Stocks rallied for a second straight week as the bulls showed up in the last full trading week of the month. The major indices jumped above their respective 50 day moving average lines and are now flirting with their 2016 high, which bodes well for the current rally. Last week we wrote, “without another wave of selling, the market looks like it wants to bounce from here” and that is exactly what happened. Looking ahead, the market will be closed on Monday for Memorial Day and then we have the always fun jobs report on Friday. Short term, the market continues acting well and it feels like it wants to go higher from here. Even though the market looks like it is forming a large top (after a 7.5 year bull market) we have to respect the tape and the fact that even with all this sloppy back-and-fourth action over the past year, the major indices are only a few percentage points below record highs. Eventually we will bust out of this long (and sloppy) sideways trading range and when it does we will be more than prepared. For the S&P 500 major resistance resides at 2,134 and major support at 1,810. We are currently trading in the upper half of this long sideways trading range which is a subtle but important signal that the bulls remain in control.

Monday-Wednesday’s Action:

Stocks were quiet on Monday as investors piled into Apple (AAPL) and several semiconductor stocks. Apple rallied after a report was released that suggested the tech giant asked its suppliers to prepare 72-78 million units, above the market’s expectation of 65 million units for the iPhone. In other news, two Fed officials spoke on Monday and both were mildly hawkish, hinting at more than one rate hike later this year. Meanwhile, economic data failed to impress. The PMI Manufacturing index came in at 50.5, missing estimates for 51.0. Yet the Fed is trying to tell us that they are raising rates later this year. The fun continues because Janet Yellen is going to speak on Friday.

Stocks enjoyed strong gains on Tuesday helping the S&P 500 jump back above its 50 day moving average line. Stocks extended gains after U.S. new home sales jumped to the highest level in eight years. New home sales rose to 619k, beating estimates for 523k. Meanwhile, the Richmond Fed Manufacturing index plunged 15 points to negative -1. Elsewhere, the U.S. Dollar and Crude oil rallied sharply while gold and silver tanked.

Stocks rallied nicely on Wednesday as buyers showed up and added to Tuesday’s gain. Overnight, the latest “deal” was reached for Greece which helped ease concerns about another debt scare. The euro zone gave Greece its firmest offer so far of debt relief in what finance ministers called a breakthrough deal that won a provisional commitment from the IMF to return to taking part in the bailout for Athens. European stocks were higher on the news and the buying continued in our market. Financials and semiconductors continued to lead which bodes well for the near term outlook. In economic news, the Markit Flash U.S. services PMI for May came in at 51.2, down from 52.8 in April and well below the long-run survey average of 55.6. The Federal Housing Finance Agency House Price Index rose 0.7%, in March, beating estimates for a gain of 0.5%.

Thursday & Friday’s Action:

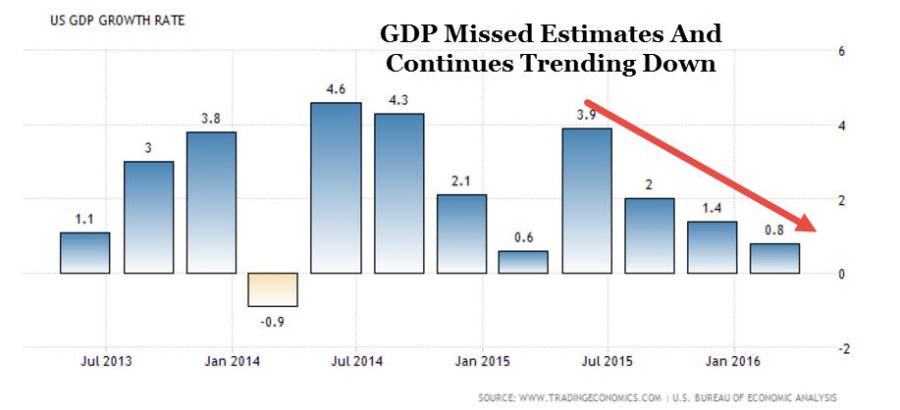

[su_rectangle_ad_right]Stocks were relatively quiet on Thursday as investors digested the latest round of economic data and Tuesday and Wednesday’s strong rally. Weekly jobless claims slid by 10k to 268k, beating estimates for 275k. Durable goods rose 3.4%, beating estimates for 0.3%. Meanwhile, pending home sales, jumped 5.1%, easily beating the Street’s forecast for 0.8%. Stocks were quiet on Friday after the government said Q1 GDP rose 0.8%, missing estimates for 0.9%. The latest figure was higher than the initial reading of 0.5%. Janet Yellen spoke at Harvard and said the economy should improve and said, “it is appropriate for the Fed to gradually and cautiously raise rates.” Elsewhere, consumer sentiment came in at 94.7, missing estimates for 95.5. Stocks rallied sharply this week as we approached month-end on Tuesday.

Market Outlook: Sideways

The market is trying to bounce from here as the bulls show up and do their best to defend near term support. Economic and earnings data remains less than stellar but all that matters now- is the easy money from global central banks. As always, keep your losses small and never argue with the tape.

[su_ar]