This post is a review of the performance of the 10 Elite Stock Setups that were sent to Advanced Stock Reports subscribers on Saturday, November 3, 2018. Each setup comes complete with annotated charts highlighting the advanced entry point and support level(s), as well as all of the necessary fundamental information.

We had a roller coaster week in the market with plenty of uncertainty heading into the midterm elections, a huge post-Election Day rally on Wednesday, and then more uncertainty to close out the week on Thursday and Friday. The market could go anywhere from here, and if it turns out that we are headed higher, we want to be focused in on the stocks that performed best over the course of this wild week.

Let’s jump in and take a quick look at each of the 10 stocks Adam highlighted for us in last weekend’s FLS newsletter and see how they held up over the week.

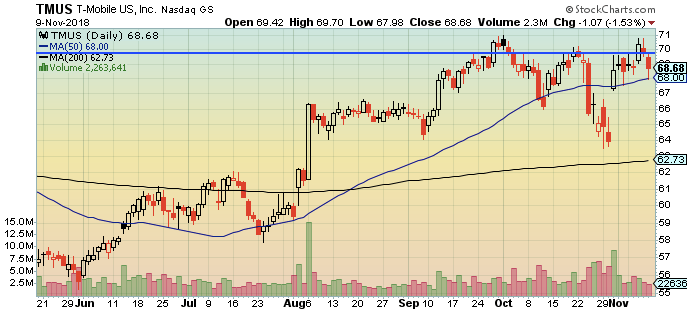

T-Mobile US, Inc.

After sitting tight through Monday and Tuesday, TMUS took off with a huge up day right through Adam’s entry point on Wednesday before backtracking to close at the entry point on Thursday and falling through it on Friday.

It wasn’t able to hold above our entry point, but it did manage to stay well above its 50-day simple moving average, which is an impressive feat in this current market environment.

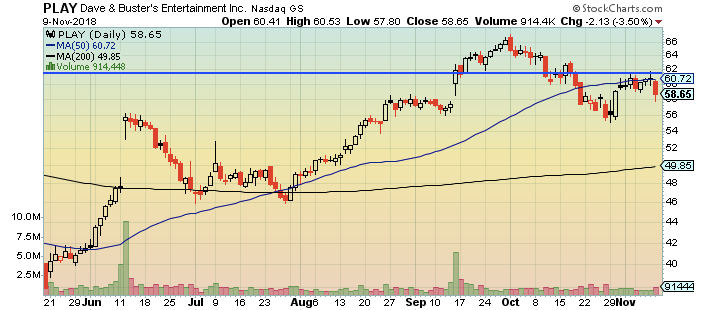

Dave & Buster’s Entertainment Inc.

PLAY had a much more difficult week as it did not cross over its entry point and struggled to retake its 50-day moving average. It didn’t have the same pop that we saw from other growth stocks in the middle of the week, and then it took a big dive on Friday.

That Friday move left PLAY with even more work to do if it wants to retake its 50-day line and work its way up through Adam’s entry point.

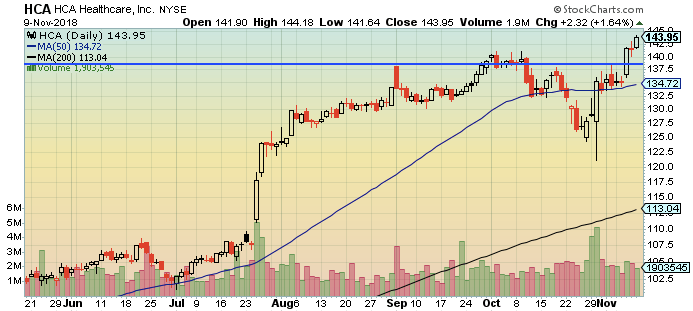

Healthcare, Inc.

HCA shot up through Adam’s entry point like a rocket on Wednesday and kept going higher while the rest of the market was pulling back on Friday. This made it one of the strongest performing stock setups of the week.

