Stocks Slid Last Week As Earnings Season Begins

Stocks Slid Last Week As Earnings Season Begins

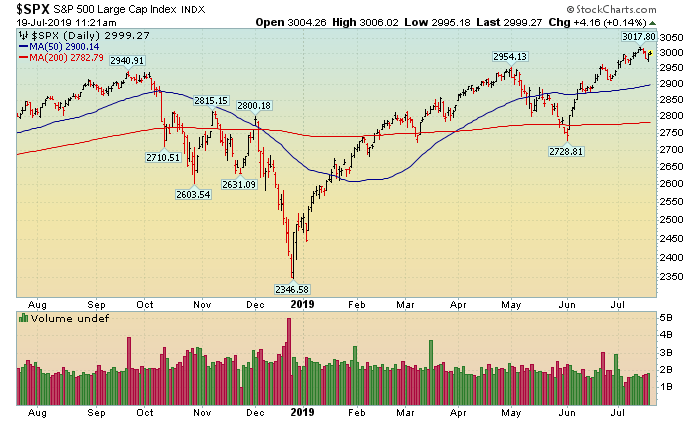

The major indices slid last week as earnings season begin in earnest. The market was mostly quiet last week as investors digested a slew of earnings and are waiting to see what the Fed will do at their next meeting. So far, earnings have been a mixed bag with a few big blow ups that hit the tape last week mainly: CSX and NFLX. Stepping back, it is perfectly normal (and healthy) to see the major indices pullback as the market digests a strong rally since early June (and wait for the Fed meeting). Investors want to see what will happen with earnings over the next few weeks and they want to see what the Fed will do at its next meeting (most likely cut rates).

Monday-Wednesday’s Action:

Stocks were quiet on Monday as investors waited a busy week of earnings. Before Monday’s open, Citigroup reported earnings which set a positive tone for other financials. In other news, rumors spread that Trump would replace Wilbur Ross. Stocks were quiet on Tuesday as investors digested the latest round of earnings and geopolitical headlines. President Trump said, there is a ‘long way to go’ on trade with China which was not ideal. The good news is that the market did not crash on the news. On Wednesday, the market was mostly lower as investors digested the latest round of earnings. Bank of America rallied after reporting earnings but CSX gapped down over 10% after the company announced lousy numbers and the CEO said he was “puzzled” by this economy.

Thursday & Friday Action:

On Thursday, stocks were quiet as investors digested the latest round of earnings. Netflix gapped down after reporting disappointing numbers. After the close, Microsoft ticked higher after reporting earnings. In other news, The House passed a bill to hike the federal minimum wage to $15 per hour which may impact corporate earnings in the future and Trump said the US Navy destroyed an Iranian drone in a “defensive” action. Stocks slid on Friday ahead of the weekend.

Market Outlook: Easy Money Is Back

Once again, global central banks showed up and juiced markets. The market has soared all year based on two key points: optimism that a trade deal will be reached between the U.S. and China and more easy money from global central banks. Earlier this year, the Federal Reserve reversed its stance and moved back into the easy money camp. Then, other central banks followed suit and that means easy money is back to being front and center for the market. Separately, the trade talks have resumed with China and the markets are back to new highs. As always, keep your losses small and never argue with the tape.

Do You Know The Most Under-Valued Stocks In The Market?

Our Members Do. Take a FREE TRIAL – CheapBargainStocks.com