This post is a review of the performance of the 10 Elite Stock Setups that were sent to Advanced Stock Reports subscribers on Friday, November 23, 2018. Each setup comes complete with annotated charts highlighting the advanced entry point and support level(s), as well as all of the necessary fundamental information.

What a wild week we just had on Wall Street! After last week, it didn’t look like we were going to have any type of Santa Claus rally this year, but the market did a complete turnaround this week, and I was “fortunate” enough to be stuck on the couch with a front-row seat all week long.

As I continue to recover from my Achilles surgery, I have had a significant amount of time to reflect on the way that Adam’s FLS Playbook has improved my approach to trading over the past year.

The biggest change is that I no longer find myself rooting for the markets to move in either direction. I simply observe the current conditions knowing that we will have a rational plan of attack no matter what happens in a given week.

That means that I didn’t panic when things looked bad last week, and it also means that I didn’t overreact when things got better in a hurry this week.

While the general market was chugging higher, we saw eight of our ten FLS Stock Setups clear Adam’s entry points this week. Let’s take a quick run through each of them to review what happened.

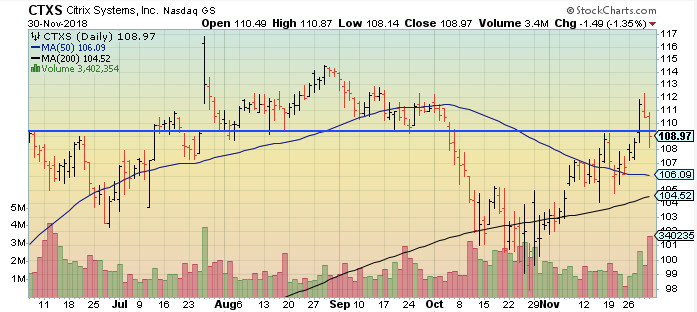

Citrix Systems, Inc. – Triggered

CTXS moved higher with the general market on Monday and Tuesday before erupting through its entry point on Wednesday. However, things got a little tougher on Thursday and it fell back below the entry point on Friday.

The stock is currently sitting well above its 50-day and 200-day moving averages, and it is still just slightly below Adam’s entry point.

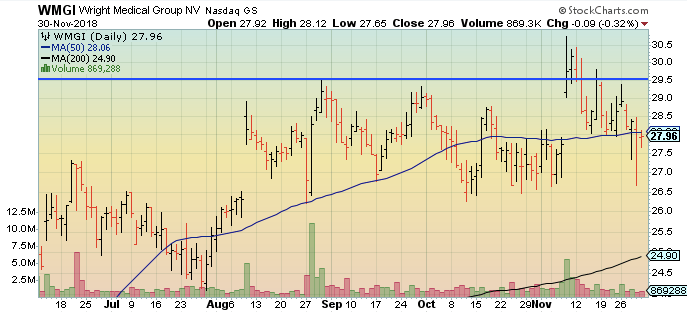

Wright Medical Group NV – Did Not Trigger

One of the few stocks that didn’t have a stellar week was WMGI, which failed to even come close to Adam’s entry point. After struggling to post a positive day on Wednesday, it gave up its 50-day moving average on Thursday and failed to retake it on Friday.

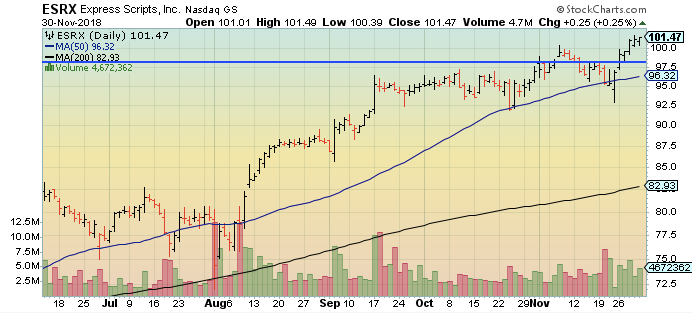

Express Scripts, Inc. – Triggered

ESRX was one of the strongest of our stock setups this week as it triggered Adam’s entry point on Monday and went on to post a gain in each of the five trading days this week. The stock is currently sitting well above its 50-day and 200-day lines and has already logged a significant profit from the entry point.

