What Makes Stocks Go Up?

The Dow Jones Industrial Average, which tracks the United States’ largest publicly traded companies’ performance and shows investors the trend of stock prices overall, had a wild year in 2020.

Back in 2001, the average closing price of the Dow was a little over 10,000. By 2020, the average closing price was over 2.5 times as much, hitting a year high of just over 28,000 and at one point dipping below 19,000.

If you were to invest in a mutual fund tracking the Dow in the early 2000s, every dollar you invested would be worth almost $3 today. But what’s causing price changes in the stock market, and what makes stocks go up. Let’s discuss what makes stocks go up (and eventually, back down.)

Every day traders buy and sell hundreds of billions of dollars’ worth of stocks on stock exchanges. Some days, the stock market makes significant gains and increases nearly 2,000 points, like it did on March 13th, 2020. This was the day that the market reacted positively to a national emergency declaration where America’s largest companies shared commitment to managing COVID-19.

However, the day before, on March 12th, there was one of the Dow’s most prominent point drops since the 1987 monetary crisis. On the 12th, the markets fell almost 13 percent, which was a major stock market correction due to fears of the coronavirus. There’s always a back and forth with the stock market, especially during times of pandemics, natural emergencies, and other significant events.

But these examples are not the only reasons why stock prices collectively seem to rise and fall. Three main factors influence stock prices. These include company fundamentals, technical factors, and market sentiment. Let’s go over these one at a time to gain an understanding of stock price shifts. At first, these forces which change stock prices seem complex, but don’t worry, we’ll break it down into definitions that are easy to understand.

Prices Start with Company Fundamentals

In the example above of the stock market crash and reversal, which took part on March 12th and 13th, outside factors influenced stock prices. However, if you track the stock market’s historical increases over a more extended period, you’ll notice that company fundamentals have the most significant impact on stock prices.

But what exactly are company fundamentals? Generally, when company profits increase, stock prices do too. Because profits are rising for many companies, even during the pandemic, fears about future earnings can shock the market one day, only for there to be a swift reversal the next.

This could be due to a realization that most company fundamentals hadn’t changed. Instead, investors were selling shares on the fear that the pandemic could hurt businesses’ bottom lines. If stock prices only increased when a company’s earnings increased, these sudden drops would rarely happen.

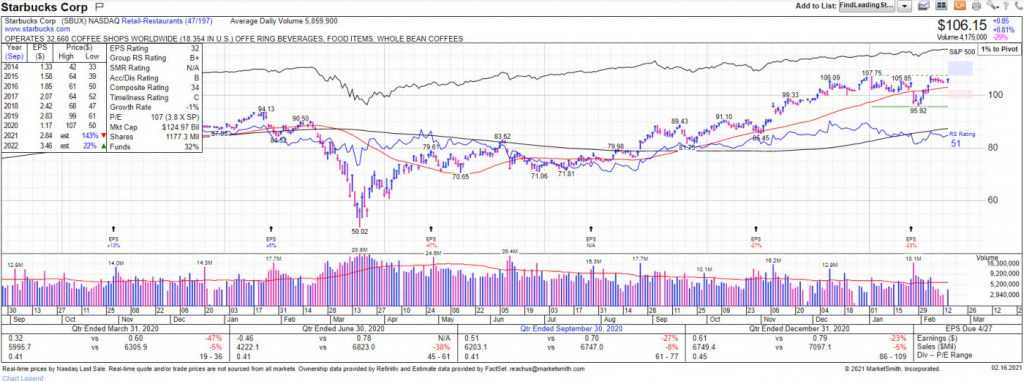

Several company fundamentals can help you determine if a stock is accurately priced. First, you must evaluate a company’s earning power. You can do this by calculating its earnings per share (EPS) or by measuring the company’s free cash flow per share. Investors use several strategies to determine how profitable a company is and how likely they’ll earn profits from products and services in the future.

The second fundamental you’ll want to track is called a valuation multiple. There are several valuation multiples that you can calculate, which help determine a company’s financial status. These include P/E ratios, price/book ratio, dividend yield, and price/sales.

Essentially, purchasing a stock share gives you the right to a proportional share of a company’s future earnings. Earnings power and valuation multiples help investors “predict” how a company will do in the future. By looking at these two fundamentals, you’ll gain an understanding of your potential return on investment over the long-term.

In addition to earnings power and valuation multiples, there are two additional vital fundamental factors: perceived company risk and discount rate. When a stock is perceived risk or a company’s future earnings are estimated at a value less than current stock prices, investors are willing to pay less per share. These factors directly influence the price of a company’s valuation.

In an efficient market, these four fundamentals would influence the price of a stock. However, stock prices are not always rational. Let’s move onto the two other factors that make stock prices rise and fall.

Technical Factors That Influence Stock Prices

In addition to company fundamentals, there are also technical factors that influence stock prices. Prices often change because of inflation, deflation, overall economic strength, economic trends, demographics of stock market investors, and even the news. These reasons make it challenging to predict prevailing market conditions today and in the future. However, these factors help investors determine short- and long-term strategies to earn investing profits. Yet, one other market factor causes a stock to increase in price, known as market sentiment.

How Market Sentiment Makes Stocks Go Up (and Down)

The final factor that influences stock prices is market sentiment. Market sentiment refers to how investors act both individually and as a collective. Because human psychology influences stock prices, it’s the most difficult to factor while valuing a company. Sometimes a company with positive earnings and a promising future outlook does not see a stock price increase because of investor sentiment. Investors might ignore the positive news and dwell on a negative statistic, even when the stock price is undervalued. This adds a bit of randomness to stock prices.

In conclusion, stock prices are complex and dynamic. Sometimes stock prices increase when a company is expected to grow and improve profitability. Other times, values increase because of technical factors, such as the current interest rate. And then, prices per share increase (and decrease) because of how investors act together and as a group. So how should you invest your money as a beginner investor, considering all the ways stocks increase and decrease in value? If you’re aiming to become a long-term investor, the best way to determine whether you’ll make money on a stock is by looking at the fundamentals and going from there.

Additional Resources

Factors That Cause the Market to Go up and Down What Makes a Stock Go Up?