Hi, I’m Andy! I’m a freelance writer and restaurant manager, and I have also been following ChartYourTrade.com since the day it launched. This post is a review of the performance of the 10 Elite Stock Setups that Adam sent to his Advanced Stock Reports subscribers on Saturday, January 12, 2019. Each setup comes complete with annotated charts highlighting the advanced entry point and support level(s), as well as all of the necessary fundamental information.

One of the reasons that I struggled to find success in the market was that I always tried to take on more than I could reasonably handle. I used to commit myself to researching dozens and dozens of stocks and tracking their daily movements, but I would always burn out after a few months and fail to keep up the pace that I set for myself.

It wasn’t until I found Adam’s weekend newsletter that I was able to see the power of a strategy that leaves room for life to get in the way. And life definitely got in the way for me this week, as I didn’t have time to check on the market even once during the week.

Thanks to Adam’s insight and my calm Saturday mornings, I am able to get myself completely caught up and refocused over the weekend. And with seven of the ten stocks from last weekend’s newsletter breaking through their entry points, I can see that the market is starting to command some more attention.

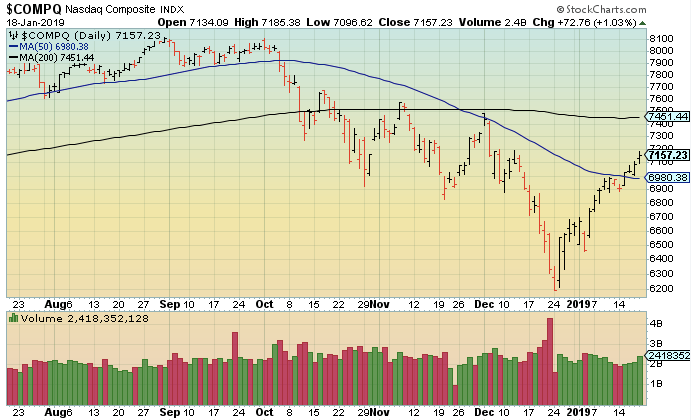

The General Market

In order to properly evaluate what each of our ten elite stock setups did this week, we need to look at them with the context of the general market fresh in our minds.

After a slow start on Monday, the market came to life on Tuesday as it crossed above its 50-day moving average line. It then continued higher throughout the rest of the week, finishing well above the 50-day moving average but still below its declining 200-day moving average.

We have seen a very strong move up from the low that was put in during the week of Christmas, but the market still has some work to do in order to convince us that the bear market is officially over. Regardless of where we are heading, a pullback is certainly in order to give this market a chance to catch its breath.

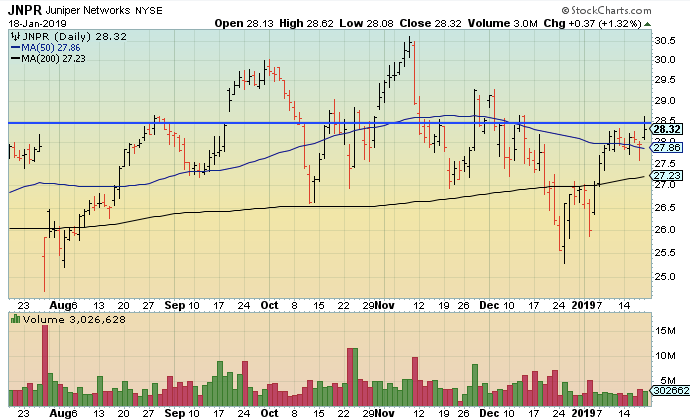

Juniper Networks – Triggered

With its 50-day moving average holding above its 200-day moving average, JNPR was already in a better position than most stocks coming into the week. After struggling on Monday, the stock retook that 50-day line on Tuesday. It then found support there on Wednesday and Thursday before moving higher on Friday.

That Friday move was strong enough to push the stock above Adam’s entry point, but it was not able to hold above that number. It did hold above its 50-day line though, and JNPR looks to be a very strong stock moving forward.

