Market Finally Pulls Back

Overall, the major indices continue trading in a very tight range after a very strong ~10% post-brexit rally. So far, the action is normal and very healthy as the market appears to be pulling back from very extended conditions. Remember, there are two ways a market can pullback after a big rally: move lower or move sideways. Right now, the latter is occurring and that is the more bullish scenario. As we have said for the past few weeks, the key now is to analyze the health of this consolidation to see if this is an orderly/healthy consolidation or something more severe.

So far, the action is healthy except for a little selling in two areas: gold/silver stocks and healthcare/biotech stocks. It is also important to note that the S&P 500 has closed near 2,183 for the past 4 weeks. That’s healthy as it shows a relatively tight pattern after a big rally. Looking forward, the bulls remain in control until support is breached (50 day moving average and then the former chart highs: Dow 18,351 and S&P 500 2,134). Since Brexit, market pullbacks have only lasted a few days, which illustrates strong investor appetite for stocks. It would be great to see a light volume pullback into support, then see the market rally sharply after support is defended. Until support breaks, the short, intermediate and long term trend remains up for Wall Street.

A Closer Look at What Happened Last Week

Mon-Wed Action:

Stocks were quiet on Monday as oil prices fell by over -3%. In recent sessions, oil flirted with resistance near $50/barrel and is now pulling back a bit. In M&A news, Pfizer ($PFE) said it will acquire Medivation ($MDVN) for $81.50/share, or about $14 billion in cash. Medivation has one big cancer drug that attracted Pfizer to the deal. Pfizer out bid four other firms. A few biotech stocks rallied on the news. Technically, the market continues acting well as it remains perched just below record highs.

Stocks rallied on Tuesday as investors digested the latest round of mixed economic and earnings data. Shares of Best Buy Co. Inc. ($BBY) gapped up after the retail giant reported earnings. The company said online sales helped last quarter and they are going to do more to win market share back from Amazon.com (AMZN). On the economic front, a few European PMIs were released and they did not show a major post brexit slowdown, as so many people had feared. In the U.S., new home sales in July unexpectedly jumped to the highest level in almost nine years. New home sales came in at 654k, beating estimates for 580k. A slew of housing stocks rallied on the news. Separately, the Markit Manufacturing PMI for August, came in at 52.1, missing estimates for 53.2.

Stocks slid on Wednesday, dragged lower by a steep decline in Gold and Silver. Gold and Silver stocks have been one of the strongest areas in the market all year but are now in pullback mode as they recently placed a near term top and broke below their respective 50 DMA lines on Wednesday. Economic data was mixed. Existing home sales slid by -3.2% last month to 5.39 million units, missing the Street’s estimate for 5.52 million. A separate report showed that home prices edged higher by 0.2%, also missing estimates for a gain of +0.3%.

Thur & Fri Action:

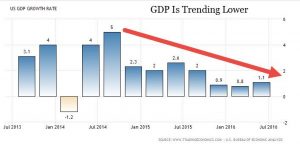

Thursday was another quiet day on Wall Street as the market continued to consolidate the recent and strong post brexit rally and waited for Yellen’s speech and the latest reading on GDP on Friday. Economic data topped estimates, with initial jobless claims falling for a third consecutive week to 261,000. Separately, durable goods orders jumped +4.4% in July, easily beating estimates for +3.7%. The Fed began its annual meeting in Jackson Hole and a few Fed heads came out and were a little hawkish. Esther George, Kansas City Fed President and voting member, said “I do think it is time to move that rate” and then Dallas Fed President Robert Kaplan said the central bank was “moving toward being able to take another step.” For the past few years, at nearly every meeting, the Fed has been teasing of another rate hike but when push comes to shove, they back off and do nothing. Before Friday’s open, the government said GDP rose 1.1% in the second quarter, which matched estimates. After GDP was announced, Janet Yellen delivered a speech in Jackson Hole, WY and said the Fed still remains data dependent.

Market Outlook: Stocks Are Strong

Stocks are strong. The market finally broke out of its very long trading range after Brexit and ahead of earnings season. The fundamental driver continues to be easy money from global central banks. Economic and earnings data remain mixed at best which means easy money is here to stay. As always, keep your losses small and never argue with the tape.