Hi, I’m Andy! I’m a freelance writer and restaurant manager, and I have also been following ChartYourTrade.com since the day it launched. This post is a review of the performance of the 10 Elite Stock Setups that Adam sent to his Advanced Stock Reports subscribers on Friday, December 21, 2018. Each setup comes complete with annotated charts highlighting the advanced entry point and support level(s), as well as all of the necessary fundamental information.

The holiday-shortened week started out ugly for the market, but buyers were the ones who showed up during the last three trading days of the year.

Unfortunately, it is going to take more than three good days for leading growth stocks to recover from the carnage that we have seen on Wall Street over the past few months.

So with that in mind, let’s dive into this week’s FLS Setups Review.

The General Market

In order to properly evaluate what each of our ten elite stock setups did this week, we need to look at them with the context of the general market fresh in our minds.

The market started out the week the same way it finished last week with a down day on Monday, but then things turned around when we came back after the Christmas holiday.

Wednesday, Thursday, and Friday were all positive days for the general market, and we closed out the year on a more positive note compared to what we have seen over the previous few weeks.

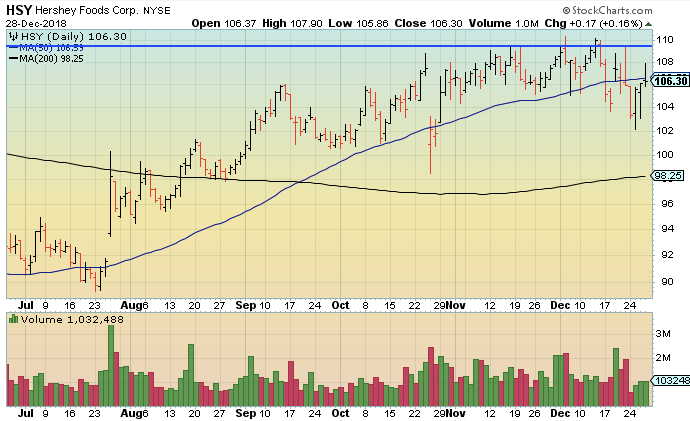

Hershey Foods Corp. – Did Not Trigger

HSH was not able to trigger Adam’s entry point this week, but it did manage to recover quite a bit of ground after starting out the week by digging a hole for itself.

Following up that big down day on Monday, the stock was able to rebound with positive days for the rest of the week and briefly peaked its head up above its 50-day moving average on Friday before closing just short of that line.

Church & Dwight Co, Inc. – Did Not Trigger

CHD was not about to make its way up to Adam’s entry point, but after following the general market down on Monday, it rebounded quickly and jumped above its 50-day moving average on Wednesday.

The stock then continued higher on Thursday and Friday as it continued to gain ground on its moving average lines heading up towards Adam’s entry point.

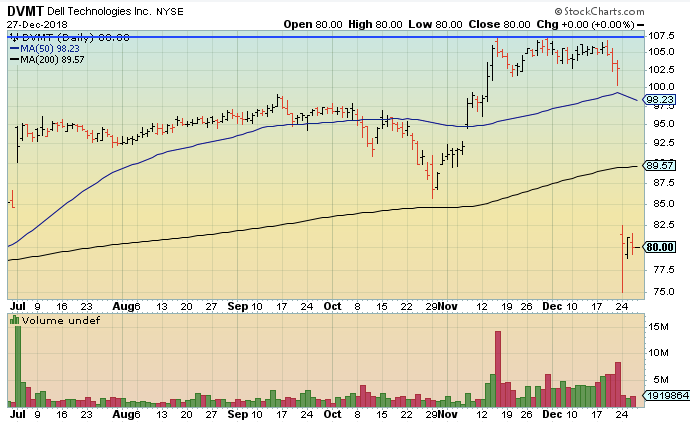

Dell Technologies Inc. – Did Not Trigger

Not only did DVMT not trigger Adam’s entry point, I actually did a double take looking at its chart because it looked like it didn’t trade at all this week.

On a second look, it turns out the DVMT did trade this week, it just did so well below both its 50-day and 200-day moving averages. After dropping like a rock on Monday morning, the stock pretty much just sat there for the rest of the week.

An even deeper dive shows that DVMT stopped trading as part of a Class V transaction designed to simplify the structure of the corporation.

CME Group Inc. – Did Not Trigger

After closing below its 50-day moving average last week and then opening even lower to start this week, it was hard to imagine a world where CME would be able to challenge Adam’s entry point during the holiday-shortened trading week.

However, the stock was able to recover nicely with a big up day on Wednesday. Then it took off even higher on Thursday, jumping back above its 50-day moving average. Things got even better on Friday as CME showed more strength.

Ameren Corp. – Did Not Trigger

Despite a lot of red bars last week, AEE was able to hold its 50-day line and looked like it might have a chance to bounce off of that line up towards Adam’s entry point this week. Unfortunately, that did not happen.

The stock sliced through its 50-day line on Monday. It did manage to recover on Wednesday and Thursday, but it fell back against the tide of the general market on Friday.

American Tower Corp. – Did Not Trigger

We have spent a lot of time highlighting stocks that didn’t trigger Adam’s entry point but still showed strength in recent weeks, and AMT was one of those stocks this week.

After falling below its 50-day moving average on Monday, the stock recovered and almost regained its 50-day line on Wednesday. Then it tried again and succeeded on Thursday before finding support there during Friday’s trading session.

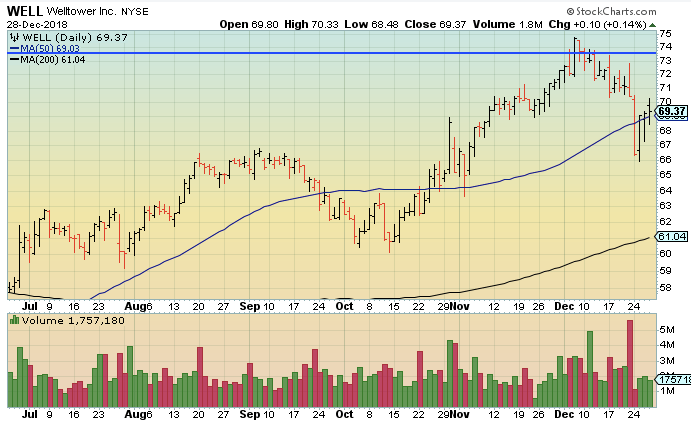

Welltower Inc. – Did Not Trigger

WELL acted an awful lot like AMT in that it held up well despite not getting up to Adam’s entry point this week. Just like AMT, WELL lost its 50-day moving average on Monday only to reclaim it and then find support there later in the week.

Barrick Gold Corp. – Did Not Trigger

Speaking of finding support at the 50-day moving average, ABX was another stock that didn’t challenge Adam’s entry point, but it wasn’t all that far away from it either.

The stock bucked the trend of the general market by posting an up day on Monday, and then things held up strong on Wednesday and Thursday before selling came in on Friday. However, ABX was able to find support at its 50-day line, which is always a sign of strength in this type of market environment.

These last few days were definitely a positive in the market, but we also have quite a bit of work to do in order to recover from the damage that we witnessed throughout the month of December. I don’t know about you, but I can’t wait to see what happens heading into 2019.

Make sure you subscribe to Adam’s Finding Leading Stocks newsletter to get this weekend’s updated list of stock setups, as well as his FLS Playbook that breaks down what our model portfolio is going to be doing in the week ahead.