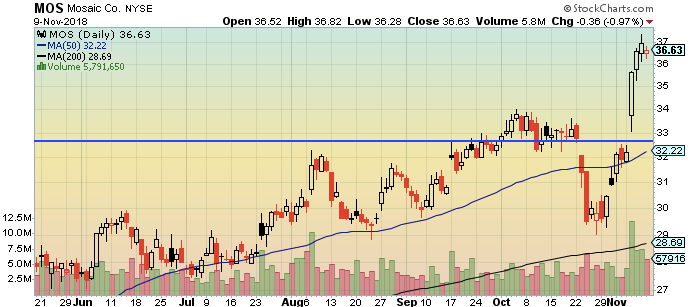

Mosaic Co.

While HCA was waiting for the election results to start its climb, MOS gapped up right past Adam’s entry point on Tuesday and continued to climb higher for the rest of the week. It also managed to hold onto the bulk of those gains when the general market turned south on Friday.

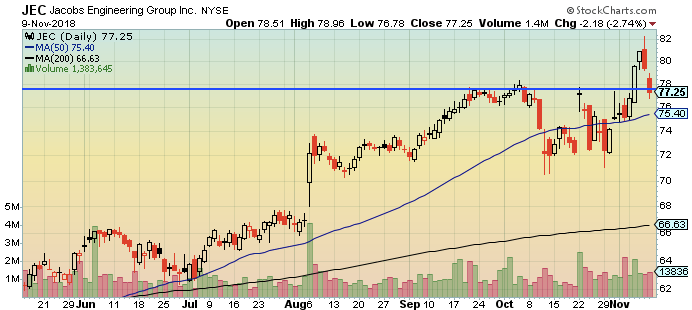

Jacobs Engineering Group Inc.

JEC took a similar path to start off the week with huge up day through Adam’s entry point on Tuesday. It then followed through with a strong Wednesday, but it wasn’t able to hold onto those gains and fell quite a bit on Thursday before crashing back down through the entry point and closing below it on Friday.

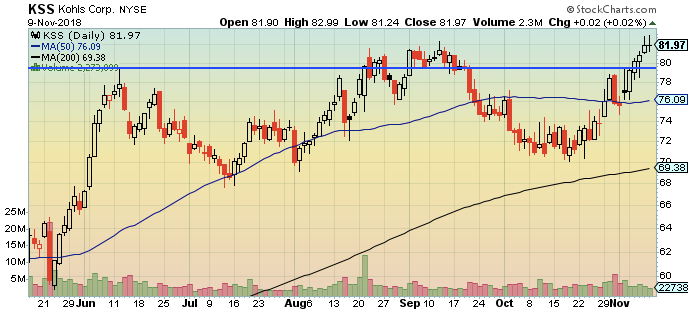

Kohls Corp.

KSS logged five positive days this week that took it up through Adam’s entry point and has it well-extended from its 50-day line.

Retail was strong throughout the week, and KSS has been one of the best of the retail stocks. And if you are looking for a little Peter Lynch-style extra credit, my wife is completely addicted to Kohl’s Cash.

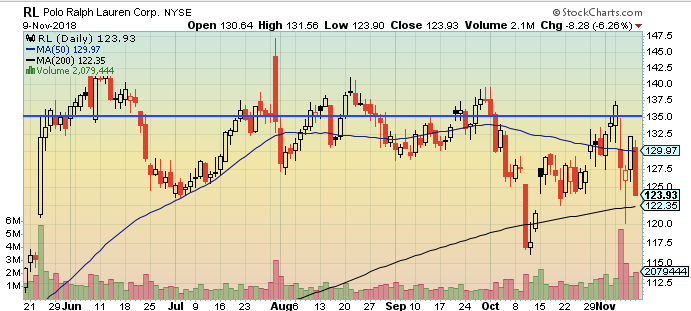

Polo Ralph Lauren Corp.

RL started out the week on a strong note with a big up day taking it over the entry point. But the things came crashing back down to earth on Tuesday and Wednesday. After a recovery back to the 50-day line on Thursday, the bottom fell out again on Friday and RL closed down more than 6% on the day.

