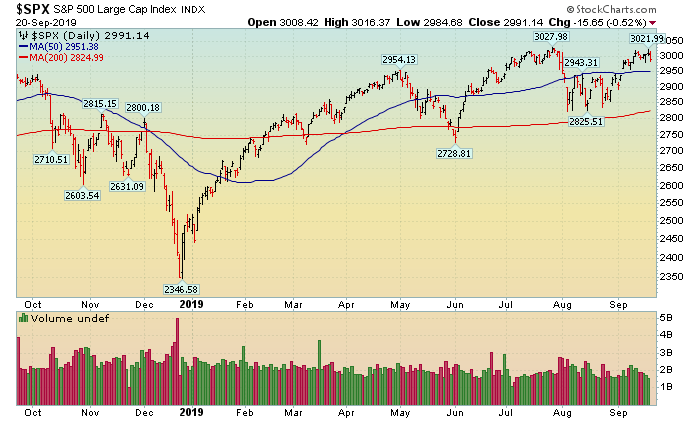

Week-In-Review: Market Snaps A 3-Week Win Streak

The market fell last week and snapped a 3-week win streak after the major indices flirted with fresh record highs. The Federal Reserve cut rates by 25 basis points which matched expectations and was largely priced in to the market. The major indices had a big move over the past few weeks and it is normal to see them pullback after flirting with resistance (the recent record high). Going forward, it is important to analyze the “health” of this pullback to see if it is another normal and healthy pullback or something more severe. A normal and healthy pullback will bring the major indices back into support (their respective 50 DMA lines). If the 50 DMA line breaks, then that will indicate something more severe may unfold. For now, the bulls deserve the benefit of the doubt as long as the market stays above support.

Monday-Wednesday’s Action:

Over the weekend, oil prices spiked after Saudi Arabia said one of its key supply hubs was attacked by drones. This was a concerted attack and it caused a lot of damage. Oil prices surged nearly 14% on Monday which is a huge move for oil! Meanwhile, US stocks fell as fear spread that this could escalate if the military gets involved and some feared that a regional war erupts. In other news, China said industrial production fell to a new 17½-year low. Production rose +4.4% in August which missed the Street’s estimate of a +5.2% gain. The industrial-production slowdown bodes poorly for the global economy. Stocks were relatively quiet on Tuesday as investors waited for the Fed to concluded its 2-day meeting. Separately, crude oil fell 5% after Saudi Arabia said it will increase production to offset what was lost due to the attack. In other news President Trump signaled that a trade deal could happen soon which helped the market edge higher. On Wednesday, the Fed cut rates by a quarter point but it was divided on future action and that initially sent stocks lower. But during the press conference the market reversed and closed higher after Jay Powell said that the Fed’s action is designed to send asset prices higher. Stocks reversed from a 211 point decline to close higher. In other news, shares of ROKU fell hard after Comcast and Facebook both announced desktop TV devices.

Thursday & Friday Action:

Stocks were quiet on Thursday as the market flirted with fresh record highs. Shares of Microsoft rallied sharply after the company said it plans to buy back a lot of stock. Stocks trimmed some of the gains in the afternoon after a state-backed Chinese media report said that known China hawk and Trump advisor Michael Pillsbury warned the U.S. is ready to escalate the trade war if a deal isn’t struck soon. Stocks fell on Friday after Chinese trade negotiators suddenly canceled a visit to meet U.S. farmers after they wrapped up trade talks in Washington this week.

Market Outlook: Easy Money Is Back

Once again, global central banks are back on the easy money bandwagon after the Fed and the ECB both announced more easy money measures in September which are directly aimed at stimulating global markets. The market has soared all year based on two key points: optimism that a trade deal will be reached between the U.S. and China and more easy money from global central banks. Earlier this year, the Federal Reserve reversed its stance and moved back into the easy money camp. Then, other central banks followed suit and that means easy money is back to being front and center for the market. Separately, the trade talks appear to be moving in the right direction which is another positive. As always, keep your losses small and never argue with the tape.