Note: The following is an excerpt from an intra-week update to Find Leading Stocks Members.

Click here to become a member.

Click here to become a member.

Market Update: A Big Top Is Forming

The market is forming a major top and unless we see another bullish monetary or fiscal bazooka show up that sends stocks to new highs – we are likely headed into a bear market. I don’t make these statements lightly but this is an aging bull market and it will eventually end. Before I go any further, to be clear, if support is defended, and the market can hit new highs, then this big top will be negated. If not, look out below. Here is what I’m seeing:

Big Paradigm Shift

The BIG PARADIGM shift that happened on Tuesday was the market stopped reacting blindly bullish (if that’s even a phrase) to the Fed. Remember, it is not the news that matters, but how the market reacts to the news. In a bull market, the reaction is overwhelmingly bullish and in a bear market the reaction is overwhelmingly bearish. Meaning, in a bull market, the market rallies on both “bullish” and “bearish” news and, in a bear market, the opposite is true. For the last ten years, we have been steadily rallying and the reaction has almost always been bullish. For the first time in ages, that dynamic changed & that needs to be respected.

Big Tops:

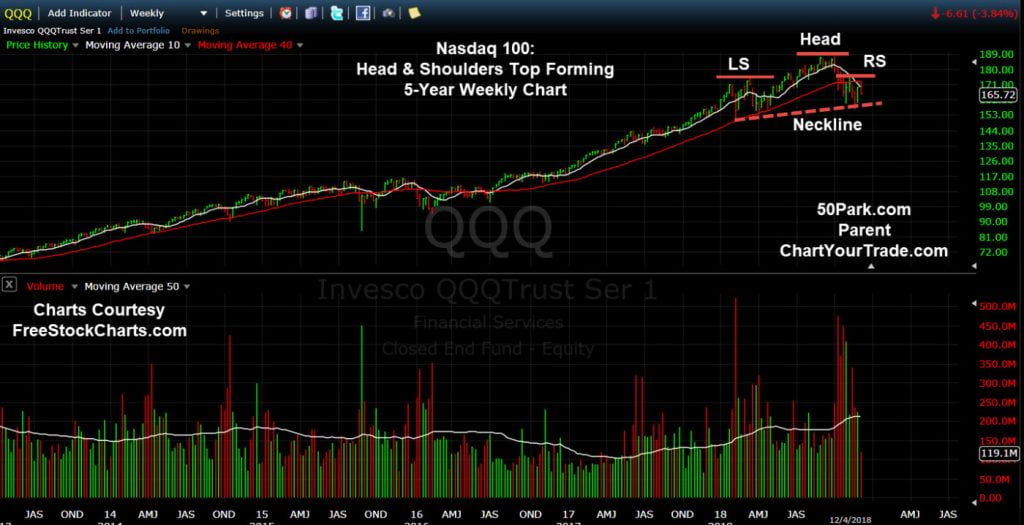

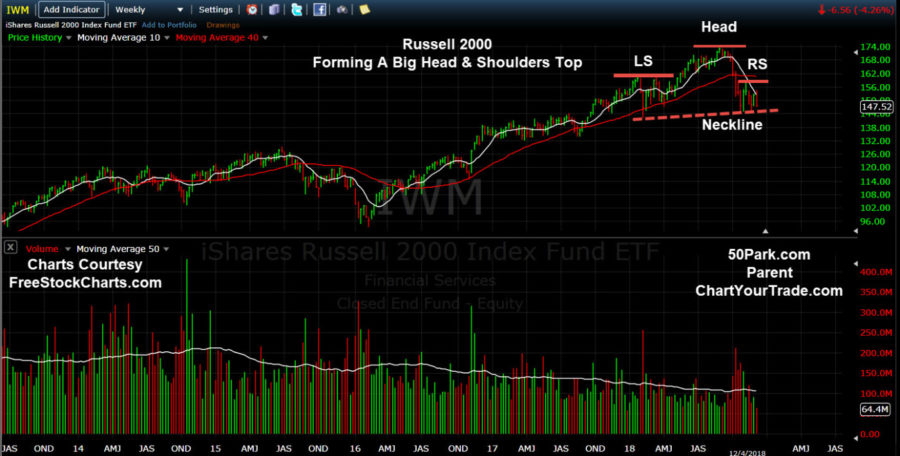

The second major part to my thesis is that bull markets do not last forever and big tops take time to form. Stepping back, 2018 is turning into one very large top. Take a look at these charts and I’ll let you decide (see below). I annotated them earlier today on a coaching session (send an email to website@chartyourtrade.com if you want Adam to coach you) with a longstanding FLS member. Clearly, we can see big topping patterns forming and that is not a good sign- especially 10 years in to the longest bull market in history. It’s funny because no one has the courage to call a top. Since everyone is so jaded with the relentless bull market we have experienced over the last decade. If I’m wrong and the market soars from here, so be it. But until then, the bearish writing is on the wall.

Nasdaq 100:

Russell 2000:

Dow Jones Industrial Average:

S&P 500:

Latest bounce:

I was wrong last week. I thought the market would rally into year-end & then roll over like it did back in late 2015 and then fell in the first two months of 2016. The market plunged on Tuesday after failing at the declining 50 and 200 DMA lines and that is a bearish sign. The market is acting poorly and I will adopt a bearish stance until all the major indices get back above their respective 50 and 200 DMA lines. Furthermore, if they take out October’s low and then Feb’s low, we will fall into a bear market.

I Welcome A Bear Market:

By the way, I welcome a bear market with open arms. Why? Because it will “reset” the clock and we can step in a clean up. I have learned how to navigate bear markets with grace and will show you how to preserve both your mental and physical capital (while nearly everyone else on the Street gets slaughtered). Then, when the “pain” is at a maximum, and the bear market bottoms, we step in and clean up. As always, I want to see where the market closes tomorrow and will have a full report for you this weekend.

By the way, I welcome a bear market with open arms. Why? Because it will “reset” the clock and we can step in a clean up. I have learned how to navigate bear markets with grace and will show you how to preserve both your mental and physical capital (while nearly everyone else on the Street gets slaughtered). Then, when the “pain” is at a maximum, and the bear market bottoms, we step in and clean up. As always, I want to see where the market closes tomorrow and will have a full report for you this weekend.