Summer Pullback Underway

Summer Pullback Underway

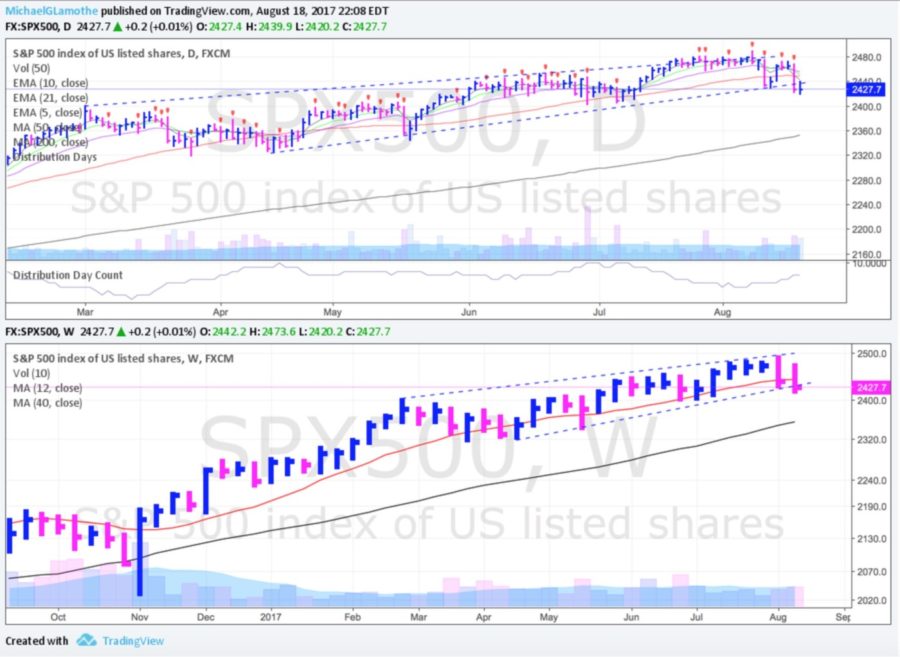

The Dow Jones Industrial Average and S&P 500 fell for a second straight week as selling finally showed up and volatility jumped. The tape remains somewhat split: The Dow Jones Industrial Average is out-performing its peers on a relative basis. The Nasdaq Composite and S&P 500 are a little weaker and closed below their respective 50 DMA lines. Meanwhile, the Dow Jones Transportation Index and the small-cap Russell 2000 continue to underperform and are both trading below their respective 50 and longer-term 200 DMA lines.

The good news for the bulls is that this pullback still remains somewhat shallow (for now). As of Friday’s close, the major indices are only down low single digits (1-6 percentage points) from their all-time highs. The Russell 2000 has erased all of its gains for 2017. Separately, the Nasdaq is down 4 consecutive weeks and bearish sentiment is picking up. Bottom line, the tape is split and continues to deteriorate. If the bulls manage to show up and curb the selling pressure we could be in for a very nice near-term bounce.

A Closer Look at What Happened Last Week…

Mon-Wed Action:

Stocks rallied nicely on Monday as fears subsided regarding the ongoing nuclear tensions with North Korea. The bulls showed up and defended the 50 DMA line for the major indices.

On Tuesday, stocks were quiet as investors digested Monday’s rally and digested a slew of data. Retail sales grew by +0.6% month-over-month, beating estimates +0.3%. Separately, the housing market index came in at 68, beating estimates for 65.

Stocks edged higher on Wednesday but closed in the middle of the range after the Fed released the minutes of its latest meeting and President Trump closed his business advisory counsel after several CEOs defected. That was the first major rift between the business community and the White House.

Thur & Fri Action:

Stocks fell hard on Thursday, after the market lost confidence in the White House’s ability to get its economic agenda passed. The small-cap Russell 2000 briefly turned negative for the year. Meanwhile, the S&P 500 and the Nasdaq composite both sliced below important support near their respective 50 DMA lines. Finally, the Dow Jones Industrial Average, which has been outperforming its peers of late, pulled back into its 50 DMA line.

Stocks fell hard on Thursday, after the market lost confidence in the White House’s ability to get its economic agenda passed. The small-cap Russell 2000 briefly turned negative for the year. Meanwhile, the S&P 500 and the Nasdaq composite both sliced below important support near their respective 50 DMA lines. Finally, the Dow Jones Industrial Average, which has been outperforming its peers of late, pulled back into its 50 DMA line.

Stocks fell on Friday after Steve Bannon was the latest person to be fired from the White House.

Market Outlook: Pull-back Mode

Once again, the market is pulling back and investors want to see if this will be another buy-the-dip opportunity or turn into something more severe. As always, keep your losses small and never argue with the tape.