We had some strong performances from Adam’s stock setups this week, but the Big Pony was definitely not one of them.

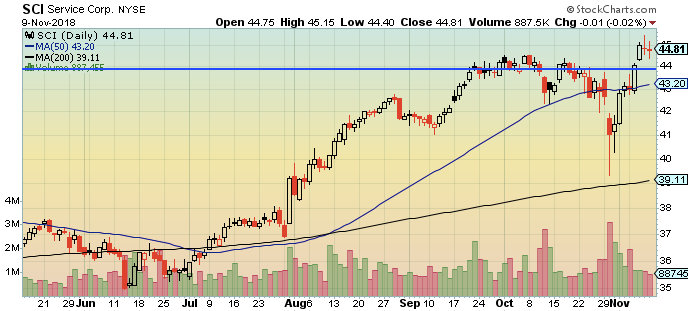

Service Corp.

SCI was another stock that crossed through an entry point on Election Day this week as it logged a big up day on Tuesday. It then followed through with strength on Wednesday before pulling back slightly on Thursday and Friday.

Since the late-week pullbacks weren’t as extreme as the early week gains, the weekly bar looks strong for SCI.

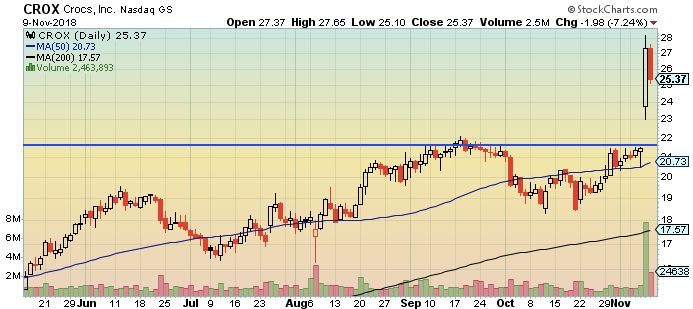

Crocs, Inc.

The award for the wildest ride of the week absolutely has to go to CROX, which started out the week calmly climbing towards Adam’s entry point. Then the price exploded higher for a monster gain on Thursday only to give back about half of that gain on Friday.

The stock finished the week well above the entry point and its 50-day line, and as long as it doesn’t close the gap up from Thursday it should continue to be a strong leader moving forward.

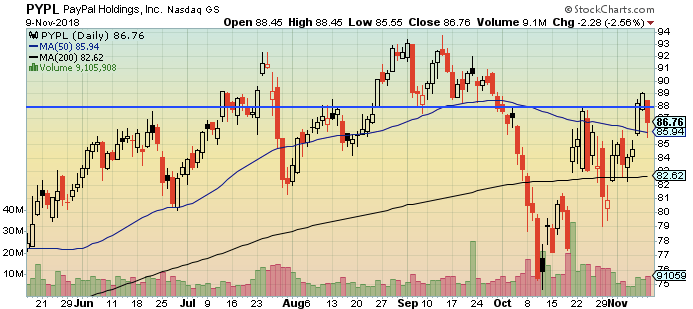

PayPal Holdings, Inc.

PYPL started out the week with a couple of solid up days before following the general market much higher and closing just above Adam’s entry point on Wednesday. It then pushed even higher on Thursday before falling back below the entry point on Friday. I’m surprised that all of my transfers to pay off NFL gambling debts aren’t having a more significant impact on the stock.

Adam’s ten stock setups to watch this week produced some big winners, a few losers, and some stocks that are still trying to figure out exactly what they want to do. Moving forward, we want to keep track of the good ones and build a list of great options for us to buy when the general market indicates that the uptrend is back on track.

Make sure you subscribe to Adam’s Advanced Stock Reports (Join Now Save 20% With Our Annual Membership) to get this weekend’s updated list of stock setups, as well as his FLS Playbook that breaks down what our model portfolio is going to be doing in the week ahead.