This post is a review of the performance of the 10 Elite Stock Setups that were sent to Advanced Stock Reports subscribers on Friday, December 7, 2018. Each setup comes complete with annotated charts highlighting the advanced entry point and support level(s), as well as all of the necessary fundamental information.

It was another difficult week on Wall Street, and the overall market looks like it is going to be stumbling right through the finish line for 2018. But we aren’t worried about what happens over the next few weeks. We’re looking to be smart over the next few decades.

With that in mind, we only had four of our ten elite stock setups pop above Adam’s entry points this week, but we did see plenty of strength. Speaking of strength, I’m starting to put some weight on my surgically repaired foot and seem to be moving right along with my recovery.

Hopefully, both the market and my foot will be in better shape once we step into 2019. Until then, we just have to wait patiently for our train to come.

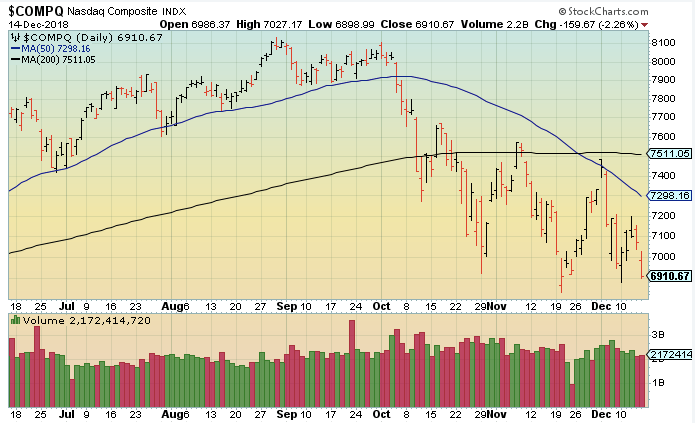

The General Market

After a rough start on the open this week, buyers showed up and turned Monday into a positive day. The market opened even higher on Tuesday, but that is when the sellers came back and drove down prices.

After a relatively calm day on Wednesday, the Nasdaq fell a good bit on Thursday before losing even more ground on Friday and closing at the low of the week.

With that type of weakness in the general market, we aren’t expecting to see much in the way of progress from Adam’s elite stock setups this week. Instead, we will be looking closely for which ones held up the best during another stressful week.

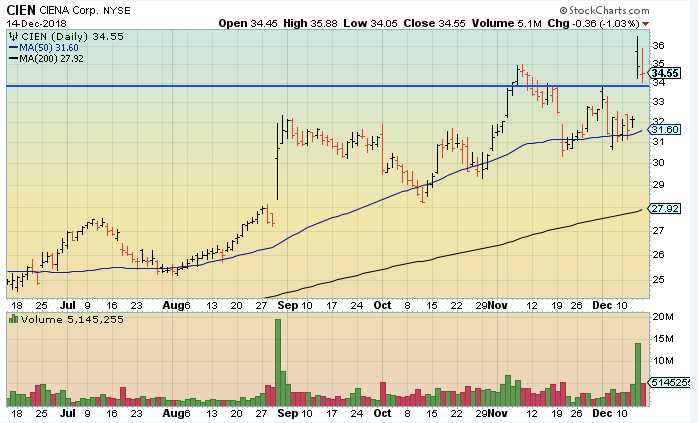

CIENA Corp. – Triggered

CIEN started out the week by following the general market in a much less dramatic fashion on Monday, Tuesday, and Wednesday. But then everything changed on Thursday and the stock rocketed higher breaking through Adam’s entry point.

Despite opening slightly lower on Friday, CIEN was able to hold above the entry point. It currently sits above its still-climbing 50-day and 200-day moving averages and appears to be one of the strongest stocks in a market that is desperate for strength.

