Stock Evaluation Guide…What’s the Point?

For quite some time, I found it difficult to properly weigh one stock against another even while looking at it through lens of just one trading methodology (in my case CANSLIM). In any trading methodology, there are numerous elements which play a role in the evaluation of a stock. But how do we sort them out? How do we weigh them against one another? Do all of these elements deserve the same weight? How do we stay objective? How can we answer all of these questions for a large group of stocks in an efficient way?

Checklists only get us half of the way there…

I started out with a checklist. However, I soon found that having and running through a simple checklist of elements that I was looking for was not enough. Counting checks for “pass” or “fail” left too many unanswered questions. If earnings were lower than I’d like, did they miss by a little or a lot? If the base pattern wasn’t a first or second stage pattern, should a later 3rd, 4th, 5th…stage all be weighted the same? If the stock’s group rank were 45 vs 125, should this be counted the same…? My answer…absolutely not!

I started out with a checklist. However, I soon found that having and running through a simple checklist of elements that I was looking for was not enough. Counting checks for “pass” or “fail” left too many unanswered questions. If earnings were lower than I’d like, did they miss by a little or a lot? If the base pattern wasn’t a first or second stage pattern, should a later 3rd, 4th, 5th…stage all be weighted the same? If the stock’s group rank were 45 vs 125, should this be counted the same…? My answer…absolutely not!

To properly evaluate a stock, it became clear that I needed to build a tool that evaluated all of the elements I was interested in looking at and weighed them somehow. I built the Stock Evaluation Guide to tackle this task. Each stock that’s in a primary base and makes it onto my Ready List gets put through this process. The process takes a little bit of time but produces a rigorous, objective analysis. Best of all, because the tool helps you run the stock through an assembly line of criteria, the process becomes very efficient over time.

How to use our Stock Evaluation Guide:

I am sharing this guide not because this is how I think you ought to evaluate stocks. Rather, I think that it is a process that is worth your time and worth implementing in order to rigorously evaluate stocks objectively and efficiently. Please use it as a template for designing your own guide! You will likely find far more conviction in weights and criteria that you identify yourself as oppose to ones provided by me or anyone else.

I am sharing this guide not because this is how I think you ought to evaluate stocks. Rather, I think that it is a process that is worth your time and worth implementing in order to rigorously evaluate stocks objectively and efficiently. Please use it as a template for designing your own guide! You will likely find far more conviction in weights and criteria that you identify yourself as oppose to ones provided by me or anyone else.

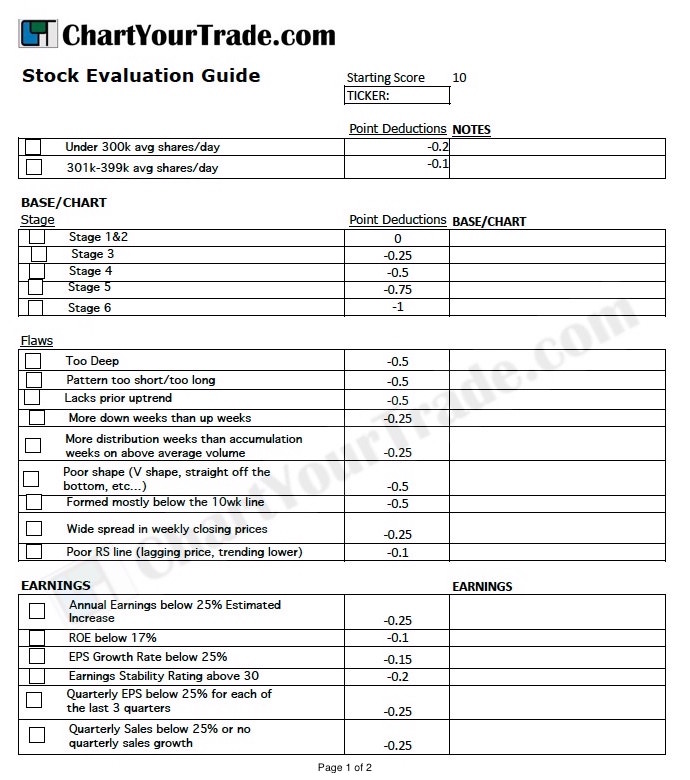

Each stock starts with a base of 10 points. I start at the top of the list and work my way down, deducting the points indicated for each flaw that I find. As I’m working my way through the checklist, I am transcribing notes into my trading journal. When I get to the bottom of the checklist, I end up with an overall rating for the stock.

I repeat this process for each stock on my Ready List. When completed, I sort my Ready List by this rating. I now have an objective rating for my Top 10 stocks and I know by how much one stock is favored over another.

Get our Stock Evaluation Guide FREE!

Join our free mailing list and we will send you our Stock Evaluation Guide and a few of our other favorite tools FREE! Click here to join.