Options sometimes get a bad rap in financial markets, especially as Warren Buffet once famously referred to them as weapons of mass financial destruction! Never mind the fact that Buffet uses options extensively in his own portfolio.

The beauty of options is they provide so much flexibility. You can use them to gain leveraged exposure, you can use them to hedge an existing position, you can use them to generate income, or trade volatility. The possibilities are endless, and I’ve talked previously on ChartYourTrade about how they can be used.

Today I want to talk about using them to gain exposure at very little cost.

Using Options For Cheap Directional Exposure

The strategy is called a butterfly spread. If you want to learn about them in detail, you can do so in my free course, but I’ll explain briefly here…

Let’s use CRM as an example because it’s a stock I know Michael and Adam are watching currently because it was in a recent Elite Stocks Setups report.

Let’s say we want a bullish exposure, but we don’t want to risk too much money.

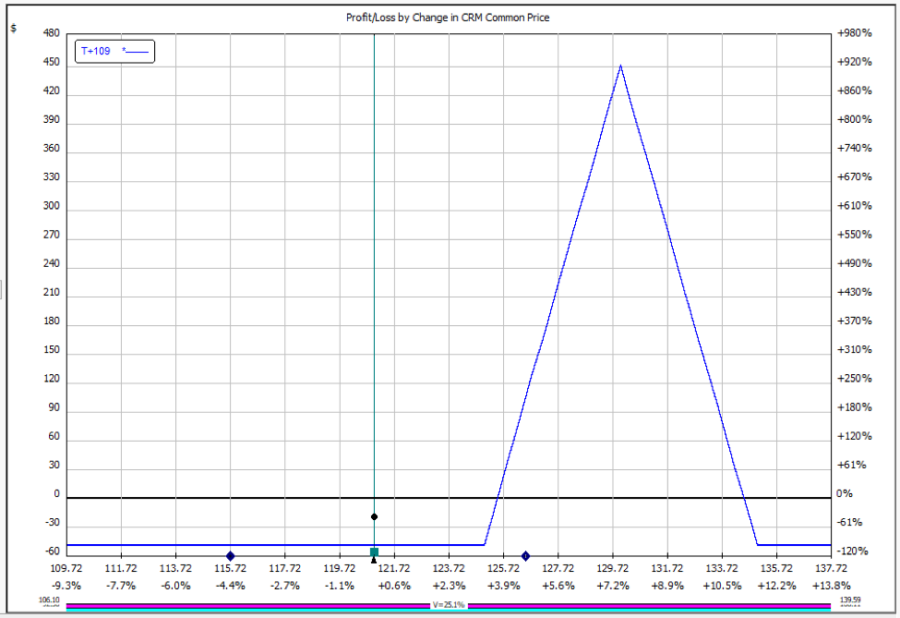

With the stock trading around $121, we could place a butterfly trade at $130 that expires in 3 months time.

To complete this trade we would do the following:

Buy 1 Aug $125 Call

Sell 2 Aug $130 Calls

Buy 1 Aug $135 Call

This gives us a triangle shape profit zone centered at $130, about 7.5% above the current price. The trade only costs $50 per spread and has a maximum profit potential of $450 per spread.

The trade makes a profit if CRM finishes anywhere between $125.50 and $134.50 at expiry.

I like using butterfly spreads as a cheap way to gain directional exposure to a stock.

I’ll do the opposite using puts on stocks that I have a bearish outlook on.

Be sure to check back in a few weeks and I’ll provide an update on how this trade progressed.

Trade safe!

Gavin McMaster