Limit Your Losses

Limit Your Losses

There is an old maxim on Wall Street that says successful traders limit their losses and let their winners run…

Simple enough, right?

But knowing how to actually do that consistently is not easy.

Why?

Because it is counter-intuitive in nature and goes against what comes “natural” for most people.

How Unsuccessful Traders Use Fear & Greed

As a quick refresher, the two most dominant emotions that drive markets across the globe are fear and greed. They are the one constant throughout history and will always be present in the markets for the rest of time. Remember, markets take on the personalities of their participants and the way the basic emotional triggers work is that when someone buys a stock at 30 and it goes to 33 they are fearful that they will lose their profits and quickly sell to lock in the gain. Conversely, if they buy a stock at 30 and it falls to 25 they become greedy and hope that it will go back up so they can get out and break-even. Another psychological layer comes into play at this point because for most unsuccessful people they believe that selling for a loss means they are “wrong” and that hurts their ego.

As a quick refresher, the two most dominant emotions that drive markets across the globe are fear and greed. They are the one constant throughout history and will always be present in the markets for the rest of time. Remember, markets take on the personalities of their participants and the way the basic emotional triggers work is that when someone buys a stock at 30 and it goes to 33 they are fearful that they will lose their profits and quickly sell to lock in the gain. Conversely, if they buy a stock at 30 and it falls to 25 they become greedy and hope that it will go back up so they can get out and break-even. Another psychological layer comes into play at this point because for most unsuccessful people they believe that selling for a loss means they are “wrong” and that hurts their ego.

How Successful Traders Use Fear & Greed

One common trait found among successful traders is that they operate with the notion that markets are counter-intuitive in nature and learn how to consciously remove their emotions from their investment decisions. This process allows them to cut their losses and let their winners run.

One common trait found among successful traders is that they operate with the notion that markets are counter-intuitive in nature and learn how to consciously remove their emotions from their investment decisions. This process allows them to cut their losses and let their winners run.

In the above example, the successful trader will do the opposite- hold on to their winner and cut their loser quickly. The successful trader always has an exit plan before they buy a stock. This way they know (ahead of time) where they are going to get out if the market moves against them and how much they are going to lose, if wrong. They also know that profits are a function of time and that they learn how to be patient with their winners and impatient with their losers.

Once you realize that taking small losses is inevitable you can plan for them and no longer take it personally when you are stopped out for a small loss. Instead, it becomes a cost to doing business.

Trading Math

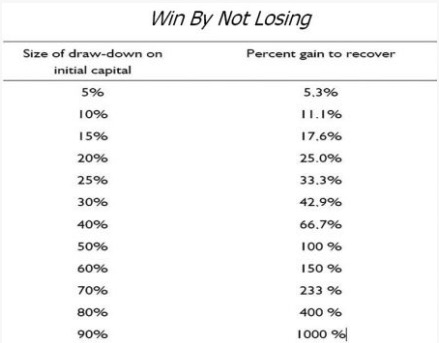

Another important fact that supports this notion is the concept of simple mathematics (see table above). It is infinitely easier to recover from a small loss than it is to recover from a large loss. The numbers above do an excellent job illustrating this important and often overlooked concept.

Create A Plan, Then Trade Your Plan

So, next time you want to buy a stock – ask yourself, where will I exit if wrong and how much am I going to lose. This simple, yet often overlooked step will help you take small losses because once you have a plan, all you have to do is trade your plan.

So, next time you want to buy a stock – ask yourself, where will I exit if wrong and how much am I going to lose. This simple, yet often overlooked step will help you take small losses because once you have a plan, all you have to do is trade your plan.