This post is a review of the performance of the 10 Elite Stock Setups that were sent to Advanced Stock Reports subscribers on Saturday, November 3, 2018. Each setup comes complete with annotated charts highlighting the advanced entry point and support level(s), as well as all of the necessary fundamental information.

It was another terrible week in the market, but I was a little too busy dealing with my own issue to even notice. Fortunately, the FLS system was there to take care of me even when I couldn’t take care of myself.

It started on Monday night when I did a quick review of my charts and headed off to my weekly pickup basketball league. Everything was going great there, and I was playing well until I suffered a non-contact injury to my right ankle. That was the beginning of the end.

I spent the better part of Tuesday discussing options with different doctors, and then had surgery to repair a completely torn Achilles tendon bright and early on Wednesday morning. I didn’t have the focus to even think about the market until after it closed early on Friday.

But through this difficult week, the FLS portfolio was there for me.

Things got really ugly, but thanks to the stop-loss order that I already had in place, I sold out of SQ and booked a solid profit while I was in the ER on Tuesday.

That’s the power of a system that doesn’t require you to be sitting in front of a computer while the market is open. That is the power of the FLS Model Portfolio.

And with that in mind, let’s take a quick look through Adam’s 10 elite stock setups from last week’s newsletter and see if anything was able to hold up better than I did this week.

T-Mobile US, Inc – Did Not Trigger

After a strong close last week, TMUS was in a great position to break through Adam’s entry point early in the week. But things didn’t go according to plan and the mobile phone provider fell along with the overall market on Monday and Tuesday.

On the bright side, things did bounce back a bit for TMUS at the end of the week with a positive day on Friday that saw it close just short of its 50-day moving average.

DexCom, Inc – Did Not Trigger

DXCM didn’t even come close to the entry point as it crashed right out of the gate on Monday morning. Things didn’t get any better on Tuesday either, and the small bounces on Wednesday and Friday didn’t do much to make up the ground that was lost on Monday.

The stock is currently sitting below its 50-day line, but is still well above its 200-day line, which means that things might not be as bad as they seem if you are able to look past the rough couple of days it had this week.

YUM! Brands, Inc – Did Not Trigger

We didn’t have a specific entry point listed for YUM this past weekend, but we can assume from the fact that it stumbled on each of the first three days of the week that it would not have triggered any reasonable buy point.

With that said, YUM is still sitting just below its 50-day line and could be in position for a nice recovery if some buyers come into the general market over the next few weeks.

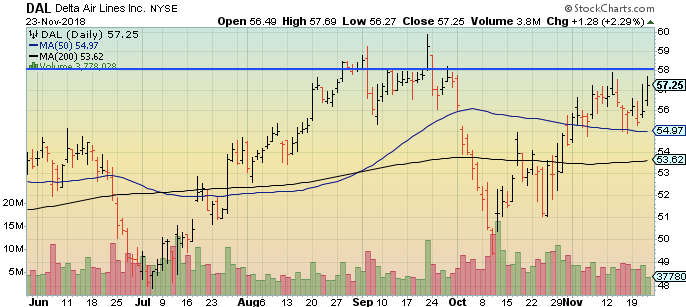

Delta Air Lines, Inc – Did Not Trigger

It might not have reached Adam’s entry point, but DAL was actually one of the strongest stocks on our stock setups watchlist this week.

After falling along with the general market on Monday, the airline quickly bounced back on Tuesday and Wednesday, and then it continued even higher on Friday. That makes it one of the few stocks to post a gain this week and has it sitting right below Adam’s entry point.

Barrick Gold Corporation – Did Not Trigger

Another stock that held up well despite the rough overall market conditions this week was ABX, which almost eclipsed its entry point on Wednesday before falling again on Friday.

ABX is currently sitting above it’s 50-day moving average and is poised to jump up through the entry point if the market moved higher on Monday.

PayPal Holdings, Inc – Did Not Trigger

PYPL was another stock that got slaughtered to open the week and was never quite able to recover. Not only did it never flirt with Adam’s entry point, it now sits well below its 200-day moving average, which is never a good thing for any stock.

Stryker Corporation – Did Not Trigger

Different stock, same story. After closing the previous week just below Adam’s entry point, SYK fell right out of the gate on Monday and never even attempted to cross into buy range.

Not only did it not test the entry point, the stock also lost it’s 50-day and 200-day lines and was only able to recover a small portion of its weekly loss on Friday’s bounce-back day.

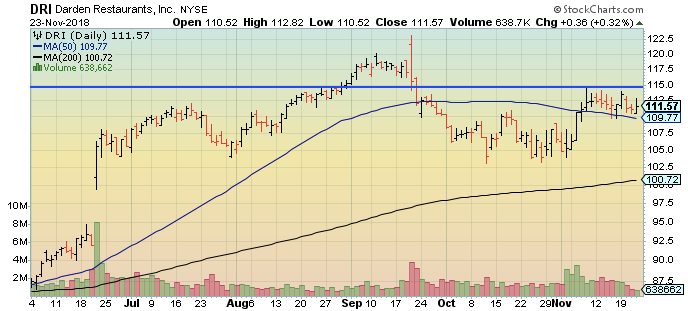

Darden Restaurants, Inc – Did Not Trigger

At this point, you can probably guess that none of our stock setups were able to trigger Adam’s entry points. However, on a week like the one we just had, all we are looking for is relative strength, and DRI showed plenty of that.

The stock was up when everything else was down on Monday, and it lost less than most leading stocks on Tuesday and Wednesday. It currently sits above it’s 50-day and 200-day lines and still has a shot at taking out Adam’s entry if things go well in the week ahead.

Oracle Corporation – Did Not Trigger

ORCL suffered the same fate as most of our stock setups this week. It fell hard on Monday and Tuesday and lost its 50-day moving average without ever testing Adam’s entry point. Then it was not able to retake that 50-day line on up days Wednesday and Friday.

Fiserv, Inc – Did Not Trigger

Here we go again. Another stock that didn’t trigger Adam’s entry point. And another stock that stumbled early in the week, lost its 50-day moving average and then failed to recover. Par for the course this week.

This was not a fun week to be trying to make money on the long side of the market. I didn’t get to experience most of it in real time, but the carnage is still here either way.

Fortunately, we have the option to sit on the sidelines while this potential bear market works itself out. Keep your powder dry and we will be ready to spring into action when the conditions change for the better.

Make sure you subscribe to Adam’s Advanced Stock Reports to get this weekend’s updated list of stock setups, as well as his FLS Playbook that breaks down what our model portfolio is going to be doing in the week ahead.