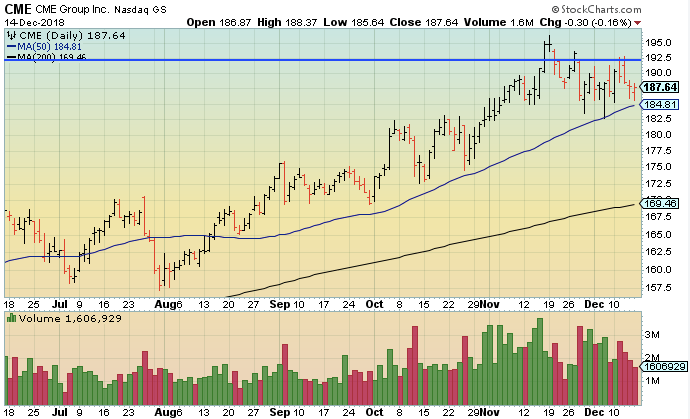

CME Group Inc. – (Technically) Triggered

CME wasn’t able to close above Adam’s entry point, but it did get above it long enough to trigger an entry on both Tuesday and Wednesday this week.

The stock got a huge boost from the buyers that came into the market on Monday before spiking above the entry point on the following two days. Then it was able to hold sellers at bay and post only minimal losses on Thursday and Friday to hold above its 50-day and 200-day moving averages.

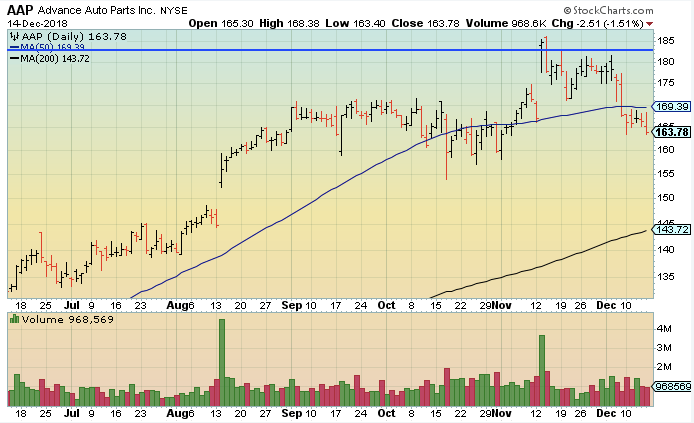

Advance Auto Parts Inc. – Did Not Trigger

AAP wasn’t able to challenge Adam’s entry point this week. It also didn’t get back above the 50-day line that it lost last Friday. But the stock was able to hold its ground and prevent falling as dramatically as the general market did on Friday.

This stock has some serious work cut out for it if it is going to retake its 50-day moving average and eventually break through its entry point, but it is still sitting well above its 200-day line and could be a solid bounce-back candidate in the weeks to come.

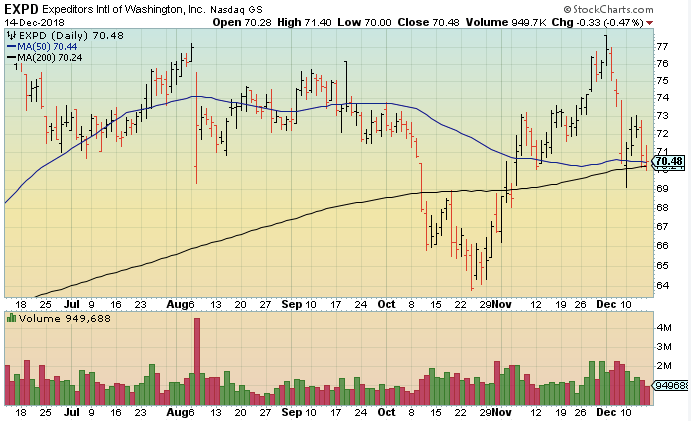

Expeditors Intl of Washington, Inc. – Did Not Trigger

EXPD put together a chart that was a mirror image of what we saw from the Nasdaq Composite this week, and after the tumble that it took last week, that could definitely be considered a positive sign.

