A few months ago, Michael invited me to try out the services offered here at Chart Your Trade. You can read my full review here:

http://www.optionstradingiq.com/chart-your-trade-review/

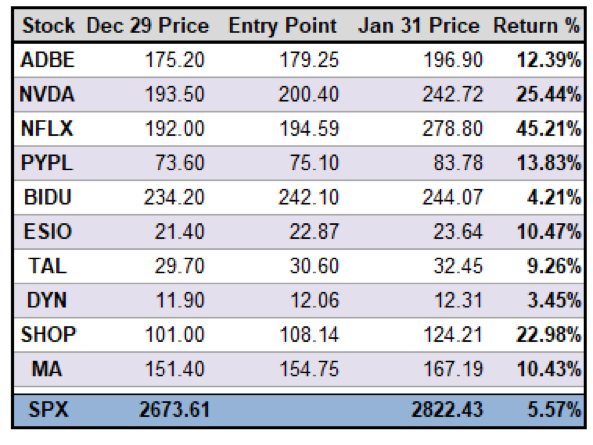

Needless to say, I was very impressed as you can see from some of the results below.

Today, I want to take things one step further and talk about how traders could use options to trade some of the recommendations from Chart Your Trade.

The first example is on NKE, which was mentioned in the February 12 Elite Stock Setups report when the stock was trading at $65.50. An entry point of $67.31 was recommended.

NKE past that entry point a few days later on Feb 14th. Since then, markets have been a little volatile. In fact, since February 14th, the S&P 500 is down 4.09%. NKE is also down, but is slightly outperforming the market at -3.68%.

POOR MAN’S COVERED CALL

One of my favorite options strategies is called a poor man’s covered call. This strategy gives you exposure to the stock for a fraction of the cost and provides income potential. It’s like taking a leveraged position on the stock, so the gains in percentage terms will be magnified on both the upside and the downside.

You can read a full tutorial on this strategy here: http://www.optionstradingiq.com/poor-mans-covered-call/

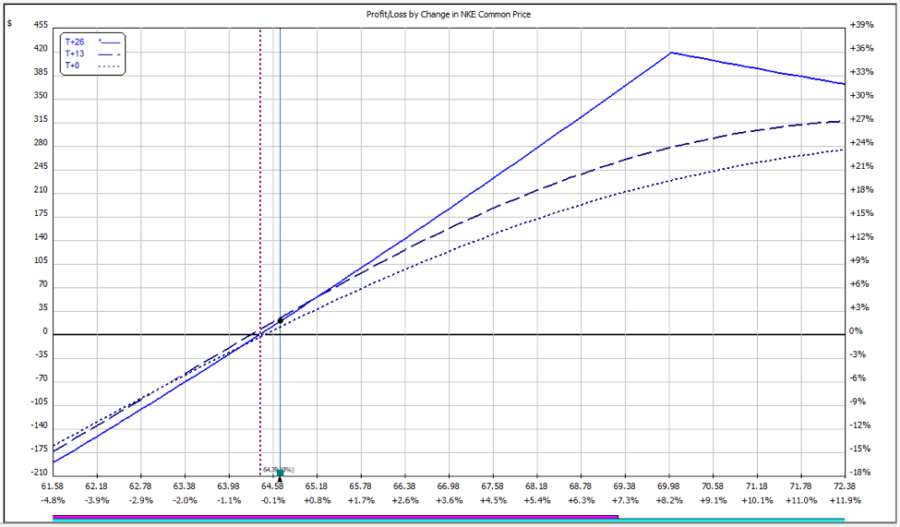

Here’s an example of how an investor might set up a poor man’s covered call on NKE once the entry point was hit:

Trade Date: February 14th, 2018

NKE Price: $67.31

Trade Details:

Buy 1 NKE Jan 19th 2019 $57.50 Call @ $13.65

Sell 1 NKE April 21st 2018 $70 Call @ $2.05

Total Premium Paid: $1,160

This position has a similar exposure to buying 100 shares of NKE and selling a covered call. However, in this case the investor has only had to invest $1,160 as opposed to $6,731.

Moving forward to March 23rd, NKE is down 3.68%, so the pure stock investor would be -$248 whereas the poor man’s covered call is +$21. Certainly not a home run but a nice outperformance.

BULL PUT SPREAD

The second way to play NKE that we’ll look at is via a simple bull put spread. This is a very simple strategy and another easy place to start for those wanted to get involved in options.

Here’s how an investor might set up the trade based on the NKE entry signal:

Trade Date: February 14th, 2018

NKE Price: $67.31

Trade Details:

Sell 5 NKE March 16th 2018 $62.50 Put @ $0.37

Buy 5 NKE March 16th 2018 $57.50 Put @ $0.11

Total Premium Received: $130

Margin Requirement: $2,370

This trade gives the investor a significant margin for error, with a breakeven point at $62.24 (a 7.53% decline) and a reasonable income potential.

The trade is risking $2,370 to make $130 for a return of 5.49% in one month. NKE stayed above $62.50 at expiry and the investor would have made a full profit on the trade.

It’s important to note that in this example, if NKE fell below $57.50 at expiry of the option trade, the investor would lose the full $2,370 whereas the pure stock investor would only be down $1,481.

The above two examples show how these two option trades outperformed pure stock ownership and both achieved positive returns from bullish trades, even though the stock was down nearly 4%.

HIGH RETURN TRADES FOR RISK TOLERANT INVESTORS

Let’s now look at another example from the table posted at the top of this article.

NFLX is a favorite stock for option traders and it was mentioned in the Dec 29th version of Elite Stock Setups. At the time the stock was trading at $193.50 with a recommended entry point of $200.40.

That price was passed on the first trading day of the year giving investors the all clear to hop onboard the NFLX train.

Investors who purchased the stock would have made a 65.39% return from January 2nd through to March 9th.

Investors with a higher risk tolerance could have instead traded a long call.

This is a high risk, high reward trade that can pay off big if the stock makes a big move.

Trade Date: January 2nd, 2018

NFLX Price: $200.40

Trade Details:

Buy 1 NFLX March 16th 2018 $185 Call @ $22.80

Total Premium Received: $2,280

With this trade, the investor was risking $2,280 and would lose all of that investment if NFLX dropped below $185 around March 16th. But, if NFLX were to go on a huge run, which it did, the high risk trade would pay off in spades.

As it turns out by March 16th, NFLX was trading at $321 and that $185 call had increased in value from $2,280 to $13,570, for a healthy 495% return.

Considering the majority of stocks from ChartYourTrade’s Dec 29th report went on to have massive gains, traders willing to take a large risk with long calls would have done incredibly well.

Thanks to Michael and the team for all their hard work and analysis and if anyone wants to learn more about options feel free to email me at info (at) optionstradingiq.com

Trade safe!

Gavin McMaster