice Setup Ahead of Earnings

OUT Setup: Nice Setup Ahead of Earnings

BMRN Setup: Early Entry Ahead of Earnings

LOCO: Early Entry Forming Ahead of Earnings

LNKD: Advanced Entry Forming Ahead of Earnings

[/su_spoiler]

[su_spoiler title=”Strongest Sectors, Groups, & Symbols” style=”fancy”]

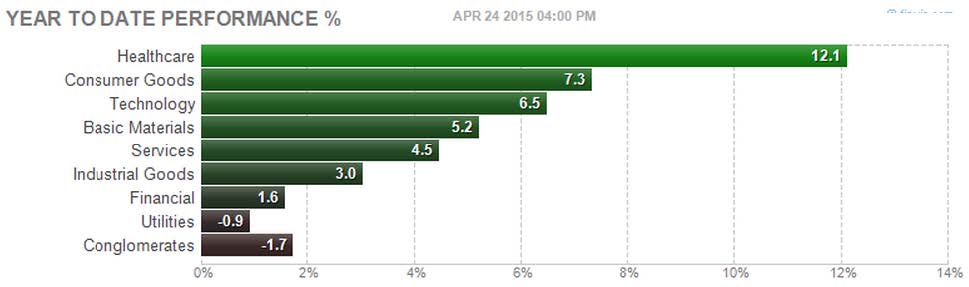

[su_heading style=”modern-1-dark” size=”18″]Strongest Sectors [/su_heading]

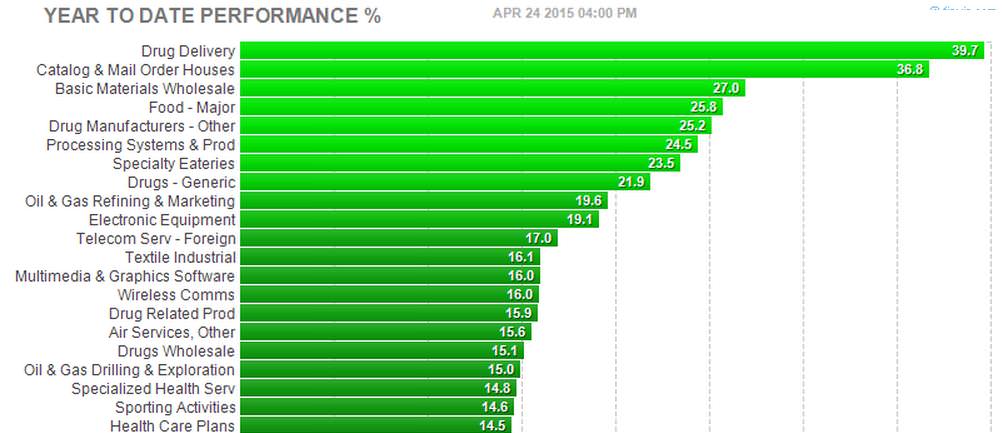

[su_heading style=”modern-1-dark” size=”18″]Strongest Groups [/su_heading]

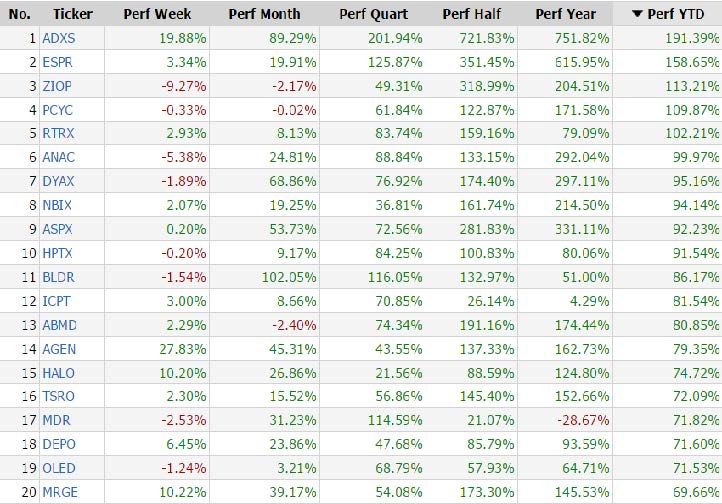

[su_heading style=”modern-1-dark” size=”18″]Strongest Performing Symbols This Year [/su_heading]

These are the top 20 strongest performing tickers on a year-to-date basis that are trading over $5, average daily volume over 500k and have a market cap >300M (Small cap-Mega Cap)

[/su_spoiler]