Stocks Bounce Back From Deeply Oversold Levels:

The market bounced last week from deeply oversold levels and investors digested a slew of earnings and some economic data. For the past two weeks, I have repeatedly said the market is oversold and due to bounce. I did not know the market would bounce as much as it did but that is what happens in deeply oversold markets. Why? Because you have two concurrent forces at play: First you get a lot of short covering (people who are short have to buy their positions back if they want to exit their shorts) and second you get the buy the dip crowd that shows up. Now the key is to see if this bounce can continue or if it is another short-lived rally in a longer downtrend. On the earnings front, the big disappointments of the week came from General Electric and Apple. GE plunged after the company was forced to slash its dividend. Separately, Apple tanked after the company reported stronger-than-expected numbers but gave lousy guidance for the busy holiday shopping season. Finally, US employers added 250,000 new jobs last month, easily beating the Street’s estimate for 190,000. Going forward, it will be very important to see how the market reacts after the election as we head into a seasonally strong period for stocks.

Monday-Wednesday Action:

Stocks opened sharply higher on Monday but turned lower after rumor spread that the US is getting ready to announce more tariffs on China if the Trump-Xi talks fail. The U.S. said it will announce tariffs on remaining $257 billion in Chinese goods and that sent stocks lower. In other news, the UK proposed a 2% tax on tech giants like Google, Amazon, and Facebook. On Tuesday, stocks surged over 400 points as the market bounced back from deeply oversold levels. In earnings news, shares of Under Armour surged after the company announced earnings while shares of General Electric plunged after the company was forced to slash its dividend. After the close, Facebook reported earnings and the stock jumped nearly 5% on Wednesday. Wednesday was the last trading day of the month and stocks ended higher for the day but lower for the month. October was one of the worst months on Wall Street in nearly a decade. Let’s see what happens in November and December.

Thursday & Friday Action:

Stocks opened lower on Thursday but turned higher after Trump tweeted and said, “Just had a long and very good conversation with President Xi Jinping of China. We talked about many subjects, with a heavy emphasis on Trade. Those discussions are moving along nicely with meetings being scheduled at the G-20 in Argentina. Also had good discussion on North Korea!” After Thursday’s close, Apple plunged over 7% after reporting earnings that beat estimates but lowered guidance. On the upside, shares of Starbucks surged as the stock is getting ready to break out of a multi-year base. Stocks fell on Friday after the government reported a stronger than expected payrolls report. The stronger report will give the Fed more incentive to raise rates and that is a big concern for many people on Wall Street.

Market Outlook: Stocks Bounce

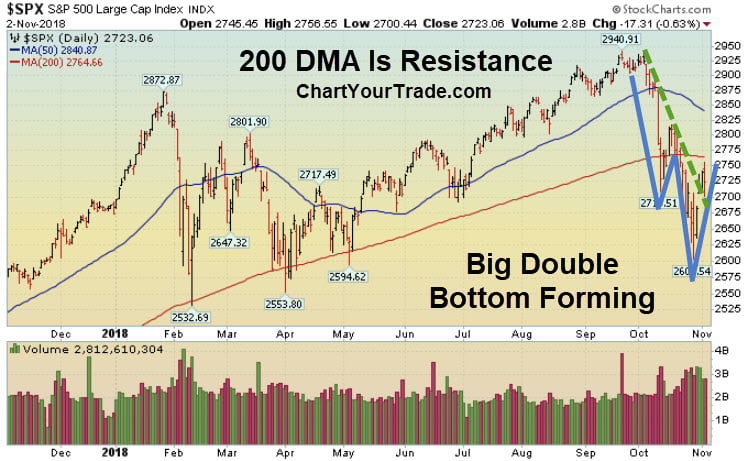

Stocks are not acting well because in healthy bull markets we do not normally see such wild swings on a week to week basis. At the end of September, I noted that the Russell 2000 broke below important support and said it should be watched closely. One week later, we saw a big sell-off on Wall Street as rates spiked. Right now, the next big level of support is February’s low and resistance is the 50 and 200 DMA lines, then 2018’s high. As always, keep your losses small and never argue with the tape.