Painful. Brutally Honest. Emotionally Charged.

Those are all words that are commonly used to describe Bob Dylan’s “Blood on the Tracks’. But they could also be used to describe everything that happened in the stock market over the past few weeks. It has been a bloody stretch on tracks of Wall Street that has seen most of the growth names that we have grown accustomed to tracking stumble and fall.

Fortunately for those of us that subscribe to the Advanced Stock Reports, Adam has been preaching caution and patience while taking some solid profits in this difficult market environment. And sitting mostly on the sidelines during these past few weeks has helped us avoid the “Idiot Wind” with some “Shelter from the Storm.”

Pfizer Inc – Did Not Trigger

PFE stumbled out of the gate Monday and would never come close to breaking through Adam’s entry point. After a second down day on Tuesday, it followed with a third one on Wednesday that sliced right through the 50-day moving average.

But things did get better for the drug maker later in the week. Positive days on both Thursday and Friday allowed PFE to retake its 50-day line. This puts it far ahead of many stocks in this choppy market environment, but still well short of our target entry point.

NetApp, Inc – Did Not Trigger

The positive finish we saw from PFE did not show up for NTAP, which also failed to challenge the entry point that Adam identified in last weekend’s Advanced Stock Report. Not only did NTAP struggle with the market early in the week, it completely fell off a cliff on Thursday and Friday gapping below its 200-day moving average.

This is a perfect example of why we always wait for a stock to prove itself by actually crossing an entry point instead of attempting to take an early position before the entry.

Visa Inc – Did Not Trigger

Keeping with the theme for the week thus far, V also fell short of even flirting with Adam’s entry point. It actually looked a lot like NTAP through the first three days of the week, but then managed to put in a strong up day on Thursday and retain at least some of those gains through Friday.

V is currently sitting well above its 200-day simple moving average, but it is still below our entry point, as well as its 50-day line.

Microsoft Corporation – Did Not Trigger

MSFT was yet another stock setup that would not come close to Adam’s entry point this week. It followed along with the market by posting a big loss on Monday followed by a slight pause on Tuesday before heading south again on Wednesday.

Like we saw from V, MSFT showed some life on Thursday and then continued even higher on Friday where it was able to make up even more ground heading back up towards its 50-day moving average.

Intuitive Surgical, Inc – Did Not Trigger

Yet another stock that failed to challenge the entry point that Adam identified for it was ISRG, which started out the week posting three straight losing days before recovering about half of those losses on Thursday and Friday.

As one of the stocks that Adam’s FLS Portfolio owned just recently, we are naturally inclined to root for this one. But it is important to differentiate our desire to see the stock perform well with a smart trading decision.

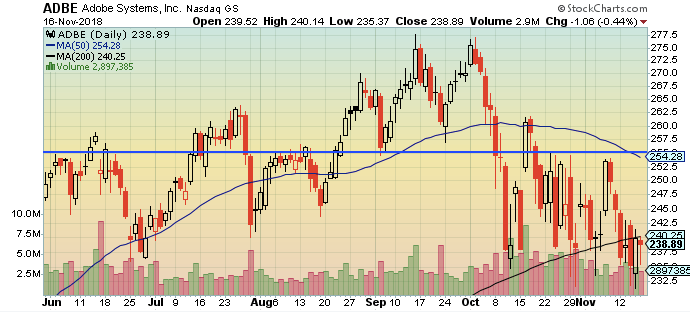

Adobe Inc – Did Not Trigger

After being the most profitable position in the FLS Portfolio for over a year, ADBE is back in the stock setups section and…stop me if you’ve heard this before…it failed to come close to its entry point this week.

ADBE demonstrated some wild price action throughout the week as it fell below its 200-day moving average on Monday, then again on Wednesday. The stock attempted to rally on Thursday, but was unable to retake its 200-day line and fell again on Friday.

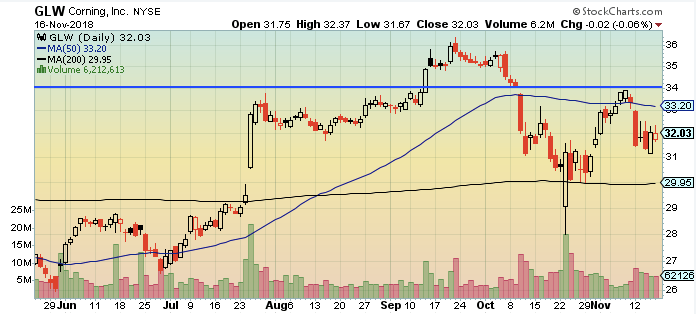

Corning Incorporated – Did Not Trigger

Another stock, another complete failure to even challenge Adam’s entry point. After closing right at its 50-day line last Friday, GLW opened up the week by slicing through it on Monday. It then fell even more on Wednesday before making a poor attempt at a rally on Thursday and Friday.

Waste Management, Inc – Triggered

The one bright spot on our stock setups list this week was WM, which moved above, below, and then back above Adam’s entry point earlier in the week. After demonstrating the strength to hold its ground while the market was tumbling on Monday and Wednesday, WM shot up like a rocket when market conditions got a little better later in the week.

The overall market conditions are still a bit too volatile to be diving into a new purchase right now, but WM is showing the type of relative strength that should earn it a solid place on everyone’s watchlist.

The Boeing Company – Did Not Trigger

BA showed a lot of strength last week as it retook its 50-day line and marched higher. But rather than continue up through the entry point that Adam identified for us, it posted five straight down days this week and lost its 50-day and 200-day lines in the process.

Booking Holdings Inc – Did Not Trigger

You’re probably getting the hang of this by now, but just in case you aren’t, BKNG wasn’t able to find its way above Adam’s entry point this week. It followed the same pattern we saw from a number of other stocks with rough days on Monday and Wednesday, and then things got even worse on Thursday and Friday.

Gary Kaltbaum regularly says that nothing good can happen to a stock that is living below its 200-day moving average, and that is exactly where BNKG is going to be hanging out until it can make its way higher.

This was definitely a rough week for our elite stock setups, it was also a terrible week for the general market. By exercising the caution and patience that Adam continues to stress in his weekly newsletter, we already have the upper hand during these challenging times.

Make sure you subscribe to Adam’s Advanced Stock Reports to get this weekend’s updated list of stock setups, as well as his FLS Playbook that breaks down what our model portfolio is going to be doing in the week ahead.