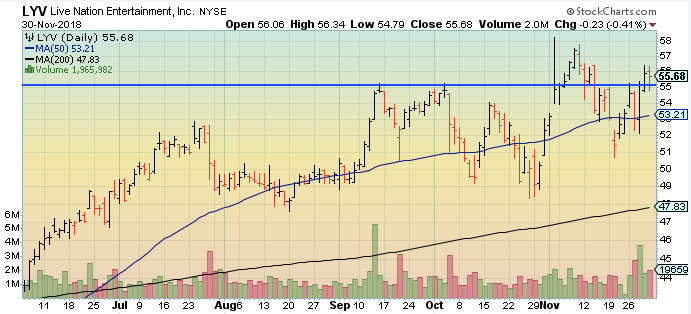

Live Nation Entertainment, Inc. – Triggered

LYV was one of our more interesting stocks to watch this week as it triggered Adam’s entry point after struggling a bit earlier in the week. It started off with a positive day on Monday, but things got rocky on Tuesday before the stock posted a huge day on Wednesday closing right at the entry point.

After continuing higher on Thursday, LYV backed off a bit on Friday. However, it is still sitting right above the entry point and is well above its significant moving averages.

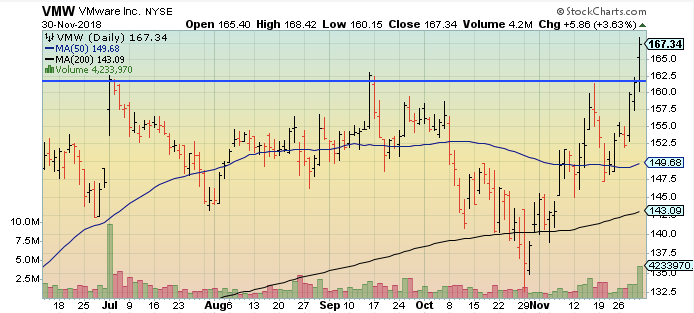

VMware Inc. – Triggered

Even on a huge week for the general market, I still thought that VMW was a longshot at best to trigger its entry point. But after working hard to gain significant ground throughout the week, that is exactly what it did on Friday.

The stock started out the week with a modest gain on Monday and then gave those gains right back on Tuesday. But after massive up days on Wednesday and Thursday, VMW jumped above the entry point on Friday and didn’t look back.

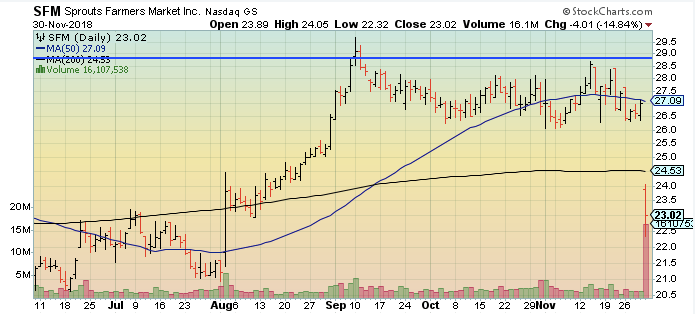

Sprouts Farmers Market Inc. – Did Not Trigger

SFM was another stock that wasn’t able to find much traction this week and did not find its way anywhere close to Adam’s entry point.

Everything looked good when the stock was able to retake its 50-day moving average on Monday, but it would spend the rest of the week trying to recover from a big loss on Tuesday and it finished the week just below that 50-day line.

