It was another solid week on Wall Street as investors digested a slew of earnings and economic data. The major indices overcame a mid-week sell-off and ended higher after several well-known tech stocks reported strong numbers and GDP beat estimates.

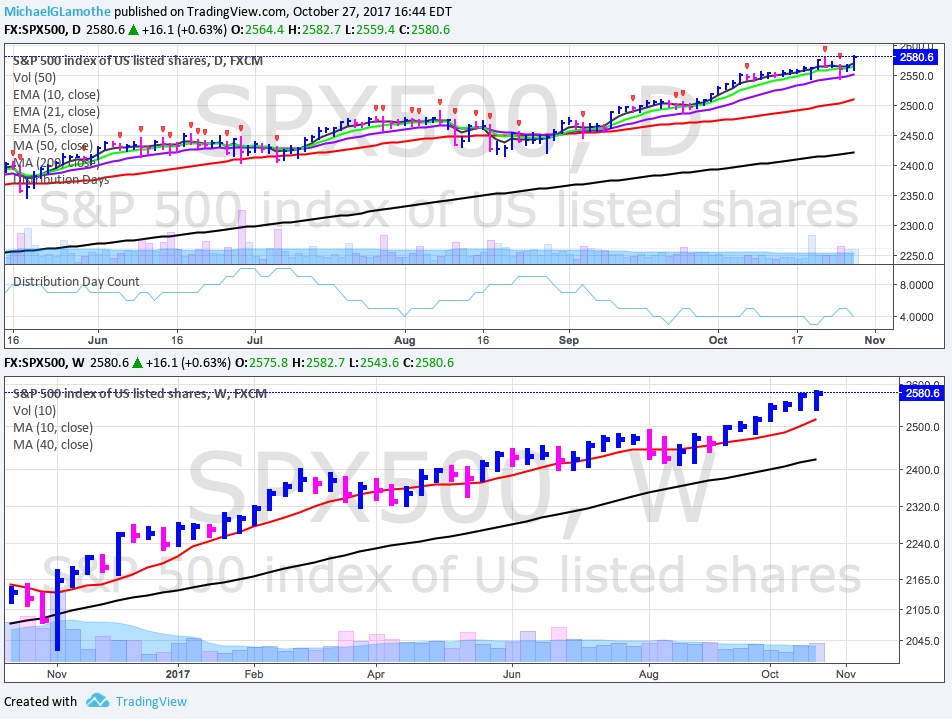

Buyers showed up on Friday after: Alphabet, Amazon, and Microsoft were some of the well-known stocks to report strong numbers last week. On the economic front, GDP grew by 3% last quarter, beating the Street’s estimate for a gain of +2.5%. The major indices continue acting very well and the fact that they refuse to pullback in a meaningful fashion continues to illustrate how strong the bulls are right now.

A Closer Look at What Happened Last Week…

Mon-Wed Action:

Stocks fell on Monday as the Dow snapped a 6-day winning streak and GE posted its largest single day decline in 6 years. Hasbro (HAS) also gapped down after reporting disappointing numbers. On Tuesday, the Dow rallied 168 points after the latest round of earnings were released. Caterpillar (CAT), 3M (MMM) and McDonald’s (MCD) were some of the stocks that rallied after reporting solid numbers. On Wednesday, The Dow fell 112 points which was the largest single day decline since September 5, 2017. Shares of Chipotle Mexican Grill (CMG) plunged nearly 14% after reporting earnings.

Stocks fell on Monday as the Dow snapped a 6-day winning streak and GE posted its largest single day decline in 6 years. Hasbro (HAS) also gapped down after reporting disappointing numbers. On Tuesday, the Dow rallied 168 points after the latest round of earnings were released. Caterpillar (CAT), 3M (MMM) and McDonald’s (MCD) were some of the stocks that rallied after reporting solid numbers. On Wednesday, The Dow fell 112 points which was the largest single day decline since September 5, 2017. Shares of Chipotle Mexican Grill (CMG) plunged nearly 14% after reporting earnings.

Thur & Fri Action:

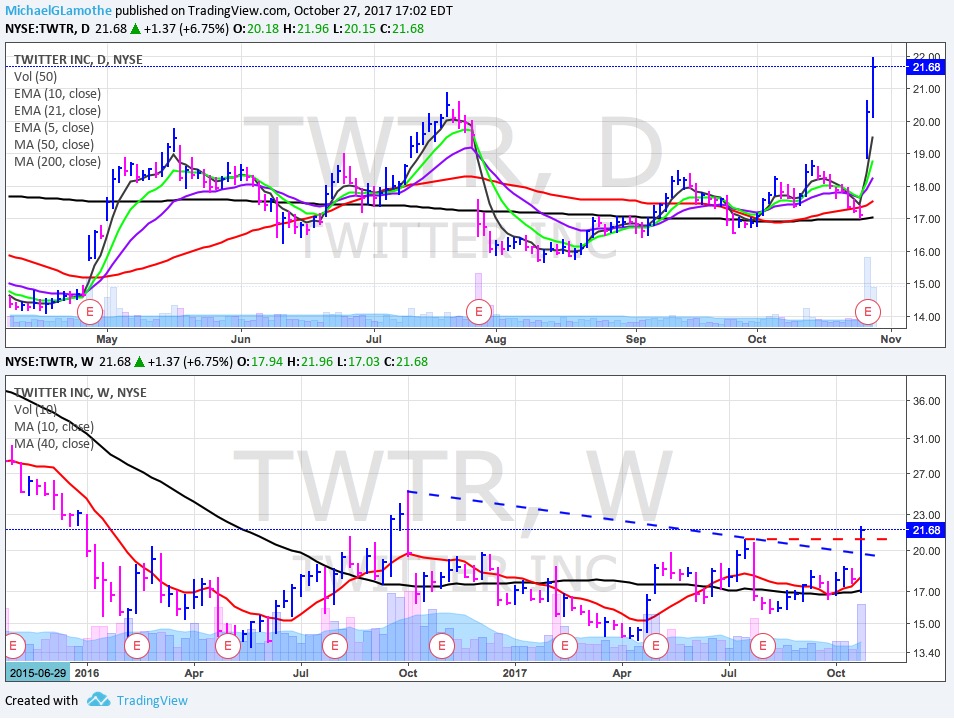

Stocks rallied on Thursday after the latest round of earnings were announced. Twitter’s (TWTR) stock soared nearly 19% after reporting earnings. Ford (F) was another big winner after reporting earnings. After the close, a slew of big tech stocks reported numbers and mostly beat estimates.

Stocks rallied on Thursday after the latest round of earnings were announced. Twitter’s (TWTR) stock soared nearly 19% after reporting earnings. Ford (F) was another big winner after reporting earnings. After the close, a slew of big tech stocks reported numbers and mostly beat estimates.

On Friday, the Nasdaq enjoyed its largest single-day rally since the Nov 2016 election! Amazon (AMZN), Alphabet (GOOGL), Intel (INCT), and Microsoft (MSFT) were some of the big tech stocks that gapped up after reporting earnings. On the economic front, GDP grew by 3% last quarter, easily beating the Street’s estimate for a gain of 2.5%.

Market Outlook: Bulls Are Running

The bulls are back in control and the market remains very strong. As always, keep your losses small and never argue with the tape.