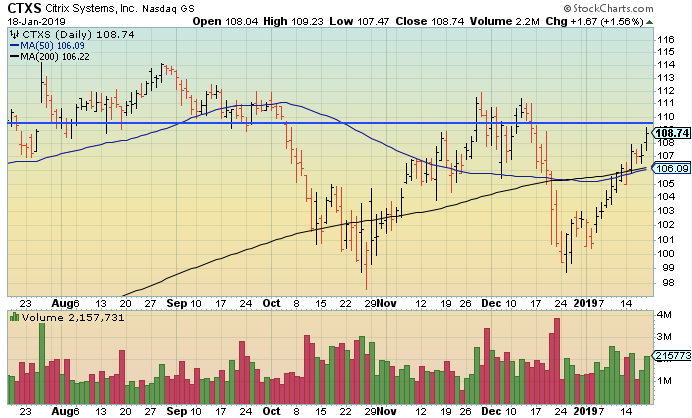

Citrix Systems, Inc. – Did Not Trigger

We have seen a ton of stocks lately that are demonstrating strength without quite getting to the entry points that Adam identifies for them. CTXS was one of those stocks this week.

The stock gave up its 50-day and 200-day moving averages on Monday, but it was able to quickly recover and shoot back above those lines on Tuesday. It then continued higher on Thursday and Friday and closed near the top of its range for the week.

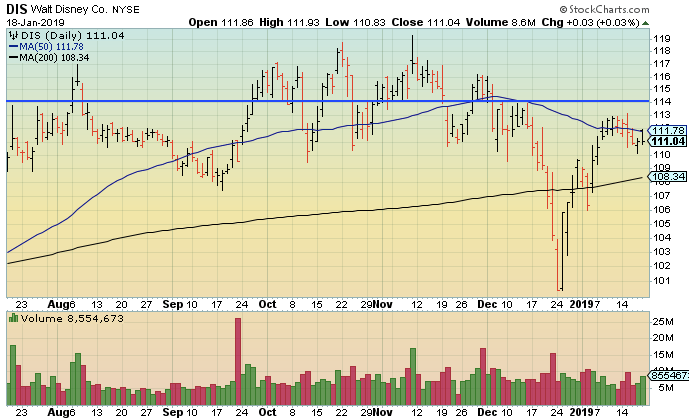

Walt Disney Co. – Did Not Trigger

DIS started out the week with a down day, just like we saw from most of our elite stock setups this week. However, this stock was unable to respond with a bounce-back day on Tuesday. It actually lost most ground that day, and then stumbled again on Wednesday.

Rally attempts on Thursday and Friday were not successful enough for DIS to close above its 50-day moving average line, which was a major disappointment considering how strong the stock had looked coming into the week.

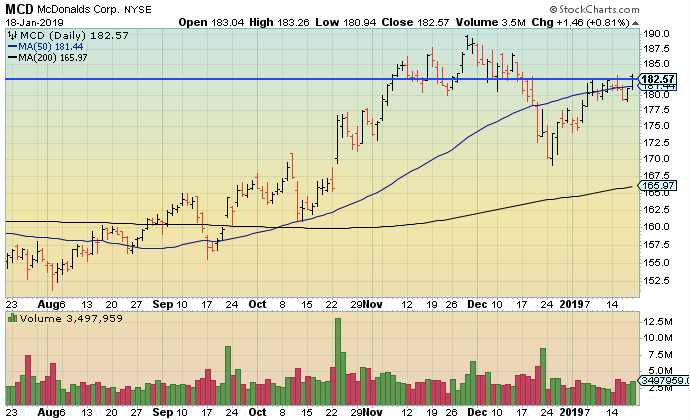

McDonalds Corp. – Triggered

MCD started off the week just like DIS with three straight down days that saw it falling below its 50-day moving average line. But the big difference is that this stock was able to post strong recovery days on Thursday and Friday where it retook that 50-day moving average and closed right at Adam’s entry point.

