2018 opened with a bang! Not only did the major averages continue to hit new record highs, there was virtually no selling to speak of. Clearly, this is very strong action and it tells you that the bulls remain in control as sellers are virtually nowhere be seen.

What does that mean for 2018? Based on historical precedent, odds favor, 2018 will be another strong year on Wall Street. In 2017, the Dow rallied +25% and that has happened ten times since 1950. Only two of those times did the market fall in the following year and it continued to rally 8 times. Out of the 8 up years, 6 of them were up double digits and the average yearly gain (after a 25% year) was +12.6%. The data suggests that 2018 will most likely be a positive year but history also shows us that volatility should pick up. Stay tuned…

A CLOSER LOOK AT WHAT HAPPENED LAST WEEK…

Mon-Wed Action:

Stocks were closed on Monday for New Years. On Tuesday, the Dow opened up over 100 points as investors opened the new year with a bang. According to Ryan Detrick, from LPL, “Does the 1st trading day of the year matter? Sounds random, but … Past 20 years, on the 1st day of a new year the S&P 500 has been higher 10 times and lower 10 times. Full year return if up the first day? +14.2%. Full year return if down the first day? -0.6%” Just some food for thought and it would surprise nearly everyone if stocks rallied sharply again this year. My clients know that, until we see any signs of weakness, I’m bullish on the market.

On Wednesday, stocks continued to rally and big money flowed into nearly all areas of the market.

Thur & Fri Action:

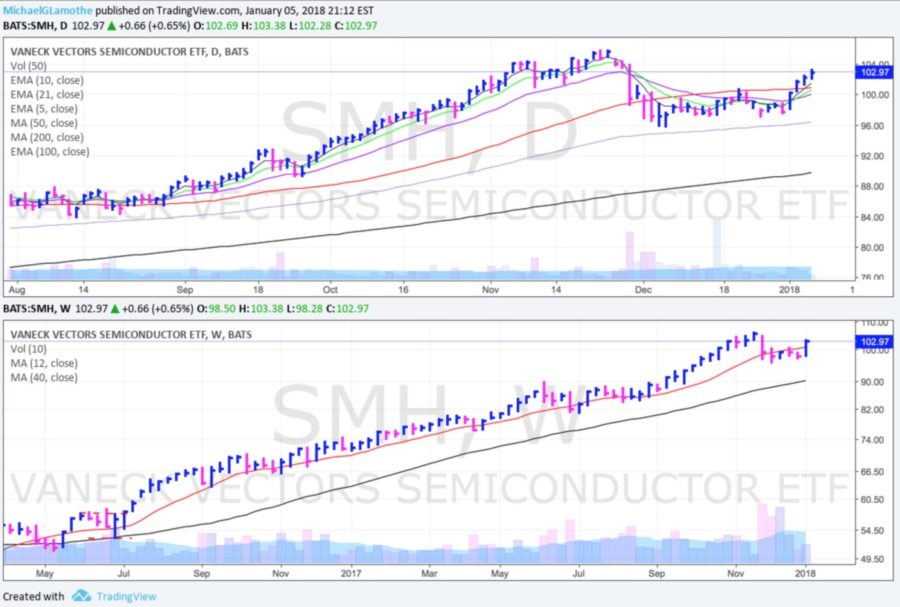

Stocks rallied on Thursday as a lot of money flowed into the semi-conductor group. Most of the semi-conductor stocks were pausing for a few weeks as they consolidated a big move in 2017. For now, the move continues and tech stocks in general remain exceptionally strong.

Stocks rallied on Thursday as a lot of money flowed into the semi-conductor group. Most of the semi-conductor stocks were pausing for a few weeks as they consolidated a big move in 2017. For now, the move continues and tech stocks in general remain exceptionally strong.

Stocks rallied sharply on Friday after the government said, U.S. employers added +148,000 new jobs last month, missing estimates for 191k.

Market Outlook: Bulls Are Strong

The bulls are back in control and the market remains very strong. As always, keep your losses small and never argue with the tape.