Week In Review: Market Selloff Continues

Week In Review: Market Selloff Continues

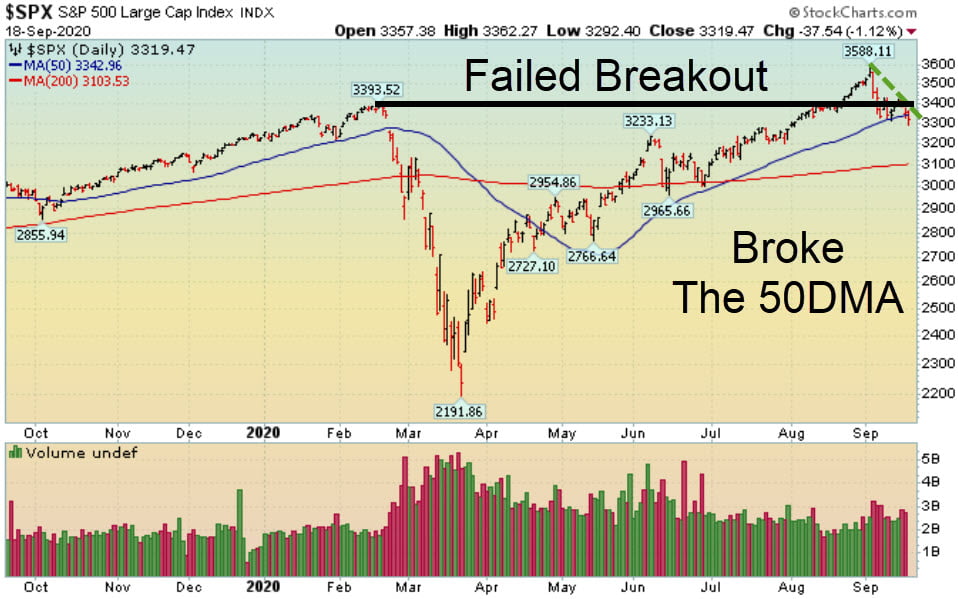

The major indices ended mostly lower last week as the tech-heavy Nasdaq 100 led the market lower. The market is pulling back and has fallen a decent amount since the high hit in early September. Right now, I’m still bullish in the intermediate and longer term as this appears to be a correction within a larger uptrend. It is normal to see the market pullback before an election and then rip higher after that “uncertainty” is removed from the equation. If the selling continues then a more defensive stance is warranted. Until then, I like to give the market the bullish benefit of the doubt.

Monday-Wednesday’s Action:

Stocks rallied nicely on Monday after the bulls showed up and defended the 50 DMA line for the major indices and specifically the tech-heavy Nasdaq Composite. This helped a slew of big cap tech stocks rally nicely which lifted the broader market. Stocks rallied nicely on Tuesday as the market continued to rally off the 50 DMA line. After Tuesday’s close, FedEx gapped up after reporting another very strong quarter. In IPO news, SnowFlake priced its IPO above the initial range giving the company an initial market cap of $33.3 billion. Stocks were up on Wednesday but ended mixed after the Fed held rates steady and reiterated their dovish (a.k.a. ultra low rate) stance for a very long time. Once again, the leading areas of the market (mainly the Nasdaq and Nasdaq 100 type tech stocks) dragged the broader market lower.

Thursday & Friday Action:

On Thursday, stocks fell as sellers showed up and sent a slew of tech stocks sharply lower. Most of these stocks have enjoyed historic runs from their March lows and are simply pulling back to digest their very strong moves. Normally, you want to see a nice light volume 5-10% pullback into support near the 50 DMA line but these stocks are anything but normal. Stocks fell again on Friday as the Nasdaq 100 sliced below its recent low and is “living” below its 50 DMA line.

Market Outlook: Flood The System With Liquidity

In September, we saw just about every major Central Bank reiterate their dovish stance which should bode well for asset prices. Global governments and global central banks stepped in with massive rate cuts and other “aid” packages to help “stimulate” both Main Street and Wall Street. So far, it is working as intended. As long as March’s lows hold, the market will likely move sideways to higher. On the other hand, if March’s lows are breached, then look out below. As always, keep your losses small and never argue with the tape.