Week-In-Review: More Stimulus Sends Stocks Higher

Week-In-Review: More Stimulus Sends Stocks Higher

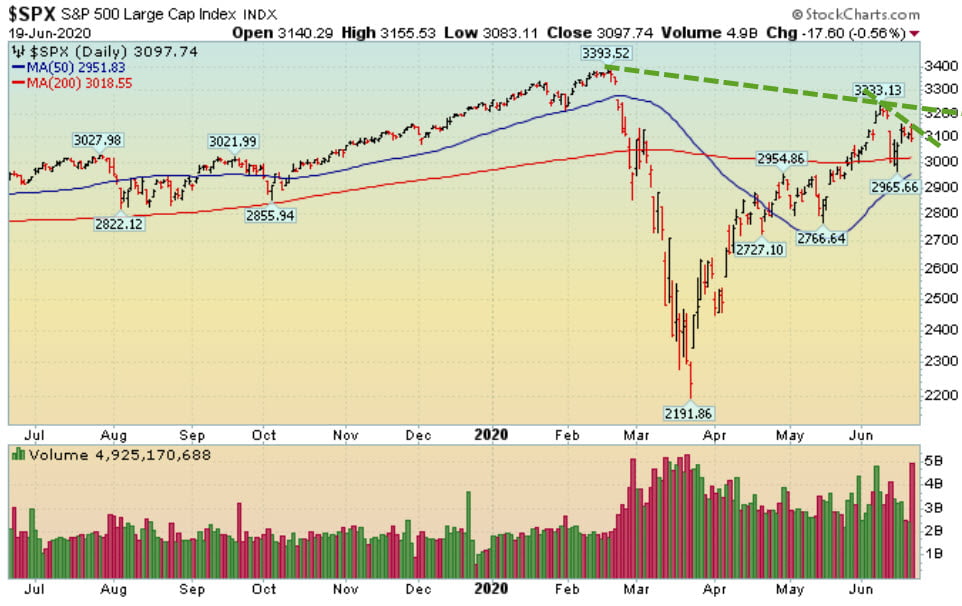

The market ended the week higher after the latest 1,2 punch from fiscal and monetary policy came out of Washington D.C.. The market opened the week lower but the bulls quickly showed up after the Federal Reserve (fiscal policy) came out and said it will directly buy corporate bonds. A few hours later, a headline crossed the tape which said the White House is considering a whopping $1 trillion infrastructure plan to stimulate both Wall Street and Main Street. The last time we saw that type of powerful 1,2 punch was at the March 2020 low. Remember, we are heading into the end of the month and the end of the quarter which typically has a slightly upward bias. For now, the market is extended and due to pullback since it is getting a little top heavy. Stepping back, the bulls remain in control as long as the major indices continue trading above their respective 50 DMA lines.

Monday-Wednesday’s Action:

On Monday, stocks opened sharply lower but turned higher after the Federal Reserve said it will buy individual corporate bonds. This is another major move from the Fed and it comes a few weeks after it said it will start buying ETFs. The Fed is firing hard and doing its best to keep stocks UP! Whenever the market gets in trouble, the Fed pulls another rabbit out of its hat. Stocks raced higher on Tuesday after the White House said it will announce a $1 trillion infrastructure plan to help stimulate both Wall Street & Main Street. In other news, retail sales bounced back with a vengeance and soared as the economy continues to slowly reopen.

Thursday & Friday Action:

On Thursday, the market was mixed for most of the day as the Nasdaq led and the Dow & S&P 500 lagged most of the day. Initial U.S.weekly jobless claims rose more than expected last week and came in at 1.508 million, which was higher than the Street’s estimate for 1.3 million. On Friday, the market ended mixed as investors digested a busy week and look ahead to the end of the month and the end of the second quarter.

Market Outlook: Flood The System With Liquidity

Global governments and global central banks stepped in with massive rate cuts and other “aid” packages to help “stimulate” both Main Street and Wall Street. So far, it is working as intended. As long as March’s lows hold, the market will likely move sideways to higher. On the other hand, if March’s lows are breached, then look out below. As always, keep your losses small and never argue with the tape.