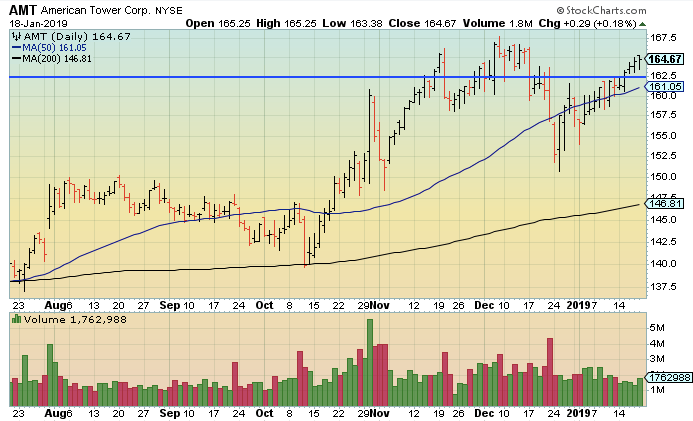

American Tower Corp. – Triggered

AMT was having none of the negativity of the general market on Monday. It was one of the few stocks that bucked the trend and posted a positive day. Then, building on that strength, it continued to move higher throughout the rest of the week.

During its run of five straight positive days this week, AMT was able to pull its 50-day moving average higher while breaking through Adam’s entry point on Tuesday and then continuing higher from there.

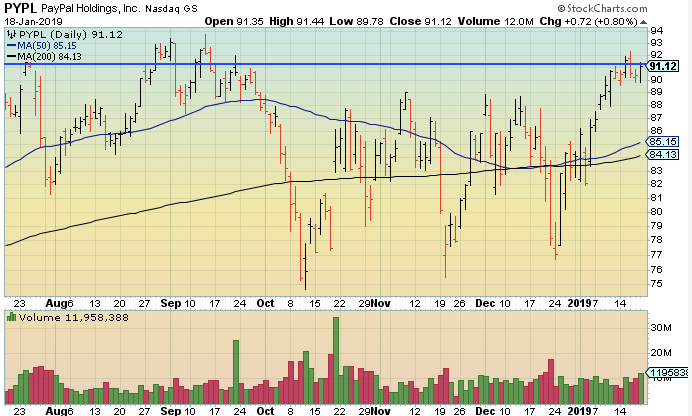

PayPal Holdings, Inc. – Triggered

There are stocks that trigger Adam’s entry points with dominant strength like we saw from AMT, and then there are stocks that struggle with those key numbers. PYPL was one of the latter stocks this week as it bounced above and below Adam’s entry point.

After starting the week with a bit of a slump to match the general market, PYPL jumped higher on Tuesday and triggered Adam’s entry point. It then fell back below that entry point on Wednesday and stayed there on Thursday before attempting to retake the entry point line on Friday and ultimately closing just short of it.

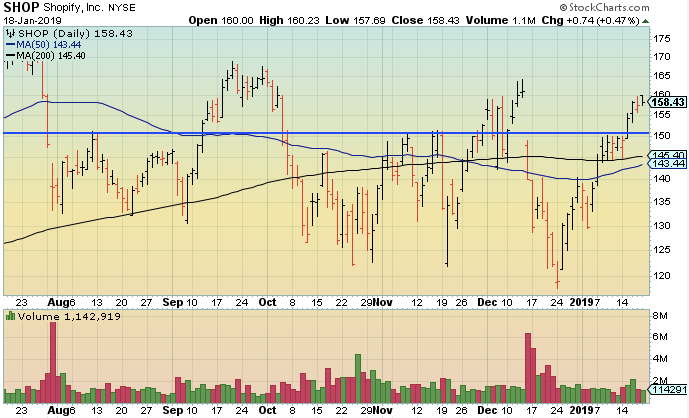

Shopify, Inc. – Triggered

SHOP was yet another stock that stumbled out of the gate on Monday and then posted a big up day on Tuesday. After bouncing off of its 200-day moving average during Monday’s trading, SHOP was able to break through Adam’s entry point during Tuesday’s move.

The stock showed even more strength later in the week as it climbed again on Wednesday, paused briefly on Thursday, and then moved even higher on Friday.

