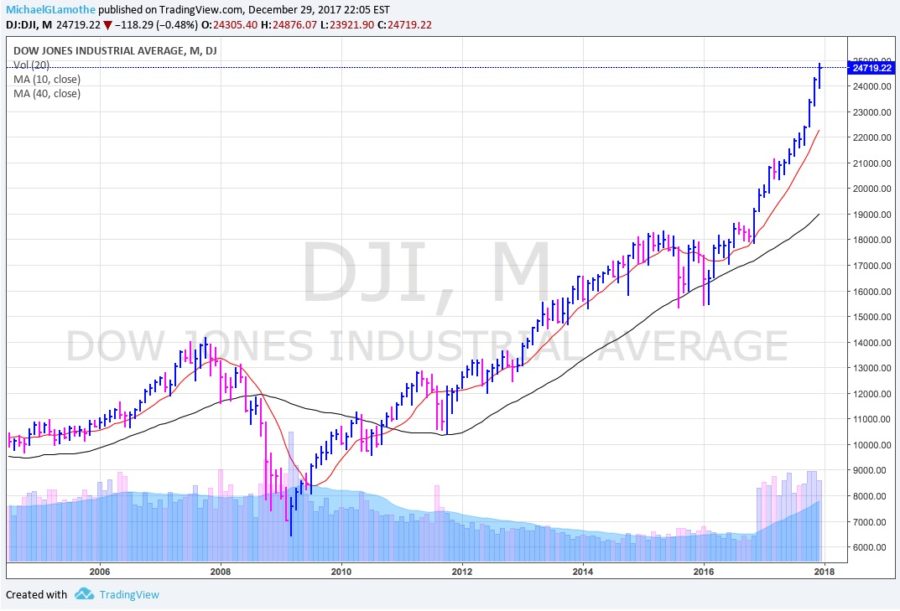

2017 will go down in history as another solid year for Wall Street. The major averages all surged to fresh record highs as volatility remained exceptionally low. There were several bullish macro catalysts for the strong rally on Wall Street, most notably: Strong GDP, Corporate Earnings, and Low-Interest Rates From Global Central Banks. The strong year ended with a big tax cut.

The market remains very strong as investors continue to show up and buy every dip. The one BIG concern as we head into 2018 is that a lot of time has passed since we have seen a meaningful pullback or a correction of any sort. The last meaningful sell-off was in Jan-Feb 2016. Since then stocks have soared. Additionally, the last bear market was in 2008-2009 which makes this the second-longest bull market in history. Bottom line, the market remains exceptionally strong until we see any selling on Wall Street.

A CLOSER LOOK AT WHAT HAPPENED LAST WEEK…

Mon-Wed Action:

Stocks were closed on Monday for Christmas. On Tuesday, the market was quiet after shares of Apple Inc (AAPL) gapped down on a report that the new iPhone X sales are sub par. The bulls showed up and defended the 50 day moving average line for Apple which is a healthy sign.

Stocks were closed on Monday for Christmas. On Tuesday, the market was quiet after shares of Apple Inc (AAPL) gapped down on a report that the new iPhone X sales are sub par. The bulls showed up and defended the 50 day moving average line for Apple which is a healthy sign.

Separately, the Wall Street Journal reported that U.S. retailers had a good Holiday Shopping season which made up for an otherwise lousy year. That news helped a slew of retail stocks to rally. Remember, retail stocks have been under pressure for the past few years as shares of Amazon (AMZN) continue to soar to new record highs.

On Wednesday, stocks closed slightly higher as utilities and real estate stocks rallied. Trading volume was very light and was one of the quietest days of the year. Big money is moving back into the beaten down commodity sector as valuations remain stretched to the downside. In a bullish note, Copper prices soared to the highest level since 2014 as investors look forward to the infrastructure plan in 2018.

Thur & Fri Action:

Stocks were quiet on Thursday as money rotated back into tech stocks after a few day breather. In another illustration of strength, on a monthly basis, the major averages are setting more records. The Dow Jones Industrial Average is on pace for its first nine-month winning streak since 1959 and the S&P is on track for its first nine-month winning streak since 1983. Stocks fell on Friday which was the last trading day of the year.

Stocks were quiet on Thursday as money rotated back into tech stocks after a few day breather. In another illustration of strength, on a monthly basis, the major averages are setting more records. The Dow Jones Industrial Average is on pace for its first nine-month winning streak since 1959 and the S&P is on track for its first nine-month winning streak since 1983. Stocks fell on Friday which was the last trading day of the year.

Market Outlook: Bulls Are Strong

The bulls are back in control and the market remains very strong. As always, keep your losses small and never argue with the tape.

Check out some of our recent blog posts:

- 5 Steps to Becoming a Long Term SUCCESS in the Market

- Great Lessons from Wall Street Legends

- Stacking the Odds of Success in Your Favor