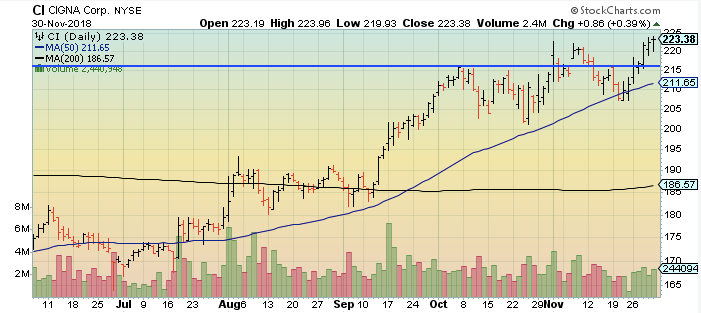

Cigna Corp. – Triggered

Much like we saw from ESRX, CI posted five straight days of positive action as it blew right through Adam’s entry point and never even thought about looking back. It currently sits well above the entry point, as well as both of its significant moving averages.

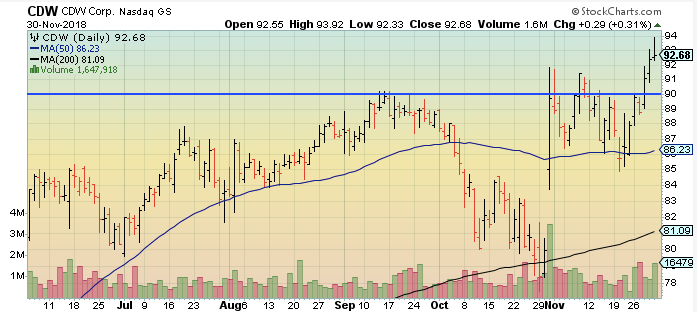

CDW Corp. – Triggered

CDW posted a similar chart to what we saw from the majority of growth stocks this week with a positive day on Monday, a slight pullback on Tuesday, and a monster move to the upside on Wednesday that triggered the entry point.

The stock then continued higher on Thursday and Friday, and it now sits well above its 50-day and 200-day moving averages.

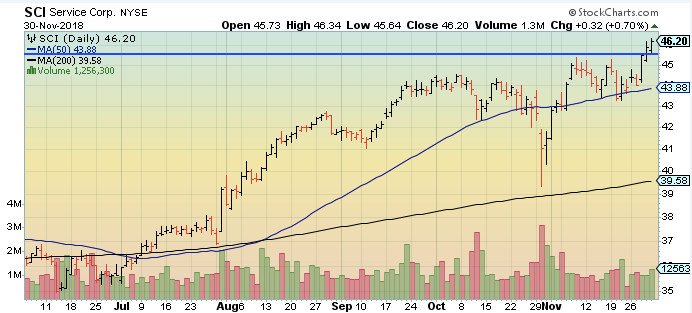

Service Corp. – Triggered

SCI followed a similar path to what we saw from CDW and was able to move up through Adam’s entry point on Thursday after closing just below it after a big gain on Wednesday. It then continued higher on Friday to create some breathing room above the entry point.

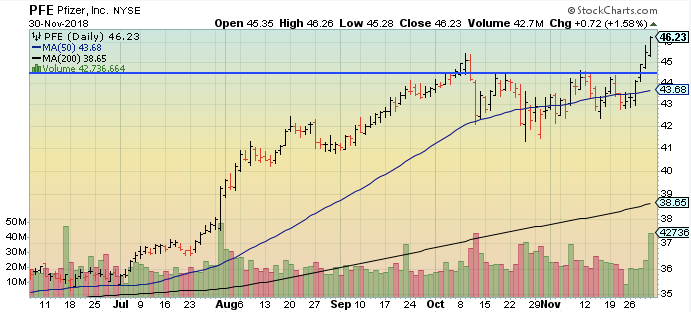

Pfizer, Inc. – Triggered

PFE was another stock that posted five straight days of gains this week while shooting right through Adam’s entry point. Are we noticing a trend with stocks in the medical field this week?

With eight out of ten stocks crossing above their entry points, this was obviously a very good week for the market. We will be curious to see if this positive energy continues into next week.

Make sure you subscribe to Adam’s Finding Leading Stocks newsletter to get this weekend’s updated list of stock setups, as well as his FLS Playbook that breaks down what our model portfolio is going to be doing in the week ahead.