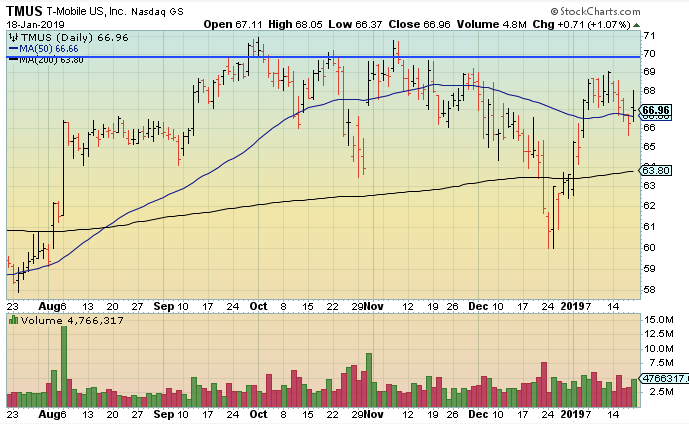

T-Mobile US, Inc. – Did Not Trigger

With four straight losing sessions to start the week, TMUS was one of the weakest stocks on our list this week. After fighting to hold its 50-day moving average through the early part of the week, it fell below that line during Thursday’s trading.

The stock was able to recover with a positive day that took it back above its 50-day moving average on Friday, but it still closed in the bottom half of that day’s range.

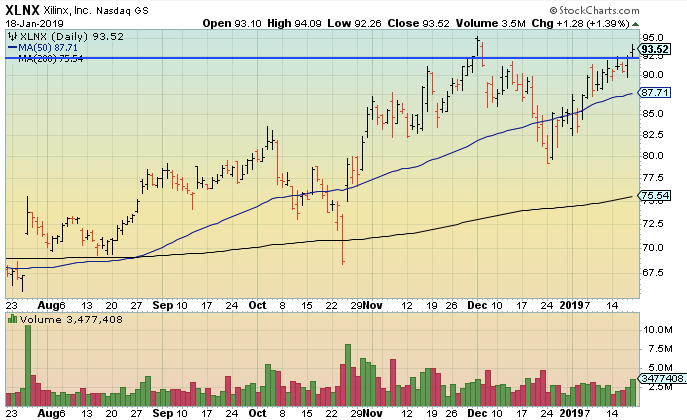

Xilinx, Inc. – Triggered

The leading stocks that make it onto Adam’s FLS Newsletter each week tend to move a bit more dramatically than the general market, but XLNX was not one of those this week. It recorded five days of tight trading that saw the stock push higher through his entry point by the end of the week.

After moving lower with the overall market on Monday, the stock moved higher on Tuesday and briefly broke through Adam’s entry point. It then fell back a bit on Wednesday before recovering and moving higher again on Thursday and Friday.

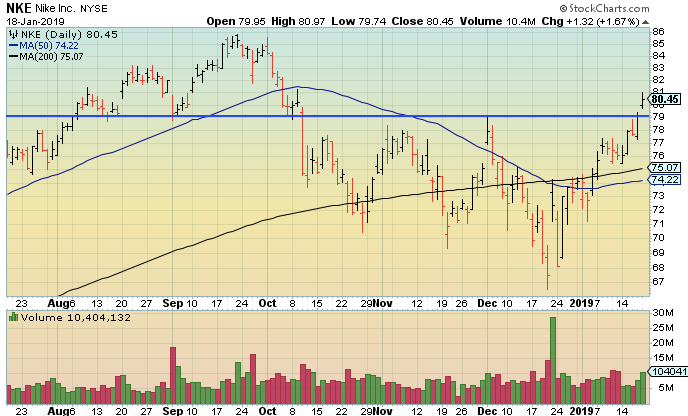

Nike Inc. – Triggered

I would never trade based on my personal shopping preferences, but I was very excited to see that NKE was going to be on our list of Elite Stock Setups heading into the week where their newest shoes would be hitting the court in the NBA.

The market obviously likes those new laceless sneakers as much as I do, because the stock posted huge gains on Tuesday, Thursday, and Friday that took it well above Adam’s entry point. It also looks like we could be seeing the stock’s 50-day line cross above its 200-day line if NKE continues to show strength in the coming weeks.

This was another strong week for the general market, and the Elite Stock Setups that Adam identified for us showed a tremendous amount of strength. If you would like to see which stocks made the list for us to track in the coming week, make sure you subscribe to his Find Leading Stocks newsletter where he maps out his entire playbook for making money in the market.