The stock was able to hold it’s 50-day and 200-day lines, which are currently converging. Should it move higher from here, we would see the 50-day line bounce right off of the 200-day line, which could also be a positive sign for the stock.

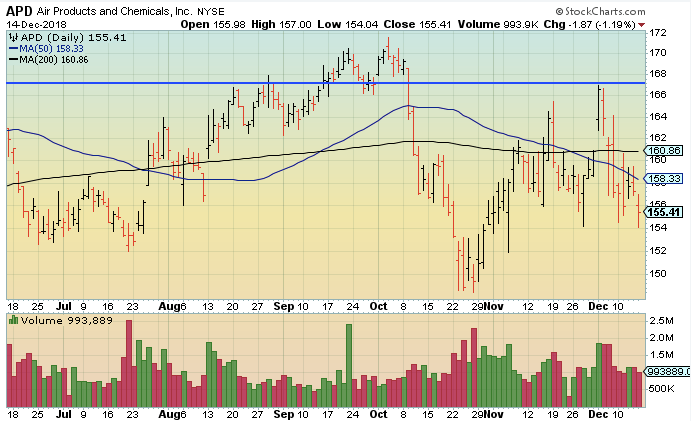

Air Products and Chemicals, Inc. – Did Not Trigger

It didn’t feel like APD had a great chance of getting up to Adam’s entry point this week, but it did have a decent shot at retaking its 50-day line. It was able to do exactly that a few times throughout the week but ultimately closed back below that mark after a rough Friday.

With the stock and its 50-day moving average both sitting below the 200-day moving average, it is going to take some serious work for APD to get back on track in the coming weeks.

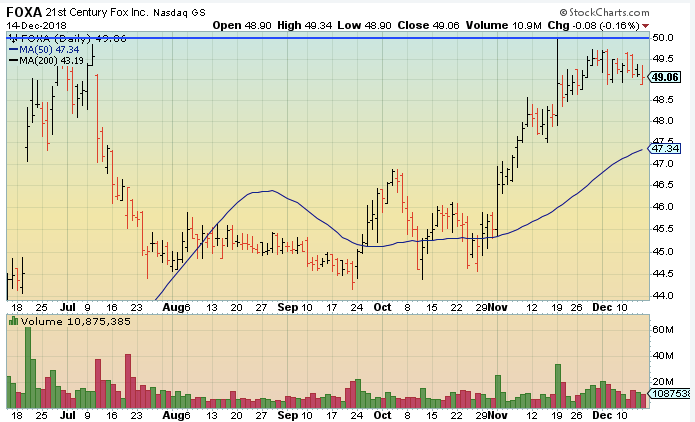

21st Century Fox Inc. – Did Not Trigger

Strength has been the name of the game for FOXA over the past few months and it maintained that strength this week despite the fact that it was not able to move higher through Adam’s entry point.

Although the price fell on three of the five trading days this week, FOXA was actually able to hold up much better than the general market and is definitely going to be a stock to watch in the coming weeks.

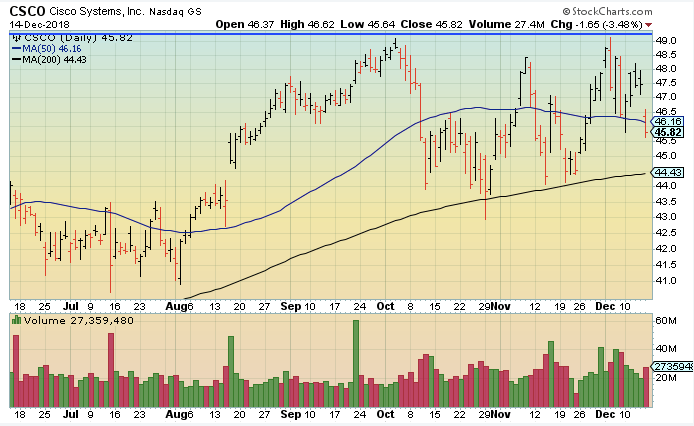

Cisco Systems, Inc. – Did Not Trigger

CSCO was another stock that would need a very ambitious effort to get to Adam’s entry point this week, but that didn’t it from trying.

