Longest Bull Market In History Breaks Out & Hits A New High

Longest Bull Market In History Breaks Out & Hits A New High

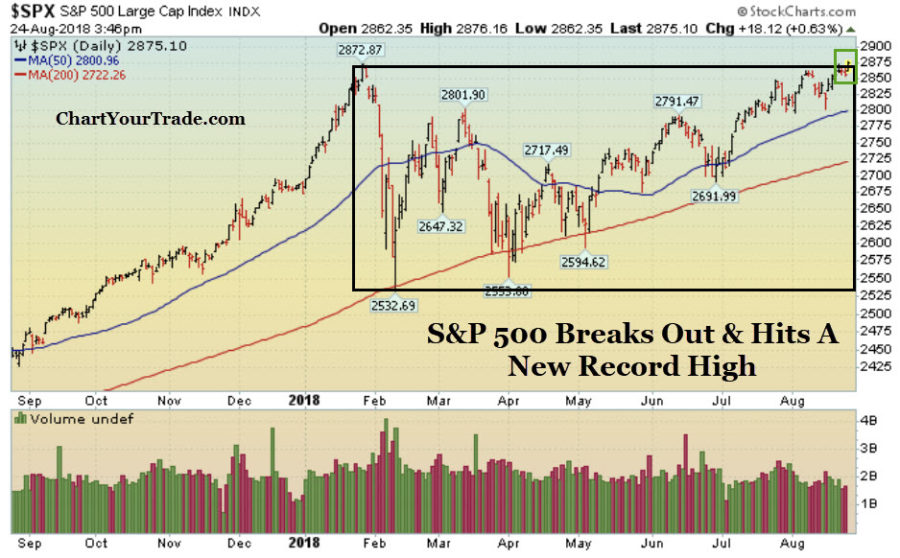

This is now the longest bull market in history and it just broke out to a new high record high. The major indices broke out of a long 6-month trading range and hit fresh record highs after the Federal Reserve made it clear it will do whatever it takes to fight inflation. Stepping back, it is important to put this breakout in the proper perspective: The market enjoyed large gains for most of 2016 and 2017. Then, in February 2018, the market sold off hard and briefly fell into correction territory. Once again, the bulls quickly showed up and the market spent the last few months moving sideways to digest the strong 2016-2017 rally. After this 6-month base, the market is now back in new record high territory and that bodes well for this long bull market. It is also important to note that the market refuses to fall on nearly any and all bearish news and that reiterates how strong this market is.

Monday-Wednesday Action:

Stocks ended higher on Monday after the latest round of M&A activity was announced. The first big deal occurred when PepsiCo agreed to buy SodaStream for $3.2 billion, or $144 per share. The price represents a 10.9% premium from SodaStream’s closing price on Friday. The deal is expected to close by January and SodaStream shares rose about 10% on the news. Separately, Tyson Foods confirmed it will acquire Keystone Foods, a chicken-processing company, for $2.16 billion in cash. Stocks edged higher on Tuesday as this bull market became the longest in history. Separately, President Trump’s former lawyer and campaign manager were both pleaded guilty to unrelated accounts. Stocks edged higher on Wednesday as positive earnings data from Target, and other retailers, lifted stocks higher.

Thursday & Friday Action:

Stocks were quiet on Thursday as concern spread regarding the global trade and President Trump’s legal issues. China announced a new round of tariffs which led many to worry that the ongoing trade war may escalate and President Trump’s legal issues dampened investor sentiment. Stocks rallied nicely on Friday even though the US-China talks hit a wall. The big move came after the US Federal Reserve said it will do whatever it takes to combat inflation.

Market Outlook: Bulls Are In Control

The bulls are in control of this market. In August, they showed up and defended support (50 DMA line) which was a big sign of strength. After the 50 DMA, the next big level of support is the 200 DMA line, then February’s low. For now, as long as those levels hold, the longer-term uptrend remains intact. Conversely, if those levels break, look out below. As always, keep your losses small and never argue with the tape. Want A Bargain? Take A FREE 1-Month Trial To CheapBargainStocks.com and Always Know The Cheapest Stocks In The Market Every Week