Photo by Clay Banks on Unsplash

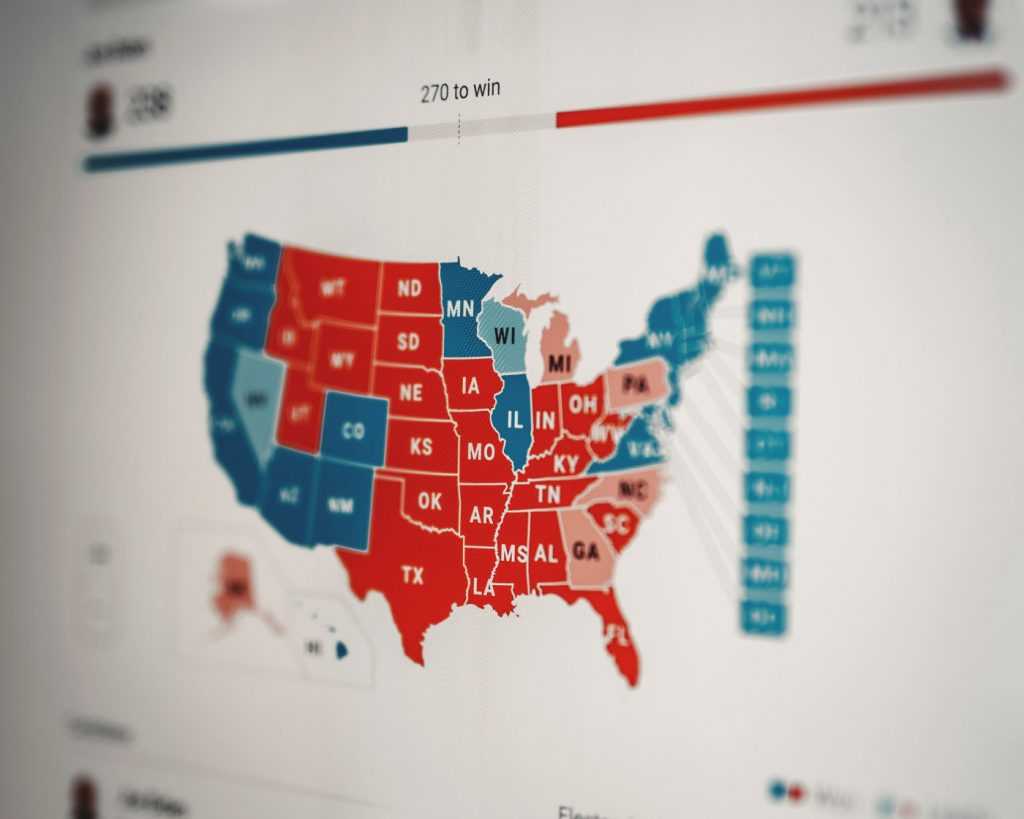

Week-In-Review: Stocks Fall Ahead of The Election

The market opened October on a positive note but closed sharply lower as the bears showed up in the latter part of the month and regained control. Stocks opened the month higher on optimism that another round of stimulus will be announced in October but when it became clear that was not going to happen, stocks sold off hard. The next disappointing event was that the number of cases soared in October which also put pressure on stocks, especially because we are heading into the winter which tends to be “flu-season.” Remember, markets like certainty and right now we have a lot of uncertainty which is putting pressure on stocks (spike in cases, the stimulus package, plus the election, just to name a few). Let’s see what happens with the election and hopefully we are one headline away from a viable vaccine. The Dow broke below September’s low which is a bearish sign but it was somewhat encouraging to see the bulls show up and defend the longer term 200 DMA line. If the S&P 500 and Nasdaq/Nasdaq 100 follow then odds favor we are heading lower. We are sitting on very large double and triple digit gains in several of our positions in the FindLeadingStocks portfolio and our stops are raised again to protect our profits.

Monday-Wednesday’s Action:

Over the weekend, the number of Covid-19 cases surged across the globe which sent stocks lower on Monday. Stocks fell close to 1,000 points on Monday as investors reacted to the surge in cases. In other news, the stimulus drama continued as the gridlock continued on both sides. Stocks ended mixed on Tuesday as the Nasdaq led while the other indices lagged. The stay-at-home stocks led the way higher as the number of cases continued to rise. After the close, Microsoft reported stronger than expected earnings as the company benefited from the cloud and other work from home services. Stocks plunged on Wednesday as the number of cases continued to spike around the world and investors waited for a lot more earnings to be announced.

Thursday & Friday Action:

Stocks rallied nicely on Thursday as slew of stocks reported earnings. Shopify, Spotify, Facebook, Amazon, and Apple were some of the stocks that reported earnings on Thursday. Before the open, the Government said Q3 gross domestic product (GDP) vaulted by +33.1% annualized pace, its fastest growth ever. The reading came after a whopping -31.4% plunge in the second quarter and was better than the Street’s forecast for a +32% gain. Stocks fell hard on Friday after a slew of big cap tech stocks reported earnings.

Market Outlook: Flood The System With Liquidity

The bears are getting stronger as we are retesting September 2020’s low. If it holds, it will be a steep correction within a longer term (and strong) uptrend. If all the major indices break below September’s low then odds favor lower prices will follow. Earlier this year, global governments, and global central banks, once again, stepped in with massive rate cuts and other “aid” packages to help “stimulate” both Main Street and Wall Street. As long as March’s lows hold, the market will likely move sideways to higher. On the other hand, if March’s lows are breached, then look out below. As always, keep your losses small and never argue with the tape.

Do You Know The Most Under-Valued Stocks In The Market?

Our Members Do. Take a FREE TRIAL