Courtesy of LPL Research:

Well, here it comes—September. It’s widely considered the worst month of the year for equities for good reason, since it has historically performed the worst. Per Ryan Detrick, senior market strategist, “September is the banana peel month, as some of the largest slips tend to take place during this month. Although the economy is still quite strong, and stocks are marking hew highs, this doesn’t mean some usual September volatility is out of the question—in fact, we’d be surprised if volatility didn’t pick up given midterm years tend to see big moves in the months leading up to the November election.”

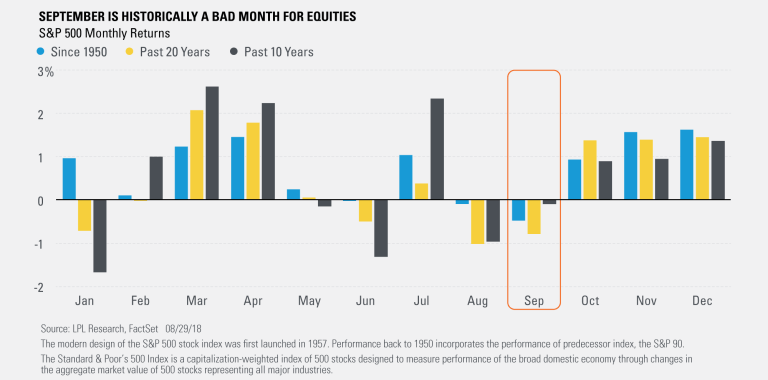

Here’s some data to consider as September approaches:

- Since 1950, no month sports a lower average return than September, with the S&P 500 Index down 0.47% on average. June and August are the only other months that are generally in the negative, while November and December tend to be the strongest months of the year.

- In the past 20 years, September has been the second-worst month, with only August fairing worse. More recently, over the past 10 years, it’s still down on average but comes in at the fifth-worst month.

- The worst September ever for the S&P 500 was a 30% drop in 1931. In fact, no other month has had more 10% drops than September, at seven. Interestingly, January is the only month that has never been down 10% or more.

- Since 1950, if the S&P 500 starts September above its 200-day moving average (like 2018 will), it tends to do much better, as it is up 0.4% on average versus down 2.7% if it starts the month below the 200-day moving average.

Last, as we shared last week, when the S&P 500 is up in the five months heading into September (like 2018), the month has historically done quite well, up 2.3% on average and higher four out of five times since 1950.

Source: https://lplresearch.com/2018/09/04/the-worst-month-of-the-year/