While they weren’t the strongest positive days, the stock did move higher in each of the first four trading sessions this week. Unfortunately, things turned south on Friday and CSCO was not able to hold onto its 50-day moving average.

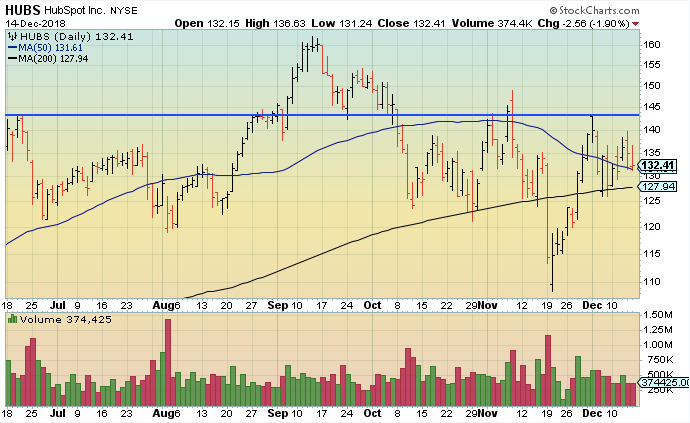

HubSpot Inc. – Did Not Trigger

HUBS was another stock on our list that failed to challenge Adam’s entry point this week. But after regaining the 50-day line that it lost last week, you could definitely argue that this was one of the stronger stocks in the market this week.

HUBS is currently sitting right above that 50-day line, and it was able to finish the week higher than it started, which is an impressive feat for any stock given the current market conditions.

Barrick Gold Corp. – Triggered

ABX had a rough beginning and end to the week, but there is no denying that the stock showed strength as it pushed up through Adam’s entry point on Wednesday and then continued higher Thursday.

Despite falling below the entry point on Friday, ABX is still sitting well above it’s 50-day moving average, which recently crossed back above its 200-day moving average. This looks like one of the strongest stocks on our list this week.

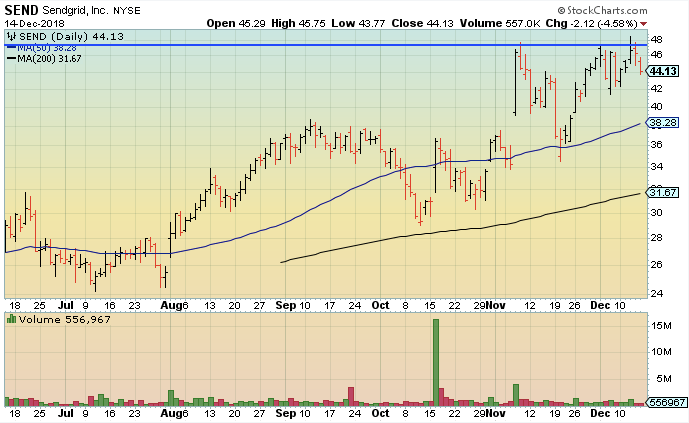

Sendgrid, Inc. – Triggered

SEND was another stock that was able to break above Adam’s entry point just briefly this week as it had three strong up days to start out the week. Things turned south on Thursday and Friday, but the stock was still able to hold its ground well above both its 50-day and 200-day moving averages.

We only saw four of our elite stock setups poke their heads above Adam’s entry points this week, but we did see plenty of strength in a market that hasn’t shown much of it. We’re not looking to jump into the market at this point, but when we do, these will be some of the stocks on our short buying list.

Make sure you subscribe to Adam’s Finding Leading Stocks newsletter to get this weekend’s updated list of stock setups, as well as his FLS Playbook that breaks down what our model portfolio is going to be doing in the week ahead.