Stocks Pause Ahead of G-20 Meeting

Stocks Pause Ahead of G-20 Meeting

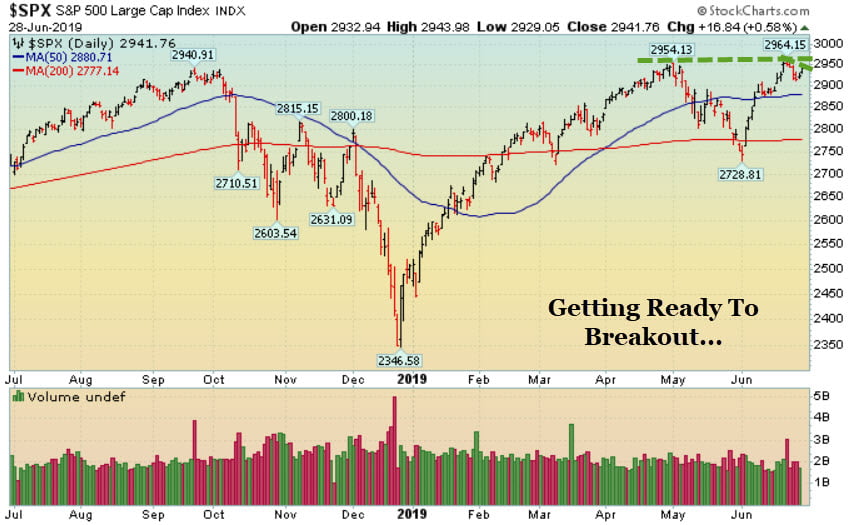

The market ended mixed last week as the Dow Jones Industrial Average, S&P 500, Nasdaq Composite, & Nasdaq 100 fell while the small-cap Russell 2000 rallied. The fact that the Russell rallied is a subtle but important bullish divergence and suggests the market can easily rip higher if a trade deal is announced soon. The major averages rallied sharply over the past three week and the fact they they pulled back last week is perfectly normal and healthy. It is not healthy to see the market rip higher week after week because that usually means we are in a climax run, and that usually means the end of a move is near. So, the fact that we erased May’s losses, rallied sharply in June, and are setting up nicely to breakout to new highs is bullish when you look at it objectively. Now, if the trade talks go sour, the market can easily fall from here. If not, then we will likely rally. From where I sit, at this point, both sides have flexed their muscles and now want a deal to get done. Based on that logic, I expect a deal to get done in the near future.

Monday-Wednesday’s Action:

On Monday, stocks were mixed to flat as investors looked ahead to the G-20 summit. In other news, Trump signed an executive order to issue hard sanctions on Iran. In speculative news, Bitcoin rallied above $11,000, nearing a 15-month high after Facebook launched Libra, it’s crypto platform. Stocks were mostly lower on Tuesday after The Conference Board said, consumer confidence fell more than expected and hit the lowest level in nearly two years. That followed a separate report which showed that new home sales sank 7.8% in May, despite a big drop in mortgage rates. The market opened higher on Wednesday but closed mostly lower as sellers showed up in the afternoon. Before the open, Treasury Secretary Steven Mnuchin told CNBC that he is optimistic that a trade deal with China will get done soon and that helped stock futures jump higher. But sellers showed up by the close and the market ended mixed to mostly lower.

Thursday & Friday Action:

The market edged higher on Thursday after the bulls showed up to defend support (50 DMA line) in the S&P 500. Investors spent the day focused on what will happen at the G-20 meeting in Japan. Larry Kudlow, National Economic Council director, added to the uncertainty around trade. Kudlow told Fox News that no preconditions were set ahead of Trump’s meeting with Xi. He also said the U.S. may move forward with additional tariffs. Kudlow’s comments were largely ignored because the market rallied on the news. The market was quiet on Friday as the world waited for the outcome of the much anticipated G-20 meeting.

Market Outlook: Easy Money Is Back

Once again, global central banks showed up and juiced markets. The market has soared all year based on two key points: optimism that a trade deal will be reached between the U.S. and China and more easy money from global central banks. Earlier this year, the Federal Reserve reversed its stance and moved back into the easy money camp. Then, other central banks followed suit and that means easy money is back to being front and center for the market. As always, keep your losses small and never argue with the tape.

Do You Know The Most Under-Valued Stocks In The Market?

Our Members Do. Take a FREE TRIAL – CheapBargainStocks.com