Conclusion: Technicals Lead, Fundamentals Lag.

This is a case study I performed in 2013. The lessons still apply just as much today as they did then.

The following two case studies illustrate a very important point: The market and individual stocks (i.e. technicals) move months BEFORE the fundamentals move (up or down). The reasons “why” are lengthy and outside the scope of this article. Instead of discussing the “why” we shall focus on the “what.” The reason is simple, we care about intelligently operating with “what is actually happening,” not why people think things are happening.

There are countless examples in history of markets and individual stocks turning months before the fundamentals turn. Every major top or bottom in the stock market happened months before the fundamentals turned. Moral: The market always knows, ignore the market’s opinion at your own risk.

Apple (AAPL) and Netflix (NFLX) are two examples of the technicals turning months before the fundamentals turn.

Apple- AAPL:

A. All-time high $705.07 on 9.21.12.

* 3-Months Before Earnings Flatten Out

*6-months BEFORE earnings turn Negative For The 1st Time In 10 years!

B. Breaks 50 DMA Line Almost Never Gets Back Above It

C. Death Cross- 50 DMA line Undercuts 200 DMA Line

D. Enters Bear Market: Defined by A >20% Decline from Recent High

E. Q1 2013 Earnings fall -18% which is the first year-over-year quarterly decline in 10 years.

Moral: The market always knows, ignore the market’s opinion at your own risk.

_________________________________________________________________

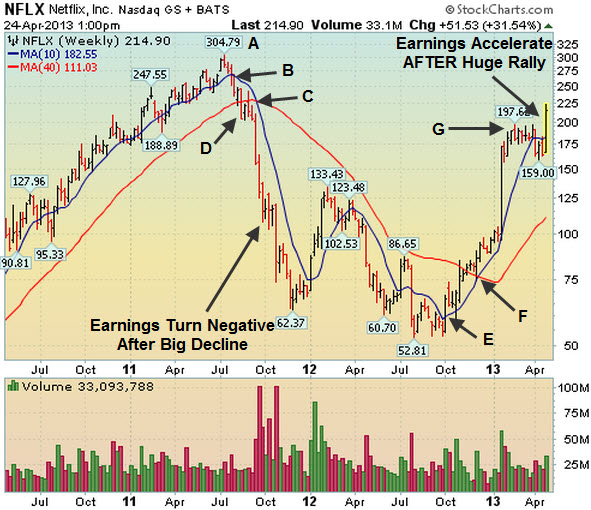

Netflix- NFLX:

A. All-time high $304.79 July 2011

*6-months before earnings turned negative

B. NFLX Breaks Below 50 DMA line & stays below it for months

C. Death Cross: 50 DMA line Undercuts 200 DMA Line

D. NFLX enters bear market and then plunges 82.6% before bottoming!

E. NFLX Bottoms then jumps back above its 50 DMA line

F. Golden Cross: 50 DMA line crosses above 200 DMA line

G. Earnings Accelerate in Q1 2013 vs Q1 2012 AFTER a 300% rally off the low!

Moral: The market always knows, ignore the market’s opinion at your own risk.