Strongest Q1 Since 1998

Strongest Q1 Since 1998

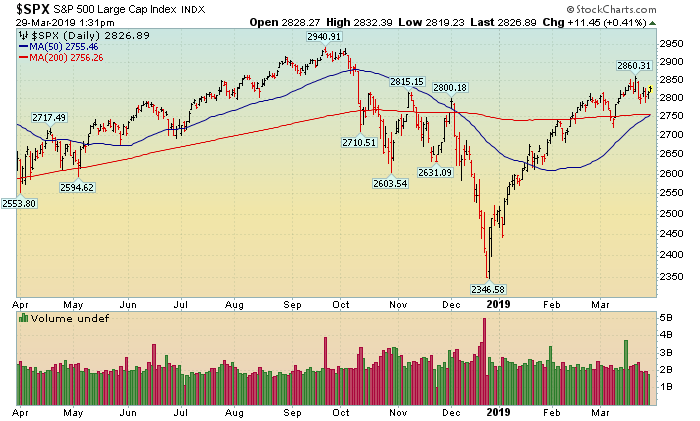

The first quarter of 2019 has officially ended, and stocks enjoyed their largest first quarter gain since 1998. That leads me to believe that we are headed into a climax run similar to what happened in 1998-2000 and 1927-1929. In 1998, the market had rallied for several years then briefly fell just over 20% in August after Long Term Capital Management failed and the Asian Financial Crisis hurt markets. After that brief and steep “correction” the market came roaring back and enjoyed a massive rally until the Dot Com Bubble burst in March 2000. Fast forward to today – the market has been rallying for the past decade, in Q4 2018, it briefly fell 20%, then came roaring back (the gains enjoyed during Q1 2019). Now the market is perched below its record high and pausing to digest the recent and robust rally from December 24, 2018’s low. During this time, Central Banks, have resumed their easy money stance and that has been a major driver for the entire bull market we have enjoyed for the past decade. Now, once again (similar to the late 20’s and 90’s) we are in an aging bull market that may just explode and turn into a climax top. Of course, this is only one possibility and I know anything is possible. What we know for certain is that the market deserves the bullish benefit of the doubt until any real selling shows up.

Monday-Wednesday’s Action:

On Monday, stocks ended mixed to mostly lower as global economic growth concerns continued to dominate the headlines. Over the weekend, Mueller submitted his report without incriminating evidence against Trump. Monday was the first trading day after the report was submitted and the market barely reacted. In other news, Apple announced, a new subscription service, a new credit card and a new TV service aimed at growing its “service” business. On Tuesday, stocks rallied but fears of an economic slowdown prevailed. The Conference Board said, housing starts slid -8.7% in February, easily missing expectations. Building permits also fell but at a slower rate than forecast. Separately, consumer confidence fell to 124.1 in March from 131.4 in February. On Wednesday, stocks ended lower as the yield on the 10 year Treasury hit the lowest level since 2007, further stoking recessionary woes.

Thursday & Friday Action:

Stocks rallied on Thursday the U.S. – China trade talks resumed and mortgage rates plunged after the recent move in the 10-year Treasury. On the economic front, the U.S. economy grew by +2.2% in the fourth quarter, which missed the Street’s estimate for a 2.4% gain. Stocks rallied on Friday after positive comments were made regarding the U.S. & China Trade Talks. Friday was the last trading day of the month and quarter.

Market Outlook: Bullish Tailwind Continues

The market remains very strong after the Federal Reserve reversed its stance and moved back into the easy money camp. Near-term resistance is 2018’s high while near-term support is March 2019’s low, then the 200 and 50 DMA lines, and then 2018’s low. As always, keep your losses small and never argue with the tape.

Do you know the most under-valued stocks in the market?